News

D&L Industries’ reports 1H21 results

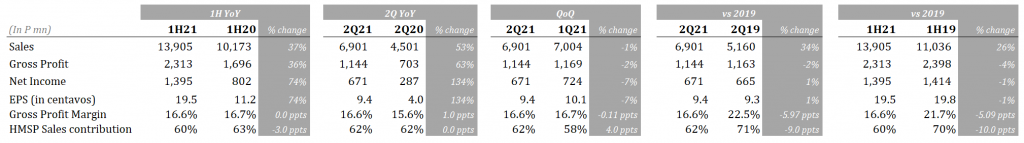

- Strong earnings recovery continued with 1H21 income +74% YoY and 2Q21 income +134% YoY

- 2Q21 and 1H21 income already at pre-COVID levels

- HMSP volume rebounded sharply in 2Q21, up 36% YoY

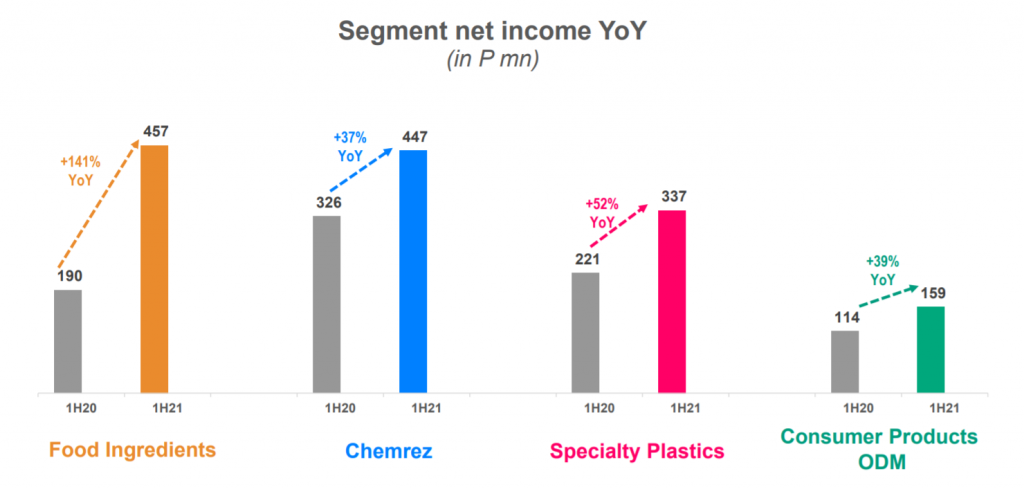

- All segments posted significant recovery YoY

- Export sales +70% YoY in 1H21; export contribution to total sales reached 33

August 11, 2021 – D&L Industries’ strong recovery continued in the second quarter of 2021 (2Q21), with earnings growing +134% year-on-year to P671 million. This brings earnings for the first half of the year (1H21) to P1,395 million, +74% YoY. All segments posted significant recovery YoY with consolidated income already at pre-COVID level. Earnings before interest and taxes was higher by 48% YoY.

Management Perspective

“Our strong earnings recovery in 2Q21 suggests that things are much better compared to last year. It also demonstrates the essential nature and the resiliency of our underlying businesses. While Metro Manila has returned to stricter quarantine measures yet again in August, we do not expect significant impact on our businesses, similar to what we have observed in the second quarter when Enhanced Community Quarantine (ECQ) and Modified Enhanced Community Quarantine (MECQ) were reimposed. With more than a year into the pandemic, we find ourselves, as well as many of our customers, in a much better position operationally to navigate the current situation with minimal business disruption,” remarked D&L President and CEO Alvin Lao.

“Assuming that the income for the first half holds steady for the remainder of the year, we are set to reach our 2019 income level. Moreover, we see emerging positive catalysts in the horizon such as the onset of the Christmas season, an additional spending boost coming from the 2022 election campaigns, and progress on the country’s vaccination efforts that can provide upside surprises,” Lao added.

“Overall, we remain optimistic and excited about the future prospects of our business, especially with our Batangas plant coming online in the next couple of quarters. We are delighted to share that our maiden bond offering, the proceeds of which will be mainly used for our expansion, was rated PRS Aaa with a Stable Outlook by Philratings. It is the highest rating assigned by Philratings which, in our view, validates our strong business prospects,” Lao concluded.

1H21 income already at pre-COVID level; on-track to at least meet 2019 net income despite another round of ECQ in August

For the first half of the year, the company saw its income reach pre-pandemic levels with 2Q21 earnings at +1% vs 2Q19 and 1H21 earnings at -1% vs 1H19. While another round of ECQ was implemented starting August 6 until August 20, 2021 due to the emergence of the COVID-19 Delta variant in the country, the company does not expect significant impact of the said quarantine status on operations, just as what was observed during the ECQ/MECQ reimposition in 2Q21. Under the current guidelines, all of the company’s business segments, being considered as essential industries, are allowed to operate at maximum capacity.

The ECQ guidelines this time around also appear less restrictive compared to last year’s ECQ guidelines. For instance, public transportation is currently allowed on a limited basis, whereas last year, it was completely prohibited. In addition, ECQ is also currently being implemented in Metro Manila and nearby areas, whereas the entire island of Luzon was placed on ECQ last year. Assuming that 1H21 income level holds steady for the remainder of the year, the company is set to at least reach its net income level in 2019.

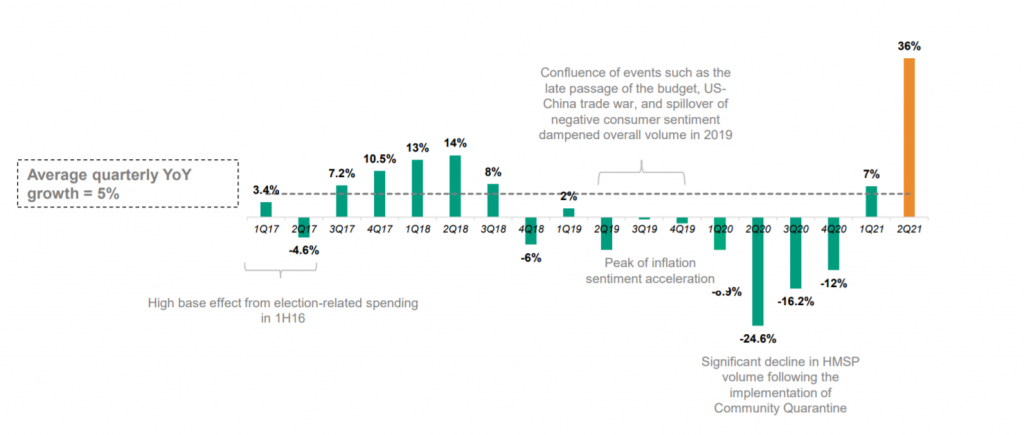

HMSP volume rebounded sharply in 2Q21, up 36% YoY; All segments posted significant recovery YoY

HMSP volume growth (YoY)

In 2Q21 alone, the High Margin Specialty Products (HMSP) side of the business, posted a 36% YoY recovery in volume. On a quarter-on-quarter basis, despite the reimposition of a new round of ECQ and MECQ from late March to mid-May in Metro Manila and nearby provinces and the Easter holiday in April, HMSP volume was only lower by 3%. Earnings in 2Q21 were lower by 7% compared to 1Q21 but this was mostly due to higher interest expense for the period. On an EBIT basis, 2Q21 was only lower by 2% quarter-on-quarter.

For the first half of the year, all of the company’s business segments posted significant recovery for the period. The continued recovery was mainly driven by people and businesses gradually adapting to the new normal. With more than a year into the pandemic, D&L, as well as many of its customers, has found new ways to continuously operate despite various mobility restrictions. This is true, not just for the chemicals segment but also for the food ingredients space wherein many food companies are now better-equipped to service customers on a 100% takeout or delivery basis.

Export business continues to be a bright spot

Export sales continued its positive momentum in 1H21 as it jumped 70% y-o-y. Export contribution to total revenues in 1H21 stood at 33% compared to just 26% over the same period last year.

Coconut-based products under food and oleochemicals were the main drivers behind the robust export growth. Coconut oil continues to gain traction in the global market due to its perceived natural antiviral, antibacterial, and antifungal properties. In addition, coconut-based products are great sustainable substitutes for petroleum-based raw materials used in many applications such as personal hygiene and home cleaning products. The company sees continued strong coconut oil-based exports, which should offset some of the weakness in the domestic market in the near term.

Catalysts emerging from Christmas spending, election campaign boost, and vaccination progress

While the COVID-19 virus mutations brought about renewed uncertainties on economic reopening, the company at the same time sees various catalysts emerging to aid near to medium-term recovery.

From a consumer spending perspective, the second half of the year appears more encouraging with the early onset of the Christmas season in the Philippines which typically starts as early as September. Pent-up demand as well as the newly acquired capability of businesses to service this type of demand, which is characterized by consumers who are mostly staying at home, will likely spur spending.

Presidential elections in May 2022, which happens every six years, may also likely provide an added boost in economic activity. Election spending typically kicks in the fourth quarter preceding the election. In the last Presidential election which happened in 2016, the company saw its total volume and income increase by 9% and 15%, respectively.

On the vaccination front, which is the true key to economic reopening, the country is making progress with about 10% of its population fully vaccinated. The country also expects the arrival of at least 20 million vaccine doses each month from August to December. The government aims to vaccinate about 50-60% of the population by the end of the year.

Batangas expansion comes at an opportune time

D&L remains committed to its Batangas expansion and construction is in full swing. The company has so far spent about P4.5 billion for the project. Remaining capex to be spent this year until 2023 stands at about P3.5 billion. The company made an announcement earlier this year that it plans to do a maiden bond offering to fund the remaining capex for this expansion.

The said facility will mainly cater to D&L’s growing export businesses in the food and oleochemicals segments. It will add the capability to manufacture downstream packaging, thus allowing the company to capture a bigger part of the production chain. For instance, while the company primarily sells raw materials to customers in bulk, the new plants will allow it to “pack at source”. This means that D&L will have the ability to process the raw materials and package them closer to finished consumer-facing products. This will enable D&L to move a step closer to its customers by providing customized solutions and simplifying their supply chain, which is of high importance given logistical challenges in general.

D&L’s Batangas expansion will be instrumental to its future growth as it plans to develop more high value-added coconut-based products and penetrate new international markets. The company to-date has successfully made in-roads in supplying various raw materials and even finished products in several relevant fast-moving consumer goods (FMCG) categories in the new normal. It plans to further expand its global footprint and targets export sales to account for at least 50% of its total sales in the long-term.

Operational and financial resilience

While the crisis posted various challenges, it has provided an equal opportunity to build further resilience. With appropriate adjustments and operational contingencies already in place, the company believes that it is now in a far better position to thrive in an adverse environment and a potentially protracted economic recovery period. Moreover, as the majority of the products that the company manufactures cater to basic essential industries such as food, oleochemicals, plastics and cleaning chemicals, the company sees continued strong demand ahead.

From a capital structure perspective, the company is in a solid position to withstand external pressures. As of end-June 2021, it remained lightly-geared with net debt at 25% and interest cover at 29x. In addition, the cash conversion cycle for the period was lower at 119 days vs 127 days in 2020, given lower account receivables days and higher payable days.

Overall, the company remains profitable. Return on Equity (ROE) and Return on Invested Capital (ROIC) stood at 15.7% and 14.3%, respectively, in 1H21.

Segment Results

Food Ingredients

The food ingredients business showed a stellar comeback performance in 2Q21 coming off a weak performance over the same period last year when the country was placed under the strictest lockdown measure for the first time. In 2Q21 alone, income for the segment was up 672% YoY and is already at par with 2Q19 income level recorded prior to the pandemic. On a quarter-on-quarter basis, 2Q21 earnings inched up by 0.5% despite stricter quarantine measures in place during the period compared to 1Q21.The continued recovery comes as many food companies are now better-equipped to operate under current mobility restrictions. Near to medium-term outlook for the food ingredients business is encouraging as it stands to benefit directly from higher consumer spending during Christmas and election season which will unfold in the next couple of quarters.

Chemrez

Chemrez continued to post strong performance with a 37% YoY increase in earnings in 1H21. Volumes were up 30% YoY which more than offset the overall margin compression of 5%. The margin compression mainly came from the Oleochemicals segment (chemicals derived from coconut oil) with average coconut oil prices up 84% YoY in 1H21. While the company passes on price changes to customers, it takes the company 30-45 day to adjust its prices. As such, in an environment of rapid price changes, temporary margin contraction is possible. Nonetheless, the company sees its margins recovering in the succeeding quarters.

Specialty Plastics

Specialty plastics income increased by 52% YoY in 1H21. This was driven by higher volume for both engineered polymers and colorants and additives. Total segment volume increased by 41% YoY for the period. The company expects steady and consistent demand moving forward given the crucial role that plastics play during the current pandemic — from various medical applications to packaging for parcel delivery.

Consumer Products ODM

Consumer products ODM, previously referred to as Aerosols, continued to post record earnings as demand for sanitation chemicals such as disinfectant sprays and alcohol saw a notable surge due to the pandemic. Total volume grew by 60% YoY and net income jumped by 39% YoY in 1H21.

-end-–

D&L Industries is a Filipino company engaged in product customization and specialization for the food, chemicals, plastics and consumer products ODM industries. The company’s principal business activities include manufacturing of customized food ingredients, specialty raw materials for plastics, and oleochemicals for personal and home care use. Established in 1963, D&L has the largest market share in each of the industries it serves, as well as long-standing customer relationships with the Philippines’ leading consumer and manufacturing companies. It was listed on the Philippine Stock Exchange in December 2012. For more information, please visit //dnl.com.ph/investors/.

This press release may contain some “forward-looking statements” which are subject to a number of risks and uncertainties that could affect D&L’s business and results of operations. Although D&L believes that expectations reflected in any forward-looking statements are reasonable, D&L does not guarantee future performance, action or events.

INVESTOR RELATIONS CONTACT

Crissa Marie U. Bondad

Investor Relations Manager- D&L Industries, Inc.

+632 8635 0680

crissabondad@dnl.com.ph / ir@dnl.com.ph