News

D&L Industries reports 1Q23 results

- Blended GPM improved by 3.2ppts, resulting in gross profit of P1.4bn, up 4% YoY in 1Q23

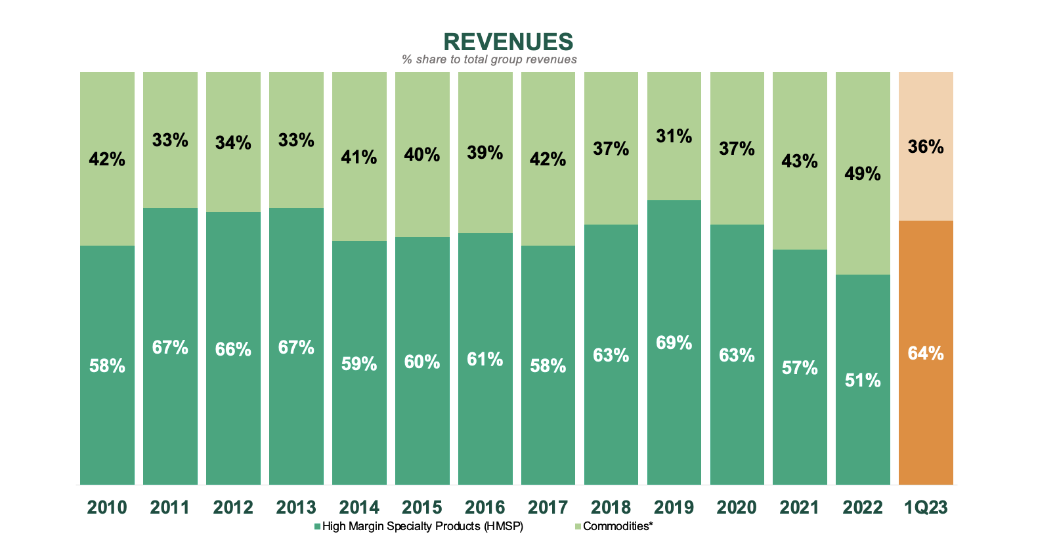

- Sales mix back to pre-pandemic level with HMSP contribution at 64% for the quarter vs 51% in 2022

- Lower volume coupled with higher opex and interest expenses, however, dragged overall income which stood at P594mn, down 24% YoY

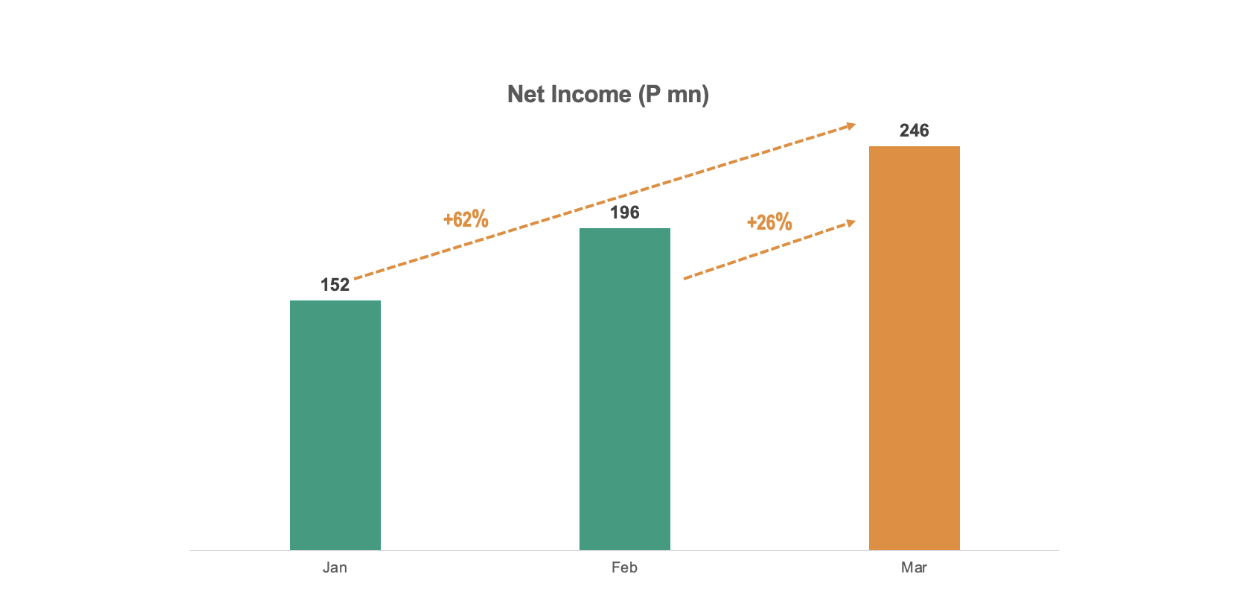

- Momentum seems to be coming back, however, with a sharp pick up in earnings in March, up 62% and 26% compared to earnings in January and February, respectively

- Free Cash Flows turned positive in 1Q23 as the company moves past peak capex and as commodity prices start to normalize

May 5, 2022 – D&L Industries’ recurring income reached P594 million, or earnings per share of P0.08, in the first quarter of 2023 (1Q23). While earnings were lower by 24% YoY in 1Q23, there was a sharp pick up in earnings in March, up 62% and 26% compared to earnings in January and February, respectively. On the gross profit level, D&L managed to book a 4% increase YoY to P1.4 billion on the back of better sales mix and higher blended gross profit margin (GPM) for the quarter.

Management perspective

“While the first two months of the year were weaker-than-expected, we anticipate things to be much better moving forward as we started seeing volumes coming back in March,” remarked President & CEO Alvin Lao. “This year, our company is celebrating its 60th anniversary and we are confident that the resilience and the ability to adapt to changing business landscape built over the years will allow us to continue to thrive despite various macroeconomic challenges,” Lao added.

“We look forward with eagerness to the commercial operations of our Batangas plant which is only a couple of months away. This plant will be transformational for us from a sustainable growth perspective. It will add the capabilities that will allow us to increase our relevance in the overall production chain and service new and bigger customers globally,” Lao concluded.

Momentum coming back with sharp earnings pick up in March

The high volume orders from prior periods coupled with the lingering effects of high inflation and generally cautious consumer sentiment resulted in weaker-than-expected volume for this quarter with HMSP and commodity volumes down 5% YoY and 20% YoY, respectively. Nonetheless, the weakness seems to be apparent in the latter months of 2022 up to January and February of 2023 with a noticeable pick up in March 2023 with earnings jumping 62% and 26% vs January and February, respectively.

While net income in 1Q23 was down by almost a quarter, on a gross profit level, the company managed to book a 4% YoY increase to P1.4 billion. This was on the back of improving sales mix and gross profit margin (GPM). On a net income level, higher operating and interest expenses dragged earnings. The higher operating expenses were mainly due to rental expenses associated with the new plant in Batangas while the higher interest expenses were mainly due to the generally higher interest rates. Moving forward, as the Batangas plant starts commercial operations, incremental revenues from it should offset the incremental costs associated with it.

Sales mix back to pre-pandemic level

While the events which transpired over the past three years have resulted in a change in sales mix favoring commodities, 1Q23 saw a reversal of this trend with High Margin Specialty Products (HSMP) revenue contribution back to pre-pandemic level at 64% from 51% in FY22. This, in turn, resulted in a 3.2ppts improvement in blended gross profit margins.

Over time, as commodity sales continue to normalize and as the company continues to allocate much of its resources in growing the HMSP business, D&L expects to see a continued increase in HMSP revenue contribution.

Nonetheless, while commodity products have lower margins, the company intends to keep this segment as it continues to have a strategic importance in the overall business in the form of 1) maintaining customer goodwill, 2) protecting HMSP business by blocking off potential competitors, 3) covering some of the fixed costs, and 4) assuring the quality of HMSP raw materials.

Free Cash Flows turned positive while debt level started coming down

As the company moves past peak capex with the upcoming completion of its Batangas plant, coupled with the normalization of commodity prices, the company’s free cash flows (FCF) turned positive for the first time in two years. In 1Q23, the company’s FCF stood at positive P890 million vs negative P1.8 billion and negative P3.4 billion booked in FY22 and FY21, respectively.

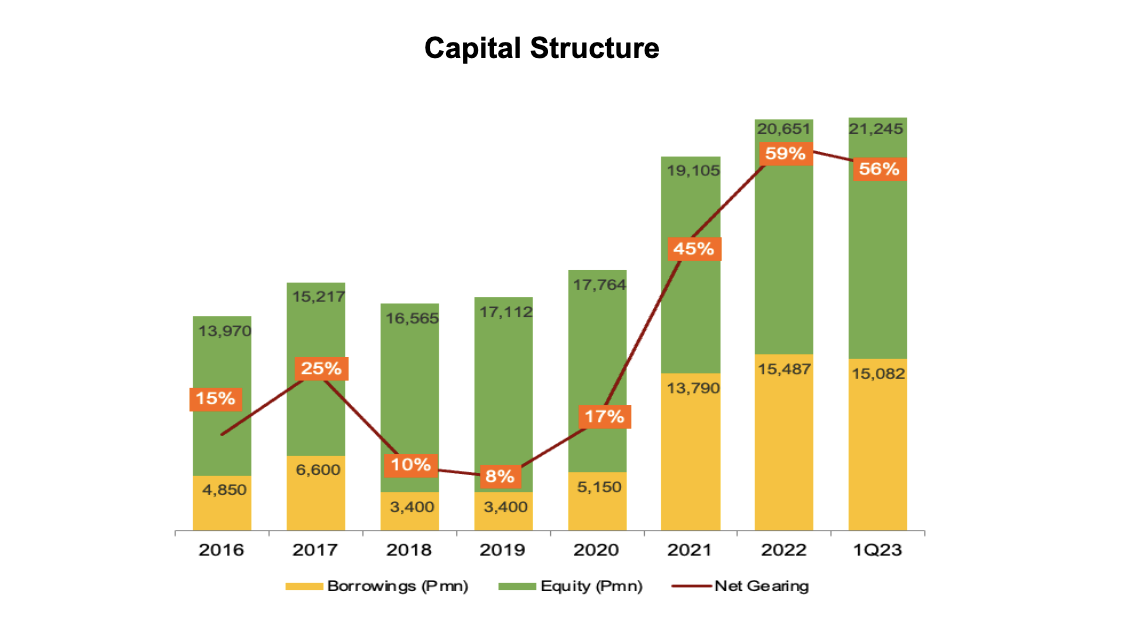

Capital Structure

Meanwhile, the company’s debt level has started to come down. In 1Q23, total outstanding debt stood at P15bn, slightly lower than the P15.5 billion debt in FY22. As there are no other major capex planned aside from the expansion plan in Batangas, the improvement in the FCF gives the company the financial flexibility to further reduce debt level over time.

As of end-March 2023, net gearing has likewise decreased to 56%, which remains to be a manageable level. Interest cover stood at 9x while average interest rate increased to 5.6% from 4.7% in full year 2022. The issuance of the P5 billion maiden bond offering of the company is helping cushion the recent increase in interest rates. The bonds carry a coupon rate of 2.7885% p.a. and 3.5962% p.a. for 3-year and 5-year tenors, respectively, which would have been significantly higher at approximately 6.73% for the 3-year tenor and 6.96% for the 5-year tenor if the company were to issue the bonds today.

Batangas expansion will position the company for long-term growth and enable the achievement of strategic priorities

D&L’s next generation facility in Batangas is set to start commercial operations by mid-2023. Total estimated capex for the new plant was slightly adjusted to P10.5 billion from P10.2 billion to incorporate additional items and upgrades to the plant. As of end-March 2023, the company has spent around P9.8 billion for the project. Once the Batangas plant is completed, capex is expected to decrease significantly as there are no other major expansions currently planned.

In September 2021, the company executed its maiden bond offering, successfully raising P5 billion to help fund the capex for this expansion. These fixed rate bonds received the highest rating of Aaa by Philippine Rating Services Corporation (Philratings) and was 5x oversubscribed, allowing D&L to price its bond at among the lowest rates in Philippine corporate bond history. The issuance was also awarded by the Asset Magazine as the Best New Bond in the Philippines for the year 2021. For the bond rating renewal in 2022, Philratings has maintained its Aaa rating with a stable outlook demonstrating the company’s solid financial position and prospects.

D&L’s Batangas expansion will be instrumental to its future growth, as this facility will enable the company to develop more high value-added coconut-based products and penetrate new international markets. In the new normal, the company has successfully made significant in-roads in supplying various raw materials and even finished products in several relevant fast-moving consumer goods (FMCG) categories. It plans to further expand its global footprint and in the long-term, targets export sales to account for at least 50% of total revenue.

The facility will mainly cater to D&L’s growing export businesses in the food and oleochemicals segments. It will add the capability to manufacture downstream packaging, thus allowing the company to capture a bigger part of the production chain. For instance, while the company primarily sells raw materials to customers in bulk, the new plants will allow it to “pack at source”. This means that D&L will have the ability to process the raw materials and package them closer to finished consumer-facing products. This will enable D&L to move a step closer to its customers by providing customized solutions and simplifying their supply chain, which is of high importance given ongoing logistical challenges.

Segment results: Consumer Products ODM and Food Ingredients seem to be the bright spots

Consumer Products ODM

Consumer Products ODM segment saw its income grow by 76% YoY for the quarter. This resulted in more than doubling the segment’s income contribution to the group which stood at 16% in 1Q23 from a mere 7% income contribution in full-year 2022. The strong growth was mainly driven by the continued reopening of the economy and the resumption of face-to-face activities which fuelled demand for many personal care products. Total volume for the segment was up 90% YoY while GPM expanded by 4.3ppts.

Food Ingredients

The Food Ingredients business managed to increase its earnings by 14% YoY for the quarter despite inflationary pressures. The earnings growth was mainly driven by better margins as raw material prices continued to normalize. GPM for the quarter expanded by 5.6 ppts. With the peak season yet to come and as the economy continues to open up, further recovery is anticipated for the Food Ingredients business.

Chemrez

Chemrez posted an earnings decline of 41% YoY for the quarter. This came in after a stellar performance in FY22 with earnings growing by 47% YoY. With the huge jump in volume last year, specifically for HMSP Oleochemicals geared for exports, Chemrez’s customers have had a longer-than-expected time to digest their inventory amidst slower-than-expected sales due to high inflation. Meanwhile, on the commodity side, the competitive landscape in the biodiesel business amidst an oversupply in the industry continues to put pressure on margins.

While the first quarter proved to be challenging, the second quarter looks to be better with exports volume starting to come back. Moreover, Chemrez has embarked on an aggressive export thrust with the appointment of distributors in key export markets. These efforts are aimed at bringing in new export business as the Batangas plant starts commercial operations.

Specialty Plastics

The Specialty plastics business was off to a slow start in 2023 with earnings dropping by 36% YoY in the first quarter. This segment encountered several challenges for the period ranging from the implementation of the Extended Producer Responsibility (EPR) Act to low resin prices, sugar shortage, and high inflation which affected the demand for plastic packaging in general.

The EPR Act requires large enterprises, those with total assets of over P1 billion, to recover a certain portion of their plastic packaging waste. This has put pressure on major enterprises to explore alternative packaging materials which are not covered by the said law. While EPR appears to be a challenge on the surface, the company sees this as an opportunity to increase its relevance to customers. With this, the company is set to launch a new range of packaging solutions to customers which aims to help them adapt to the changing business landscape.

Over the long term, this division is expected to continue to grow fuelled by the company’s R&D investments that are aimed at developing new applications for its products and introducing new technologies that will make plastics more economical and environmentally-friendly at the same time.

D&L champions high impact sustainability initiatives

D&L Industries has embraced a holistic approach to sustainable innovation, long before the term “ESG” became mainstream. With R&D at the company’s core, D&L is relentless in developing products that answer the needs of its customers while at the same time staying attuned to the needs of the planet. In the global scene, D&L is seen as an advocate for sustainable products derived from sustainable materials such as coconut oil, given its extensive technical knowhow and wide array of product offerings.

With its upcoming state-of-the-art manufacturing facility in Batangas, D&L is spearheading a paradigm shift in its approach towards sustainability. With the new capabilities that the Batangas plant will bring, D&L aims to offer turnkey solutions to customers that are both economically and environmentally friendly.

D&L envisions empowering brands globally to make a meaningful shift towards high impact sustainability initiatives in the manufacturing of their products by giving them the option to buy direct from source. The direct from source approach simply means converting raw materials into finished goods in the country of raw material origin, instead of going through multi-leg production stages which usually happen across different locations in the globe. This naturally translates into simpler logistics, less wastage, lower costs, higher efficiency, and as such, significantly cutting down the carbon footprint (C02) of the entire supply chain.

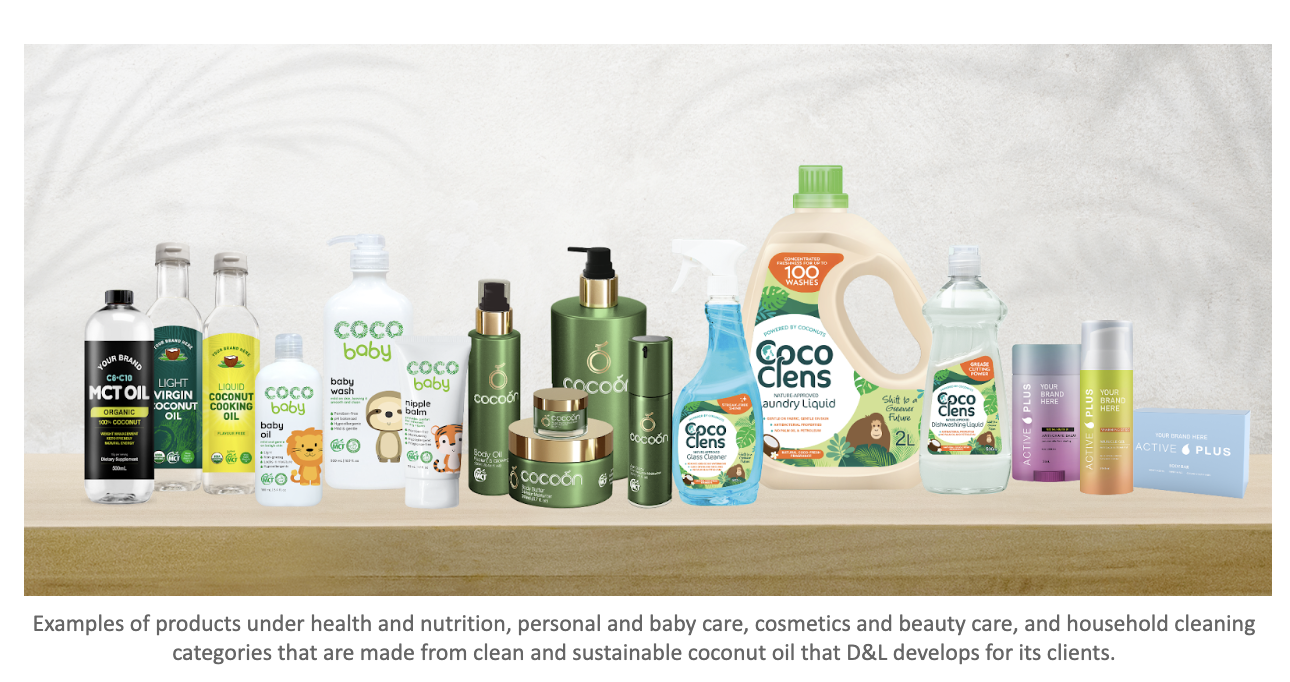

D&L is gearing up towards launching a full range of shelf-ready products for its export customers, made from coconut oil, for the personal and baby care, cosmetics and beauty care, household cleaning, health and nutrition, and food and vegetable oils categories that are sustainable, natural, and organic. This initiative offers a plug-and-play solution for global brand owners who are looking to beef up their sustainable product offerings. Under this strategy, D&L will primarily target export customers who do not have the proximity to the source and instead would traditionally go through multiple layers of production before their products get into its final form and ready for end-customer purchase or consumption.

-end-

D&L Industries is a Filipino company engaged in product customization and specialization for the food, chemicals, plastics and consumer products ODM industries. The company’s principal business activities include manufacturing of customized food ingredients, specialty raw materials for plastics, and oleochemicals for personal and home care use. Established in 1963, D&L has the largest market share in most of the industries it serves, as well as long-standing customer relationships with the Philippines’ leading consumer and manufacturing companies. It was listed on the Philippine Stock Exchange in December 2012. For more information, please visit https://www.dnl.com.ph/investors/.

This press release may contain some “forward-looking statements” which are subject to a number of risks and uncertainties that could affect D&L’s business and results of operations. Although D&L believes that expectations reflected in any forward-looking statements are reasonable, D&L does not guarantee future performance, action or events.

INVESTOR RELATIONS CONTACT

Crissa Marie U. Bondad

Investor Relations Manager – D&L Industries Inc.

+632 8635 0680

crissabondad@dnl.com.ph / ir@dnl.com.ph