News

D&L Industries posts record 9M earnings

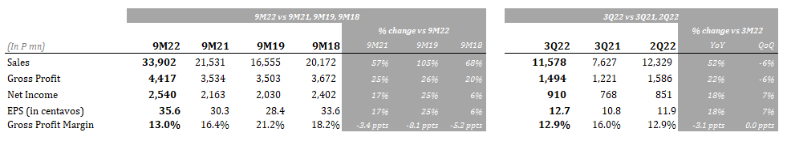

- 9M22 earnings of P2.5 billion higher by 17%, 3Q22 earnings of P910 million higher by 18% YoY, record level earnings despite a confluence of macroeconomic headwinds

- HMSP margins continue to recover, up 2.5% from the low in 1Q22

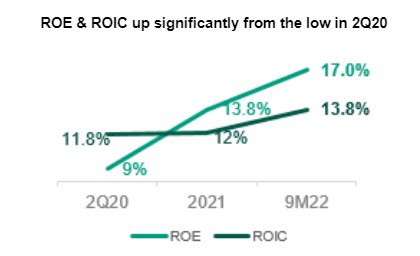

- ROE and ROIC up significantly from the low in 2Q20; ROE higher by 8ppts to 17%, ROIC higher by 2ppts to 13.8%

- With the strong momentum, earnings are on-track to possibly exceed full-year record income achieved in 2018

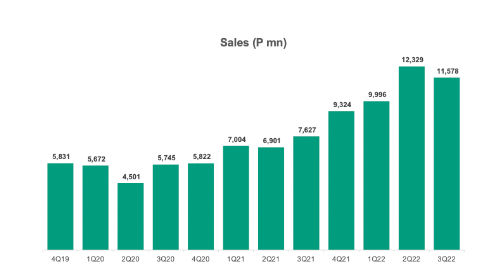

November 8, 2022 – D&L Industries’ net income in the first nine months of the year stood at P2.5 billion, higher by 17% YoY and almost at par with the full year income of P2.6 billion recorded last year. 9M22 earnings represent the highest 9M income level in the company’s history, amidst a confluence of macroeconomic headwinds and an Omicron surge in January. In 3Q22 alone, D&L booked a record quarterly net income of P910 million, which was up 18% YoY. The better-than-expected earnings were mainly driven by a wider economic reopening and exports seeing resilient growth. The robust earnings also demonstrate D&L’s ability to weather various macroeconomic conditions given its diversified businesses, the essential nature of the products it manufactures, and its ability to adjust its selling prices regularly.

Management Perspective

“With the strong earnings momentum so far this year and near-term catalysts such as the anticipated holiday-induced spending and the lifting of mask requirements indoors, our earnings are on-track to possibly exceed our record net income booked in 2018,” remarked President & CEO Alvin Lao.

“While global macro concerns remain, there’s a fundamental growth story within the company that’s proving to be resilient. We look forward to the commercial operations of our Batangas plant starting next year. This will be instrumental in enabling our next leg of growth by helping to expand our global footprint and further advance our R&D and manufacturing capabilities,” Lao concluded.

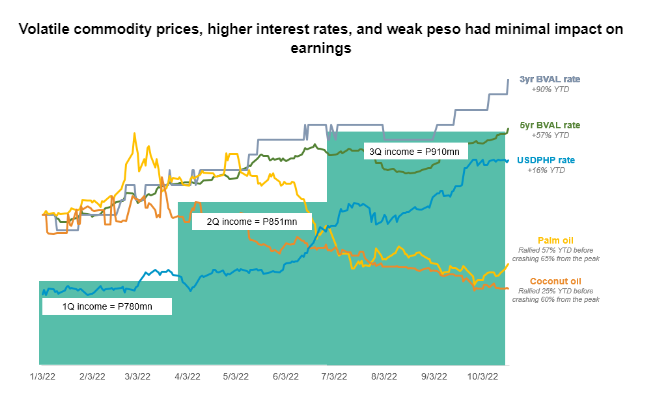

Record income despite a confluence of macroeconomic headwinds

D&L Industries managed to book record income for the period despite a confluence of volatile raw material prices, higher inflation and interest rates, a weak peso, and an Omicron surge early in the year. The better-than-expected earnings were mainly driven by the continued reopening of the Philippine economy and stronger company exports. With the lowest alert level in place and the lifting of the mask mandate in open areas, economic activity and consumer mobility continue to pick up as people become more comfortable going out. This is evidenced by the higher consumer traffic in retail establishments, higher occupancy in restaurants, and higher frequency of flights. Meanwhile, D&L’s export business is proving to be resilient with Chemrez’s earnings growing by over 50% in 9M22. The growth was largely driven by the higher export market penetration and higher demand for sustainable, organic, and natural coconut oil-based raw materials used in various health, personal, and home care products.

D&L’s robust earnings demonstrate its ability to weather various macroeconomic conditions given its diversified businesses, the essential nature of the products it manufactures, and its ability to adjust its selling prices regularly.

Weathering volatility in commodity prices | HMSP margins up 2.5% from the low in 1Q22

Prices of some of the company’s key raw materials such as coconut and palm oil have been volatile for the period, driven by recent global developments such as the Russia-Ukraine conflict and the temporary ban on export of palm oil by Indonesia. Average coconut oil and palm oil prices have rallied 25% YTD and 57% YTD, respectively, before correcting by 60% and 65%, respectively, from recent peaks.

D&L maintains its ability to weather the volatility in raw material prices, as the company adjusts its selling prices regularly to reflect higher input costs. As shown in the chart below, D&L’s revenues have been increasing since the pandemic, evidencing the company’s ability to pass on higher raw material prices.

While margins underwent temporary contraction, given the rapid increase in commodity prices over a short period of time and the 30-45 day time lag before the company can adjust selling prices, margins are expected to normalize and recover once commodity prices start to stabilize. In fact, in 3Q22, HMSP margins have already started to recover, already up by 2.5 ppts from the low recorded in 1Q22.

Beyond the margin recovery from the normalization of commodity prices, the company sees ample room for margins to go up further over the long term. With the unprecedented business and supply chain disruptions over the past two years, D&L has cemented its position as a reliable partner and supplier to its customers. This should pave the way for better business opportunities as good times come back. Given the company’s extensive R&D and manufacturing capabilities, there are also plenty of opportunities to develop higher value added products as consumer tastes and preferences evolve.

Export continues to be a bright spot

The exports division continued its positive momentum in 9M22, with revenues jumping 60% YoY for the period. Export contribution to total revenues in 9M22 stood at 33%, evidencing the company’s commitment to diversifying its revenue base by strategically growing its international customer base.

Coconut-based products under food and oleochemicals were the main drivers behind robust export growth in the period. Coconut oil continues to gain traction in the global market due to its perceived natural antiviral, antibacterial, and antifungal properties. In addition, coconut oil remains a valued, sustainable substitute for petroleum-based raw materials used in many applications such as personal hygiene and home cleaning products. Going forward, the company expects its foothold in coconut oil-based exports to strengthen especially as the company builds its capabilities to serve a wider array of international customers.

Batangas expansion will position the company for long-term growth and enable the achievement of strategic priorities

D&L remains committed to its Batangas expansion which is set to start commercial operations in 2023. Total estimated capex for the new plant is around P10.2 billion. As of end-September 2022, the company has spent around P8.3 billion for the project. Quarterly capex has likely already peaked at P972 million in 1Q22 with 2Q22 and 3Q22 capex lower at P660 million and 944 million, respectively. Once the Batangas plant is completed, capex is expected to decrease further as there are no other major expansions currently planned, and free cash flows of the company may turn positive by next year.

In September 2021, the company executed its maiden bond offering, successfully raising P5 billion to help fund the remaining capex for this expansion. The bond received the highest rating of Aaa by Philippine Rating Services Corporation (Philratings) and was 5x oversubscribed, allowing D&L to price its bond at among the lowest rates in Philippine corporate bond history. The issuance was also awarded by the Asset Magazine as the Best New Bond in the Philippines for the year 2021. For the bond rating renewal in 2022, Philratings has maintained its Aaa rating with a stable outlook demonstrating the company’s solid financial position and prospects.

The facility will mainly cater to D&L’s growing export businesses in the food and oleochemicals segments. It will add the capability to manufacture downstream packaging, thus allowing the company to capture a bigger part of the production chain. For instance, while the company primarily sells raw materials to customers in bulk, the new plants will allow it to “pack at source”. This means that D&L will have the ability to process the raw materials and package them closer to finished consumer-facing products. This will enable D&L to move a step closer to its customers by providing customized solutions and simplifying their supply chain, which is of high importance given ongoing logistical challenges.

D&L’s Batangas expansion will be instrumental to its future growth, as this facility will enable the company to develop more high value-added coconut-based products and penetrate new international markets. In the new normal, the company has successfully made significant in-roads in supplying various raw materials and even finished products in several relevant fast-moving consumer goods (FMCG) categories. It plans to further expand its global footprint and in the long-term, targets export sales to account for at least 50% of total revenue.

Operational and financial resilience

As the world gradually recovers from the pandemic, D&L is emerging more resilient than ever, having instituted various adjustments and operational contingencies. While there are renewed risks to global growth and recovery, the company believes that it is now in a far better position to thrive in an adverse environment and a potentially protracted economic recovery period. Moreover, as most products that the company manufactures cater to essential industries such as food, oleochemicals, plastics and other basic materials, the company sees continued strong demand ahead.

From a capital structure perspective, the company is in a solid position to withstand external pressures. As of end-September 2022, net gearing continues to remain manageable at 61%, interest cover at 15x, and average interest rate at 4.2%. The issuance of the P5 billion maiden bond offering of the company is helping cushion the recent increase in interest rates. The bonds carry a coupon rate of 2.7885% p.a. and 3.5962% p.a. for 3-year and 5-year tenors, respectively, which would have been significantly higher at approximately 6.7579% for the 3-year tenor and 7.3555% for the 5-year tenor if the company were to issue the bonds today.

Meanwhile, the cash conversion cycle for the period was lower at 101 days vs. 120 days in 2021, given lower inventory and account receivables days.

Overall, the company’s profitability ratios remain healthy. Return on Equity (ROE) and Return on Invested Capital (ROIC) stood at 17% and 13.8%, respectively, in 9M22.

Better lives through sustainable innovation

D&L Industries has already been practicing a holistic approach to sustainable innovation, long before the term “ESG” became mainstream. With R&D at the company’s core, D&L is relentless in developing products that answer the needs of its customers while at the same time staying attuned to the needs of the planet. In the global scene, D&L is seen as an advocate for sustainable products derived from sustainable materials such as coconut oil, given its extensive technical knowhow and wide array of product offerings.

D&L sees a future that integrates all aspects of product design and development, as well as manufacturing to come up with products that are better for the consumers and better for the environment. Its Batangas plant signifies the company’s investments to double down on sustainability with a 360 degree approach – designing and building a sustainable infrastructure and operations for a wider array of inherently sustainable products.

The company currently offers various sustainable products such as plant-based replacements for dairy and animal-derived ingredients, biodiesel which is a more environment-friendly substitute for fossil fuels, coconut oil-based natural and organic raw materials for home and personal care products, organic fertilizers, and even sustainable packaging materials. As the world shifts toward a more sustainable consumption, D&L plans to continue to play on its strengths and develop more products designed to better lives while reducing its impact on the environment. The company sees this trend as the next leg of growth and sees the next decade as transformational for the company.

Segment Results

Food Ingredients

With the continued reopening of the economy, the food ingredients segment posted a volume growth of 24% YoY for the period. However, with the extreme volatility in commodity prices this year, blended margins dropped by 3.4ppts, resulting in a 6% decline in earnings for the period. Nonetheless, margins are seen to recover once commodity prices start to stabilize.

This business was the segment most heavily affected by the pandemic, hence it is also expected to post the sharpest recovery post-pandemic. With quarantine restrictions now easing across the country and in the economic hub of Metro Manila, the company anticipates that further recovery is set to continue as fully vaccinated individuals are granted more freedom of movement, especially when frequenting restaurants, hotels, and the service industry.

Chemrez

With higher export market penetration and the strong demand for organic, sustainable, and natural coconut oil-based products, Chemrez’s stellar performance continued in the third quarter of the year as it posted a record quarterly income. Overall, Chemrez’s earnings grew by 53% YoY for the first nine months of the year. Oleochemicals division, which was the main growth driver, saw its volume grow by 51% YoY and GPM increase by 1.1ppts.

Under the Oleochemicals division, the company sells various coconut oil derivatives which are categorized as either commodity (biodiesel) or high margin coconut oil-based products mostly for exports. As the economy continues to reopen, demand for biodiesel has started to pick up. Meanwhile, the high margin coconut-based products which are sustainable substitutes for petroleum-based raw materials used in many applications such as personal hygiene and home cleaning products continue to benefit from the increasing consumer awareness and preference for natural, organic, and sustainable products.

Plastics

Specialty plastics income increased by 12% YoY in 9M22 as the 1.2-ppt margin expansion more than offset the impact of the 18% YoY volume decline for the period. The drop in volume was mainly due to the disruptions brought about by the Omicron surge in January and the global shortage of semiconductor chips used in automotives which resulted in lower demand for wire harnesses.

Consumer Products ODM

Consumer products ODM, previously referred to as Aerosols, saw its income decline by 23% YoY in 9M22 partly due to higher raw material prices for the period and partly due to the normalizing demand for disinfection and sanitation products as the world moves towards the tail end of the pandemic. Nonetheless, 9M22 earnings were still well-above pre-pandemic income level recorded in 1H19.

As the company adjusts its selling prices regularly, margins are anticipated to recover once key raw material prices start to stabilize. The company also anticipates demand for its consumer products to strengthen as quarantine restrictions ease, leading to greater foot traffic in retail outlets and more consumers resuming the regular use of personal hygiene products.

-end-

D&L Industries is a Filipino company engaged in product customization and specialization for the food, chemicals, plastics and consumer products ODM industries. The company’s principal business activities include manufacturing of customized food ingredients, specialty raw materials for plastics, and oleochemicals for personal and home care use. Established in 1963, D&L has the largest market share in most of the industries it serves, as well as long-standing customer relationships with the Philippines’ leading consumer and manufacturing companies. It was listed on the Philippine Stock Exchange in December 2012. For more information, please visit https://dnl.com.ph/investors/.

This press release may contain some “forward-looking statements” which are subject to a number of risks and uncertainties that could affect D&L’s business and results of operations. Although D&L believes that expectations reflected in any forward-looking statements are reasonable, D&L does not guarantee future performance, action or events.

INVESTOR RELATIONS CONTACT

Crissa Marie U. Bondad

Investor Relations Manager – D&L Industries Inc.

+632 8635 0680

crissabondad@dnl.com.ph / ir@dnl.com.ph