News

Press Release 2025 2Q

D&L Releases Second Quarter 2025 Financial Results

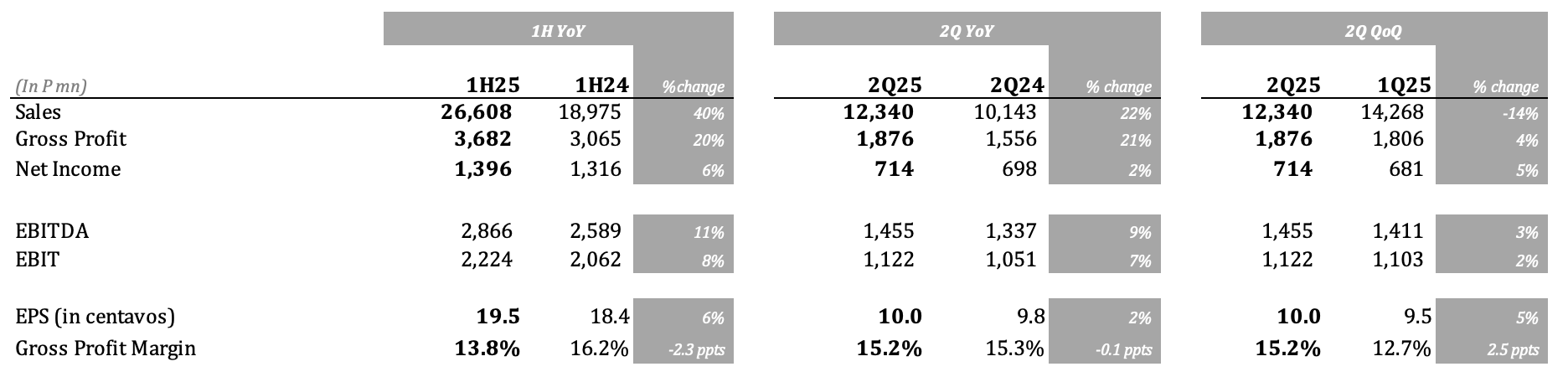

- 1H25 net income +6% YoY to P1.4 bn as Batangas plant consistently books profits; 2Q25 net income +2% YoY to P714 mn, tempered by abnormally high coconut oil prices

- Margins started to pick up with HMSP margins +3.9ppts QoQ; Blended GPM +2.5 ppts QoQ

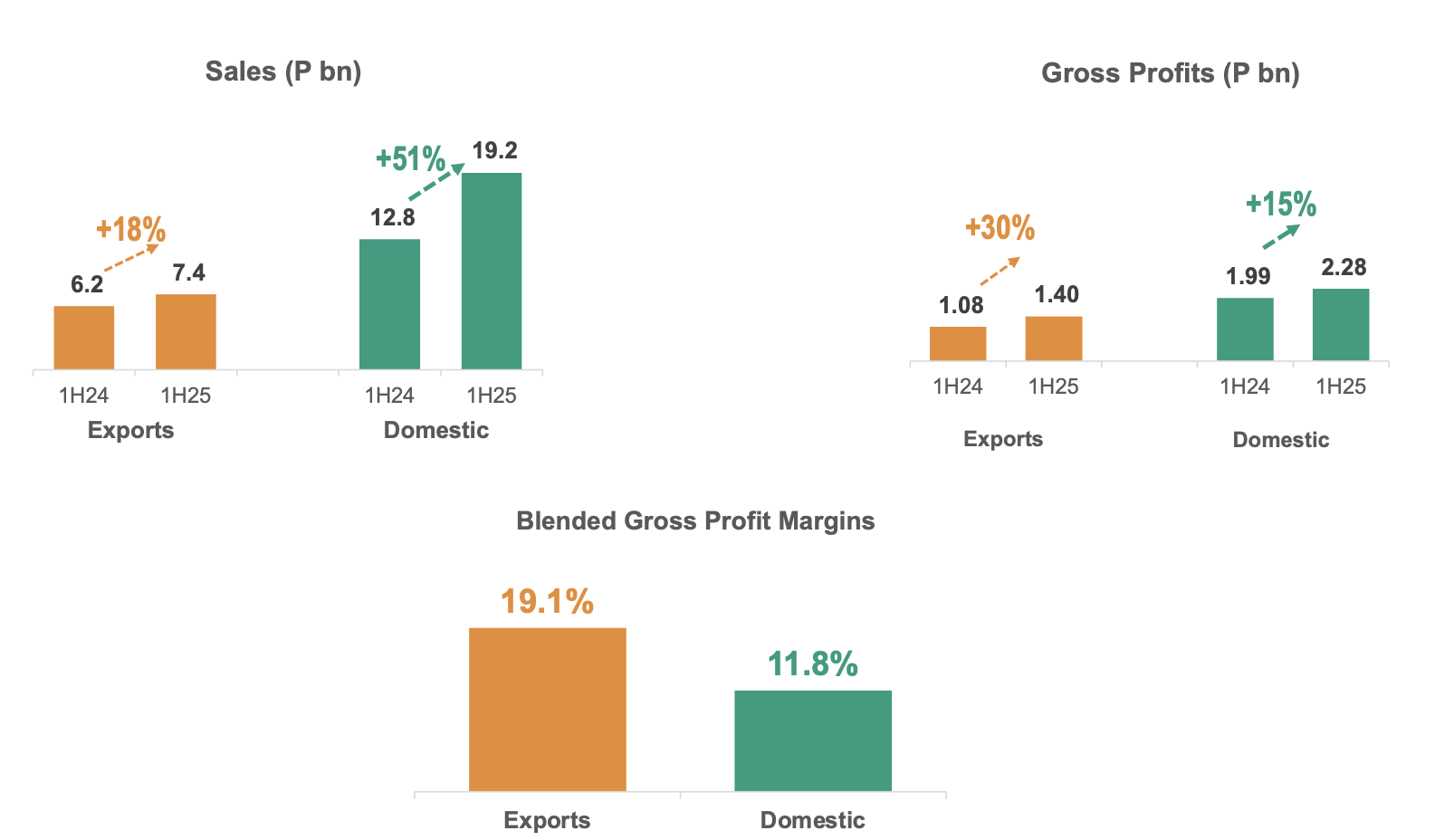

- Exports continue to drive growth with GP +30% YoY in 1H25; Exports contribution to gross profits stood at 38% for the period

- Return ratios continue to improve; ROE stood at 12.9% (+2.1ppts vs FY24), ROIC stood at 10.1% (+1.1ppts vs FY24)

- Management sees better 2H, optimistic on achieving double-digit income growth for FY25

Key Figures Summary

August 12, 2025 – D&L Industries’ recurring income reached P1.4 billion, or earnings per share (EPS) of P0.195, in the first half of 2025 (1H25). This is higher by 6% year-on-year (YoY). Meanwhile, in the second quarter of 2025 (2Q25), recurring income reached P714 million or EPS of P0.1, higher by 2% YoY. The growth in earnings was mainly driven by the consistent quarterly profitability of the Batangas plant and the robust exports business amidst elevated coconut oil prices.

Management perspective and outlook

“The second quarter proved challenging amid record-high coconut oil prices. Nonetheless, the company delivered a modest 2% year-on-year growth for the quarter. With coconut oil prices appearing overstretched, the second half is expected to benefit from more stable and potentially lower prices, supporting a stronger earnings performance compared to the first half. We maintain our outlook for double-digit net income growth for the year,” D&L CEO & President Alvin Lao remarked.

“On the macroeconomic front, inflation has been on the downtrend. Interest rates have come down and will likely go down further. These should continue to stimulate economic activities and consumer spending. Meanwhile, the rollout of the 4% biodiesel blend mandate has been deferred, allowing industry players and the supply chain additional time to recalibrate operations—positioning the sector for stronger, more sustainable long-term growth,” Lao added.

“On the global trade front, uncertainties remain over the potential impact of higher U.S. tariffs. However, the U.S. accounts for only about 3% of our total revenues, with most shipments comprising products recognized for their distinct technical and functional attributes,” Lao continued.

“Lastly, MSCI has announced the removal of DNL from the MSCI Philippines Small Cap Index, effective August 27, 2025, which may trigger short-term passive outflows. We view this as a technical event that does not reflect the company’s fundamentals or growth trajectory. At current share price levels, we see deep intrinsic value underpinned by the strength of our business model and the opportunities ahead. Demonstrating this conviction, the Lao family—through holding company Jadel—has steadily increased its ownership, acquiring about 3% of the company’s total outstanding shares since the pandemic. In 2024 and year-to-date-2025, the family purchased 20 million and 41 million shares, respectively. At prevailing market prices, the stock offers an attractive dividend yield of 4.4%,” Lao continued.

“Our focus remains on executing our growth strategy, expanding into new markets, and strengthening our competitive position to capture the significant opportunities we see both locally and globally. We are committed to delivering sustainable value for shareholders and remain confident in the company’s long-term prospects,” Lao concluded.

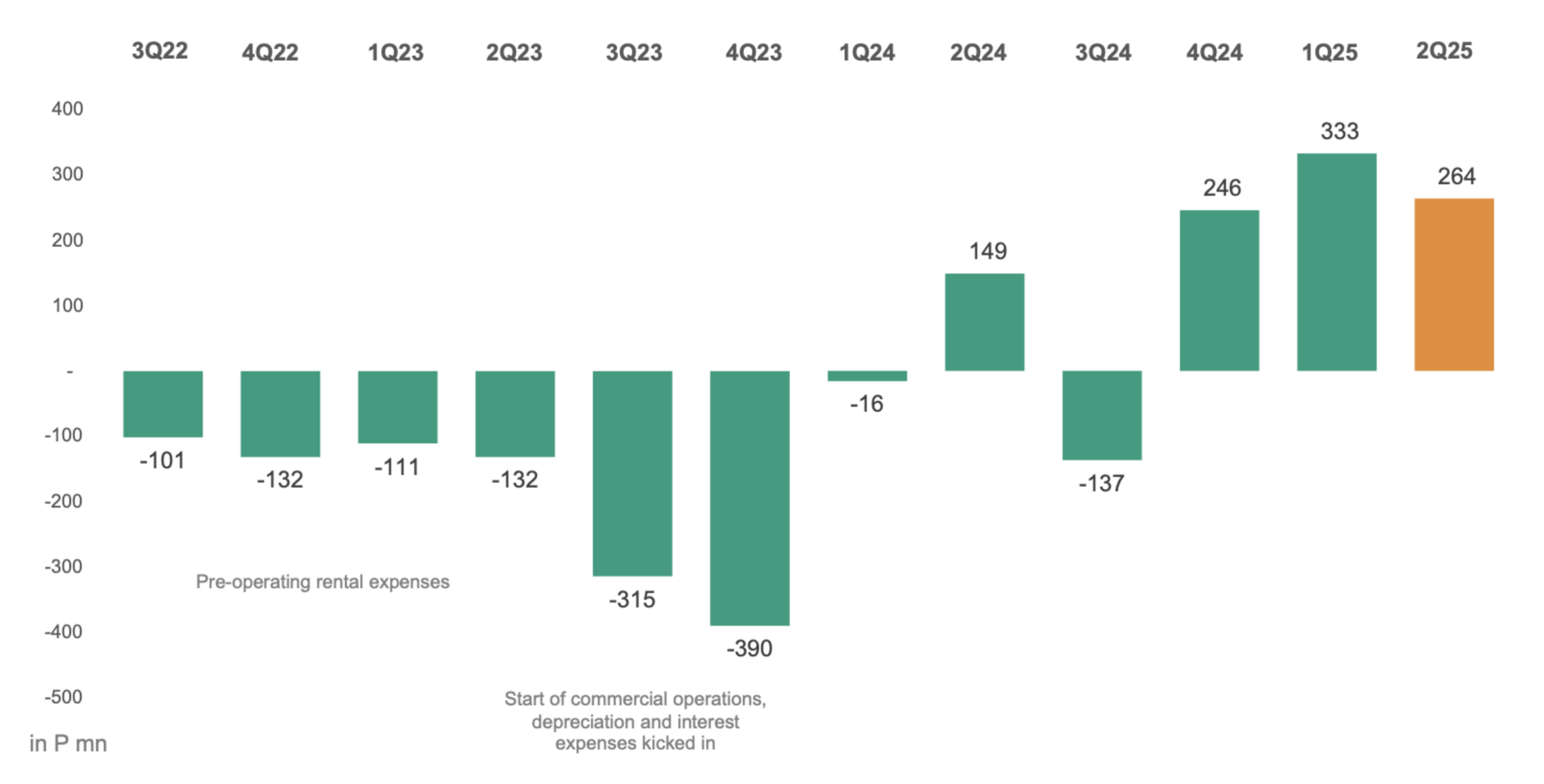

Consistent profitability at Batangas plant boosts return ratios

Just two years into commercial operations, D&L’s Batangas plant has already posted profits for three consecutive quarters. In 1H25, the plant booked an income of P597 million, up by more than three-fold from the same period last year. This came in ahead of management’s initial expectations of merely achieving breakeven in the first two years of operations.

D&L believes that it is only beginning to unlock the full potential of its new plant, supported by vast opportunities across both local and international markets. To date, the facility has successfully fulfilled orders for domestic and export customers. Several audit and certification processes are currently underway to enable the onboarding of additional clients.

Quarterly income of Batangas plant

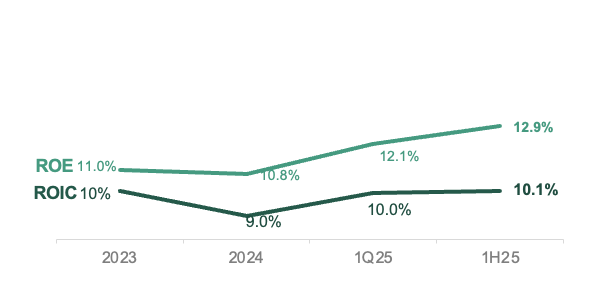

Driven by sustained profitability from its Batangas plant, the Company continues to see improvement in its return ratios. Return on Equity (ROE) reached 12.9% for the period, up by 2.1 percentage points (ppts) from FY24. Meanwhile, Return on Invested Capital (ROIC) improved to 10.1%, representing a 1.1 ppt increase from the FY24 level. Management aims for a consistent enhancement in both ratios, with a medium-term target in the mid- to high-teens range.

Return Ratios continue to improve

Margins start to recover amidst still elevated coconut oil prices

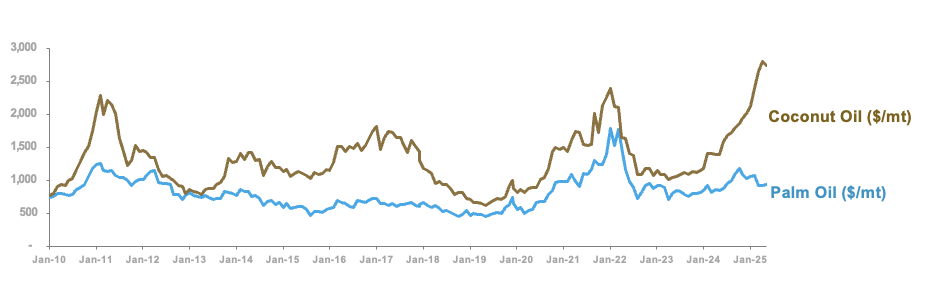

Coconut oil, a key raw material for the company, saw its average price increase by 85% YoY for the period. In the second quarter alone, coconut oil prices inched up by 15% from levels recorded at the end of the first quarter. This unprecedented increase in coconut oil prices has put pressure on the company’s overall margins and tempered the bottomline impact of 10% overall volume growth achieved for the period.

Despite coconut oil prices remaining elevated, the company has started to see margin recovery for the quarter as it continues to adjust its selling prices to pass on price changes to customers. In 2Q25, blended gross profit margins (GPM) bounced back by 2.5 ppts quarter-on-quarter (QoQ) to 15.2%. This was mainly driven by the 3.9 ppts QoQ margin recovery for the High Margin Specialty Products segment (HMSP).

In general, it takes the company an average of 30-45 days to adjust its prices which normally leads to a temporary margin contraction or expansion in an environment of rapidly changing commodity prices. The substantial increase in coconut oil prices was largely due to increasing global demand at a time when supply is temporarily constrained due to the negative effects of El Niño last year on coconut tree yield. D&L expects its margins to fully recover once commodity prices start to stabilize. As illustrated in the chart on the next page, periods of rapid coconut oil price increases have historically been followed by equally swift corrections.

Rapid increases in coconut oil prices followed by equally swift corrections

Exports is a key growth frontier with contribution to total gross profits already at 38%

The export business continues to deliver with revenues growing by 18% YoY to P7.4 billion in the first six months of the year. Meanwhile, exports gross profits grew by 30% YoY in 1H25, faster than the 15% YoY growth in gross profits recorded by the domestic business.

The company believes that exports will remain a key growth driver for the company amidst global uncertainties such as the implementation of new sets of tariffs by the US. D&L does not anticipate a material impact from the higher U.S. tariffs, as the U.S. market accounts for only approximately 3% of the Company’s total revenues. Moreover, the majority of products sold to the U.S. are valued for their distinct technical and functional attributes.

Exports vs Domestic Market

As part of its strategy to further grow its exports business, D&L is actively exploring new markets and applications—particularly those where coconut oil’s natural and sustainable profile serves as a key competitive advantage. The company continues to invest in research and development to drive innovation and develop higher-margin specialty oleochemicals and functional ingredients that are derived from coconut oil tailored for niche applications. These specialty products, which are less sensitive to commodity price fluctuations, enable the Company to command better margins.

In 1H25, exports contributed 28% to the Company’s total revenues. Management aims to increase this share to 50% over the medium term. Notably, exports already account for approximately 38% of total gross profit, reflecting the higher GPM of exports.

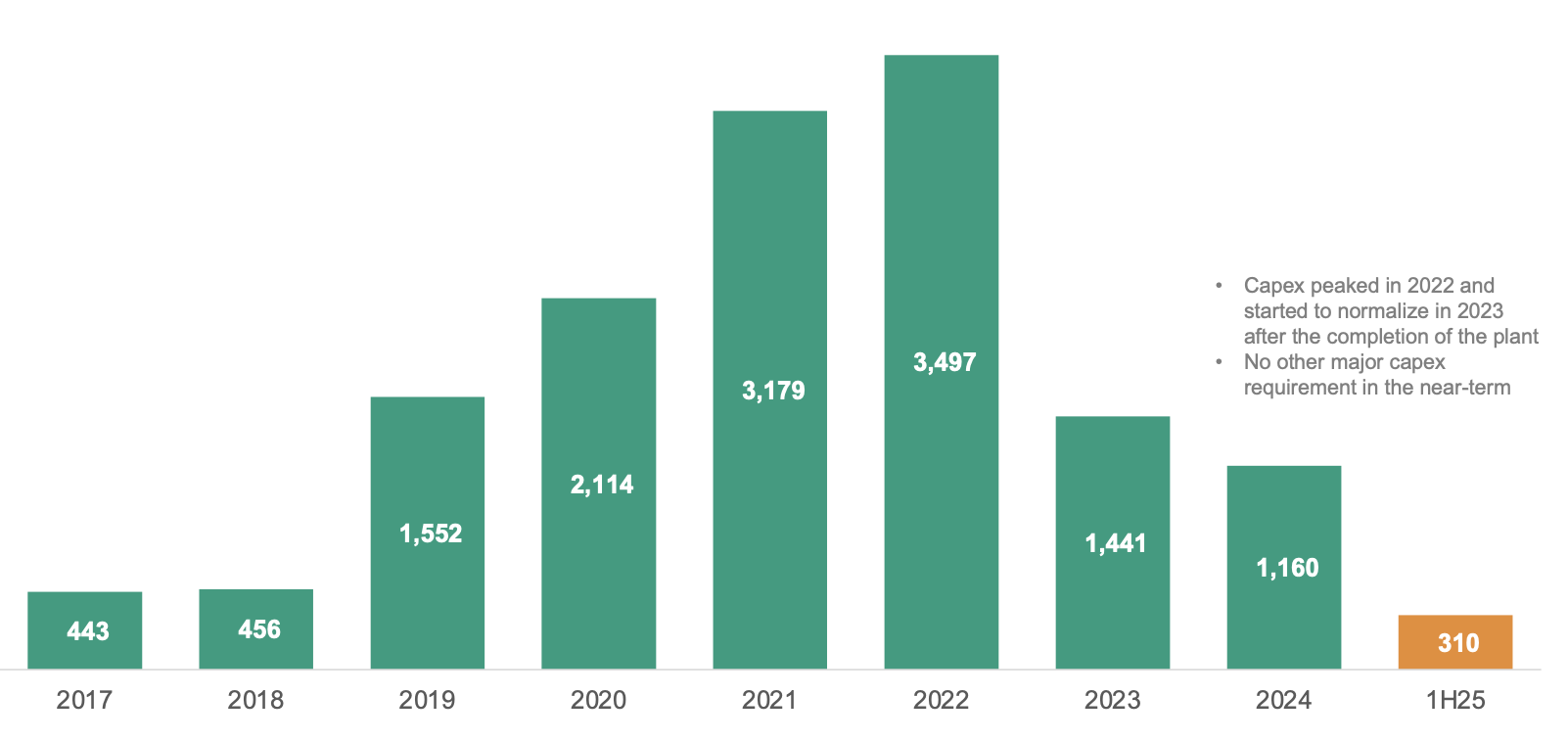

Balance sheet remains robust; capex likely to be sub-P1 billion in 2025

The Company’s balance sheet remains solid despite elevated capital expenditures in recent years and the impact of unprecedented increases in commodity prices, which drove higher working capital requirements. As of end-June 2025, interest coverage remained at a comfortable 4x, while net gearing stood at 101%. The average cost of debt slightly declined to 6.2%, compared to 6.29% as of end-December 2024.

With inflation continuing to ease and the Bangko Sentral ng Pilipinas (BSP) maintaining a generally dovish policy stance, the Company sees potential for further reduction in borrowing costs over the course of 2025. Moreover, as commodity prices begin to stabilize, management anticipates a gradual deleveraging of the balance sheet.

On the capital expenditure front, the Company does not foresee significant spending in the near term. Following the completion of the Batangas plant, capex has begun to taper, with 1H25 spending amounting to only ₱310 million. On an annualized basis, this is expected to result in full-year capex of less than ₱1 billion.

Historical Capex (in P mn)

Segment Results

Food Ingredients

The food ingredients division booked a 6% YoY volume growth in 1H25. However, the surge in coconut oil prices resulted in a 3.6 ppts YoY compression in gross profit margin which led to a 52% drop in net income for the period.

The Company expects margins to improve as coconut oil prices begin to stabilize. Additionally, it anticipates stronger earnings performance in the second half of the year, supported by seasonal demand as the festive period approaches.

Chemrez

Chemrez delivered stellar performance in 1H25 with overall volume growing by 28% leading to the doubling of net income for the period, coming off from a low base in 2024 and back to levels recorded in 2022. The growth was mainly driven by the increasing demand for coconut oil-derived products globally coupled with the increase in mandated biodiesel blend from 2% to 3% starting October 1, 2024.

The government has deferred the implementation of the planned increase in the mandated biodiesel blend to 4%, originally scheduled to take effect on October 1, 2025. Nonetheless, Chemrez remains optimistic about its growth prospects, particularly in the global market. The Company continues to explore new markets and product applications that expand the scope of its current portfolio and technical capabilities. With the new Batangas plant now operational, Chemrez is well-positioned to attract more international customers and deliver higher value-added solutions.

Specialty Plastics

The specialty plastics division takes a breather with its earnings flat YoY in 1H25 following a high base and strong performance in 1H24 where earnings grew by 51% YoY. Despite the flattish performance this year, the Company continues to see sustained long term growth in this segment driven by continued investments in research and development, with a strong focus on pioneering sustainable solutions in plastics.

Consumer Products ODM

With the continued ramp up in the Batangas plant, the Consumer Products ODM division saw its GPM expand by 6 ppts for the period which resulted in a 45% YoY earnings growth. The company anticipates continued growth in this division as inflation continues to cool off which should stimulate demand for various consumer discretionary products manufactured under this division. In addition, exports provide a new leg of growth with contribution to total sales currently at 13% from virtually zero about six years ago. Management sees export contribution to continue to go up over the long term.

-end-

D&L Industries is a Filipino company engaged in product customization and specialization for the food, chemicals, plastics and consumer products ODM industries. The company’s principal business activities include manufacturing of customized food ingredients, specialty raw materials for plastics, and oleochemicals for personal and home care use. Established in 1963, D&L has the largest market share in most of the industries it serves, as well as long-standing customer relationships with the Philippines’ leading consumer and manufacturing companies. It was listed on the Philippine Stock Exchange in December 2012. For more information, please visit https://www.dnl.com.ph/investors/.

This press release may contain some “forward-looking statements” which are subject to a number of risks and uncertainties that could affect D&L’s business and results of operations. Although D&L believes that expectations reflected in any forward-looking statements are reasonable, D&L does not guarantee future performance, action or events.

INVESTOR RELATIONS CONTACT

Crissa Marie U. Bondad

Investor Relations Manager – D&L Industries Inc.

+632 8635 0680

crissabondad@dnl.com.ph / ir@dnl.com.ph