News

D&L Industries posts record 1H22 earnings

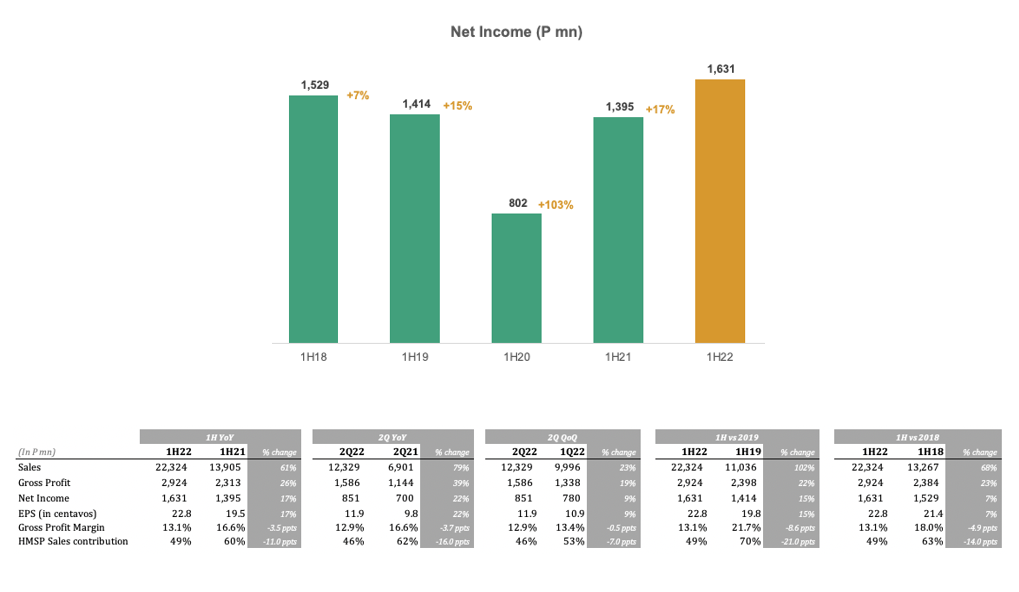

- 1H22 net income higher by 17% at P1.6bn and 2Q22 net income higher by 22% at P851mn, despite Omicron surge in January and sharp increase in commodity prices

- Strong export performance continued with 1H22 export sales up 69% YoY; export contribution to total sales at 34%

- HMSP margins started to recover, up 1.7ppts QoQ

- Continued optimism despite increasing COVID case counts as mostly mild cases are being reported

- D&L once again recognized as among the honored companies in Asia by Institutional Investor

August 10, 2022 – D&L Industries’ earnings in the first half stood at P1.6 billion, which was up 17% YoY, and above pre-COVID income levels booked in 1H19 and 1H18. 1H22 earnings represent the highest first half income level in the company’s history, despite the Omicron surge in January and sharp increase in commodity prices. In 2Q22 alone, net income was higher by 22% YoY at P851 million. The better-than-expected earnings were mainly driven by the continued economic reopening which was felt in all of the company’s segments. While COVID cases are on the rise again, most cases are mild and the government’s shift away from a lockdown strategy should bode well for continued economic growth and business optimism.

Management Perspective

“Our record 1H22 results demonstrate that despite various global macroeconomic headwinds, our company is benefiting from renewed business momentum amidst economic reopening and pent up demand from the past two years. Barring any unforeseen event, we will likely at least match our record full-year income booked in 2018,” remarked President and CEO Alvin Lao.

“Beyond the forces supporting demand hinged on the economic reopening, we see a structural growth story for the company underpinned by our growing global footprint and advancing R&D and manufacturing capabilities with the commercial operations of our new plant in Batangas by early next year. With this conviction, through our family holding company Jadel we will continue to buy DNL shares as we see value emerging from the currently depressed equity market valuations,” Lao added.

“Our hard work has not gone unnoticed and we are pleased to be recognized once again as one of the honored companies in Asia by Institutional Investor magazine. We thank the investing community for their continuous support. We will remain focused on delivering value to all our stakeholders,” Lao concluded.

Record 1H22 net income despite Omicron surge and sharp increase in commodity prices

D&L Industries managed to book a record first half income of P1.6 billion despite the Omicron surge in January and sharp increase in commodity prices for the period. With 2Q22 being the first full quarter with alert level 1 in place, D&L’s earnings recovered sharply to P851 million, up 22% YoY and well above pre-COVID income levels.

The better-than-expected income demonstrates that while there remain various global macro headwinds, the economic reopening remains the dominant force in spurring demand. This was felt strongly by the company’s food ingredients segment, which saw a sharp increase in earnings of 28% YoY in 2Q alone, bringing 1H earnings growth to 5% and reversing the 19% YoY earnings decline recorded in 1Q22.

While COVID cases are picking up again, most cases are mild. Moreover, the new government explicitly indicated in the recently concluded state of the nation address (SONA) that there will be no more lockdowns. This should bode well for the continued economic recovery and business optimism.

Weathering volatility and commodity prices | HMSP margins started to recover

Prices of some of the company’s key raw materials such as coconut and palm oil have been quite volatile for the period, driven by recent global developments such as the Russia-Ukraine conflict and the temporary ban on export of palm oil by Indonesia. Average coconut oil and palm oil prices have rallied 25% YTD and 57% YTD, respectively, before correcting by 47% and 58%, respectively, from recent peaks.

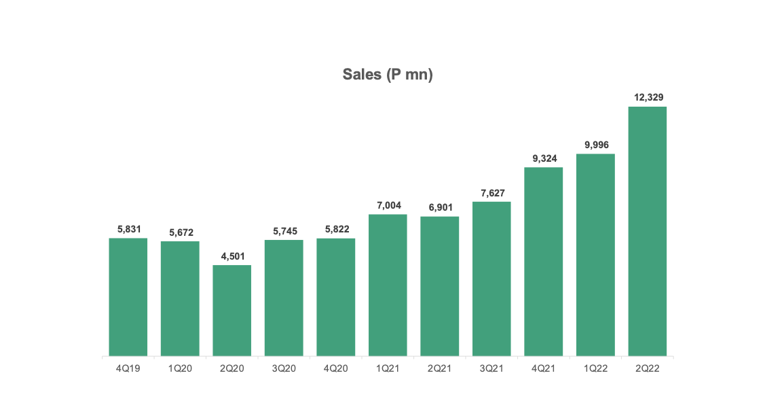

D&L maintains its ability to weather the volatility in raw material prices, as the company adjusts its selling prices regularly to reflect higher input costs. As shown in the chart below, D&L’s revenues have been increasing since the pandemic, evidencing the company’s ability to pass on higher raw material prices.

While margins have experienced temporary contraction given the rapid increase in commodity prices over a short period of time and the 30-45 day time lag before the company can adjust its selling price, margins are expected to normalize and recover once commodity prices start to stabilize. In fact, in 2Q22, HMSP margins have already started to recover, expanding by 1.7 ppts QoQ.

Beyond the margin recovery from the normalization of commodity prices, the company sees ample room for margins to go up further over the long term. With the unprecedented business and supply chain disruptions over the past two years, D&L has cemented its position as a reliable partner and supplier to its customers. This should pave the way for better business opportunities as good times come back. Given the company’s extensive R&D and manufacturing capabilities, there are also plenty of opportunities to develop higher value added products as consumer taste and preference evolve.

Export continues to be a bright spot

The exports division continued its positive momentum in 1H22, with revenues jumping 69% YoY for the period. Export contribution to total revenues in 1H22 stood at 34%, evidencing the company’s commitment to diversifying its revenue base by strategically growing its international customer base.

Coconut-based products under food and oleochemicals were the main drivers behind robust export growth in the period. Coconut oil continues to gain traction in the global market due to its perceived natural antiviral, antibacterial, and antifungal properties. In addition, coconut oil remains a valued, sustainable substitute for petroleum-based raw materials used in many applications such as personal hygiene and home cleaning products. Going forward, the company expects its foothold in coconut oil-based exports to strengthen especially as the company builds its capabilities to serve a wider array of international customers.

Batangas expansion will position the company for long-term growth and enable the achievement of strategic priorities

D&L remains committed to its Batangas expansion which is set to start commercial operations in January 2023. As the company invests in the future and envisions a facility specced to the highest standards, D&L made several additions and upgrades to the original plan, which resulted in an increase in the budgeted capex from P9.1 billion to P10.2 billion. As D&L had already begun the construction of the new plant in 2018, which was before the pandemic started, there was minimal impact from price increases.

As of end-June 2022, the company has spent around P7.8 billion for the project. Quarterly capex has likely already peaked at P972 million in 1Q22 with 2Q22 capex lower at P660 million. Once the Batangas plant is completed, capex is expected to decrease further as there are no other major expansions currently planned, and free cash flows of the company may turn positive by next year.

In September 2021, the company executed its maiden bond offering, successfully raising P5 billion to help fund the remaining capex for this expansion. The bond received the highest rating of Aaa by Philippine Rating Services Corporation (Philratings) and was 5x oversubscribed, allowing D&L to price its bond at among the lowest rates in Philippine corporate bond history. The issuance was also awarded by the Asset Magazine as the Best New Bond in the Philippines for the year 2021.

The facility will mainly cater to D&L’s growing export businesses in the food and oleochemicals segments. It will add the capability to manufacture downstream packaging, thus allowing the company to capture a bigger part of the production chain. For instance, while the company primarily sells raw materials to customers in bulk, the new plants will allow it to “pack at source”. This means that D&L will have the ability to process the raw materials and package them closer to finished consumer-facing products. This will enable D&L to move a step closer to its customers by providing customized solutions and simplifying their supply chain, which is of high importance given ongoing logistical challenges.

D&L’s Batangas expansion will be instrumental to its future growth, as this facility will enable the company to develop more high value-added coconut-based products and penetrate new international markets. In the new normal, the company has successfully made significant in-roads in supplying various raw materials and even finished products in several relevant fast-moving consumer goods (FMCG) categories. It plans to further expand its global footprint and in the long-term, targets export sales to account for at least 50% of total revenue.

Operational and financial resilience

As the world gradually recovers from the pandemic, D&L is emerging more resilient than ever, having instituted various adjustments and operational contingencies. While there are renewed risks to global growth and recovery, the company believes that it is now in a far better position to thrive in an adverse environment and a potentially protracted economic recovery period. Moreover, as most products that the company manufactures cater to basic essential industries such as food, oleochemicals, plastics and cleaning chemicals, the company sees continued strong demand ahead.

From a capital structure perspective, the company is in a solid position to withstand external pressures. As of end-June 2022, gearing continues to remain manageable at 52%, interest cover at 14x, and average interest rate at 3.09%. The issuance of the P5 billion maiden bond offering of the company is helping cushion the recent increase in interest rates. The bonds carry a coupon rate of 2.7885% p.a. and 3.5962% p.a. for 3-year and 5-year tenors, respectively, which would have been significantly higher at approximately 5.8% for the 3-year tenor and 6.5% for the 5-year tenor if the company were to issue the bonds today.

Meanwhile, the cash conversion cycle for the period was lower at 105 days vs. 120 days in 2021, given lower inventory and account receivables days.

Overall, the company’s profitability ratios remain healthy. Return on Equity (ROE) and Return on Invested Capital (ROIC) stood at 17.1% and 14%, respectively, in 1H22.

DNL recognized as among the Honored Companies in Asia by Institutional Investor

D&L Industries was recently named one of the honored companies in Asia in Institutional Investor’s 2022 Asia (ex-Japan) executive team survey. The company ranked fifth among Consumer Staples in the Small and Midcap Category in Asia and seventh among Consumer Staples in the Asia (ex-China, Japan) category.

Meanwhile, D&L’s Investor Relations Manager, Crissa Bondad was named as the Best IR Professional for Consumer Staples (Asia ex-China, Japan) and third Best IR Professional overall for Small and Midcap firms under the Consumer Staples category by buy side professionals.

Institutional Investor is a leading international business-to-business publisher, focused primarily on international finance. For over 50 years, it has been a trusted source for research and rankings among top analysts and portfolio managers in the financial industry. This year’s survey results reflect the opinions from 4,854 investment professionals at 1,612 financial services firms.

Better lives through sustainable innovation

D&L Industries has already been practicing a holistic approach to sustainable innovation, long before the term “ESG” became mainstream. With R&D at the company’s core, D&L is relentless in developing products that answer the needs of its customers while at the same time staying attuned to the needs of the planet. In the global scene, D&L is seen as an advocate for sustainable products derived from sustainable materials such as coconut oil, given its extensive technical knowhow and wide array of product offerings.

D&L sees a future that integrates all aspects of product design and development, as well as manufacturing to come up with products that are better for the consumers and better for the environment. Its Batangas plant signifies the company’s investments to double down on sustainability with a 360 degree approach – designing and building a sustainable infrastructure and operations for a wider array of inherently sustainable products.

The company currently offers various sustainable products such as plant-based replacements for dairy and animal-derived ingredients, biodiesel which is a more environment-friendly substitute for fossil fuels, coconut oil-based natural and organic raw materials for home and personal care products, organic fertilizers, and even sustainable packaging materials. As the world shifts toward a more sustainable consumption, D&L plans to continue to play on its strengths and develop more products designed to better lives while being kind to the planet. The company sees this trend as the next leg of growth and sees the next decade as transformational for the company.

Segment Results

Food Ingredients

With 2Q22 being the first full quarter with alert level 1 in place, the food ingredients business saw strong earnings recovery, up 28% YoY and surpassing pre-pandemic quarterly earnings recorded in 2Q18 and 2Q19. This brings 1H22 earnings growth to 5%, reversing the 19% YoY earnings decline recorded in 1Q22.

This business was the segment most heavily affected by the pandemic, hence it is also expected to post the sharpest recovery post-pandemic. With quarantine restrictions now easing across the country and in the economic hub of Metro Manila, the company anticipates that further recovery is set to continue as fully vaccinated individuals are granted more freedom of movement, especially when frequenting restaurants, hotels, and the service industry.

Chemrez

Chemrez’s stellar performance in the first half of the year saw earnings growing 61% YoY. The earnings growth was mainly driven by the Oleochemicals division which saw its volume grow by 36% YoY and GPM recover by 2.4 ppts, evidencing the company’s ability to adjust its prices regularly to reflect higher input costs.

Under the Oleochemicals division, the company sells various coconut oil derivatives which are categorized as either commodity (biodiesel) or high margin coconut oil-based products mostly for exports. As the economy continues to reopen, demand for biodiesel has started to pick up. Meanwhile, the high margin coconut-based products which are sustainable substitutes for petroleum-based raw materials used in many applications such as personal hygiene and home cleaning products continue to benefit from the increasing consumer awareness and preference for natural, organic, and sustainable products.

Plastics

Specialty plastics income increased by 18% YoY in 1H22 as the 2.6-ppt margin expansion more than offset the impact of the 18% YoY volume decline for the period. The margin expansion mainly came from the colorants and additive division due to the election-fuelled demand for higher margin plastic colorants used in tarpaulins which are used as campaign materials. Meanwhile, the drop in volume was mainly due to the disruptions brought about by the Omicron surge in January and the global shortage of semiconductor chips used in automotives which resulted in lower demand for wire harnesses.

Consumer Products ODM

Consumer products ODM, previously referred to as Aerosols, saw its income decline by 28% YoY in 1H22 partly due to higher raw material prices for the period and partly due to the normalizing demand for disinfection and sanitation products as the world moves towards the tail end of the pandemic. Nonetheless, 1H22 earnings were still well-above pre-pandemic income levels recorded in 1H18 and 1H19.

As the company adjusts its selling prices regularly, margins are anticipated to recover once key raw material prices start to stabilize. The company also anticipates demand for its consumer products to strengthen as quarantine restrictions ease, leading to greater foot traffic in retail outlets and more consumers resuming the regular use of personal hygiene products.

-end-

D&L Industries is a Filipino company engaged in product customization and specialization for the food, chemicals, plastics and consumer products ODM industries. The company’s principal business activities include manufacturing of customized food ingredients, specialty raw materials for plastics, and oleochemicals for personal and home care use. Established in 1963, D&L has the largest market share in most of the industries it serves, as well as long-standing customer relationships with the Philippines’ leading consumer and manufacturing companies. It was listed on the Philippine Stock Exchange in December 2012. For more information, please visit https://dnl.com.ph/investors/.

This press release may contain some “forward-looking statements” which are subject to a number of risks and uncertainties that could affect D&L’s business and results of operations. Although D&L believes that expectations reflected in any forward-looking statements are reasonable, D&L does not guarantee future performance, action or events.

INVESTOR RELATIONS CONTACT

Crissa Marie U. Bondad

Investor Relations Manager – D&L Industries Inc.

+632 8635 0680

crissabondad@dnl.com.ph / ir@dnl.com.ph