News

D&L’s next generation Batangas plant starts commercial operations in time for its 60th anniversary; 1H23 income has yet to reflect new plant’s potential

- D&L’s Batangas plant has started commercial operations, ushering in a transformational period for the company

- 1H23 earnings at P1.2 bn, down 28% YoY, has yet to reflect new plant’s potential;

- Excluding pre-operating expenses, 1H23 earnings down 13% YoY to P1.5 bn

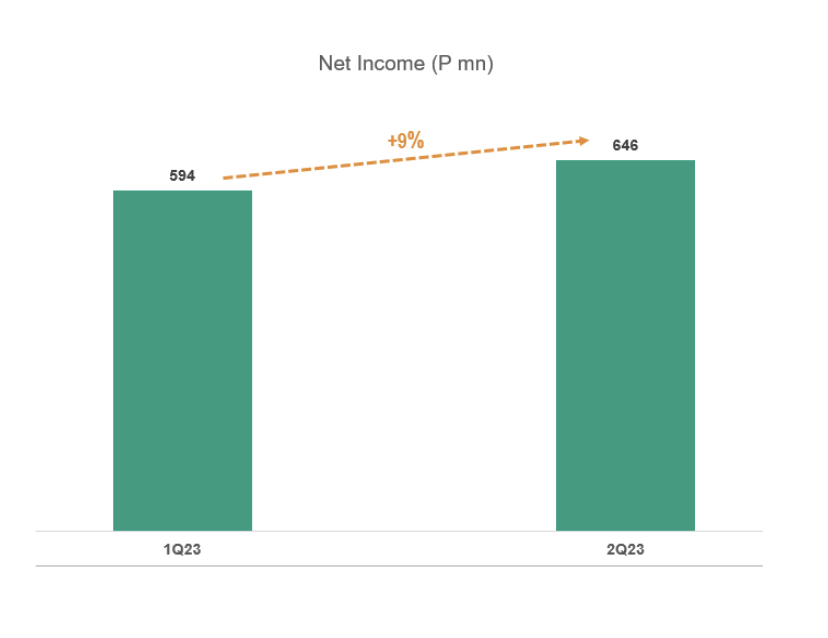

- Recovery continued with 2Q23 earnings at P646 mn, up 9% QoQ;

- Blended GPM improved from 13.1% in 1H22 to 17.7% in 1H23

- With improving FCF, falling debt levels, and the continued optimism on the prospects of the business, D&L has the highest confidence in its ability to service bonds maturing in 2024 and 2026

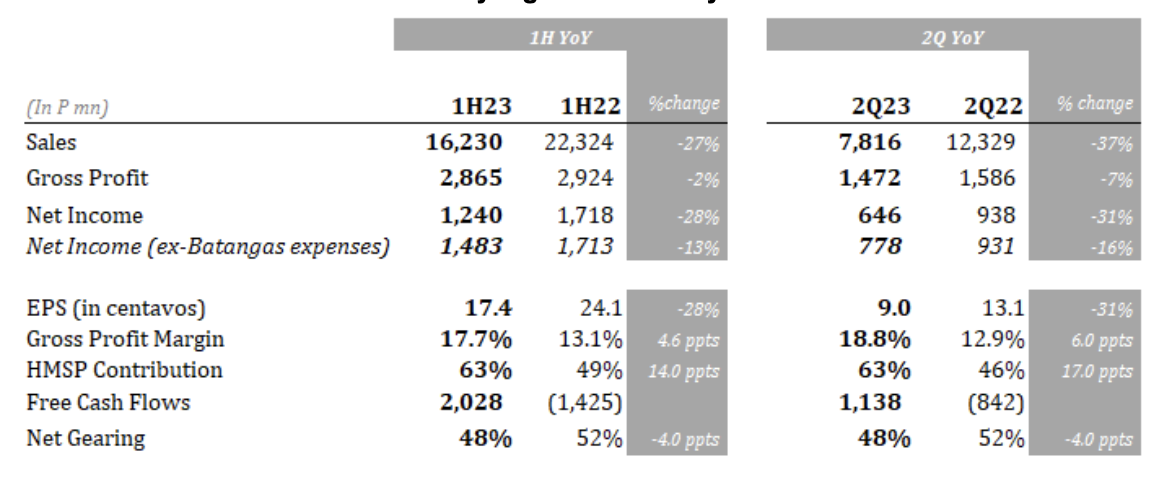

Key Figures Summary

August 9, 2023 – In time for D&L Industries’ 60th anniversary, its next generation facility in Batangas started commercial operations last July with the issuance of its first invoice. With upgraded capabilities and a footprint that will more than double the company’s existing manufacturing capacity, the new plant ushers in a transformational period for D&L.

“The plant that we have built is not just another plant. Specced to the highest standards and equipped with new capabilities, our Batangas plant will elevate the company to operate on a whole new level. Its construction and completion during an unprecedented period due to COVID, to us, is a major milestone that attests to the commitment of all the people in our organization and to the resilience that we have built over the years as a company,” D&L President and CEO Alvin Lao remarked.

“Similar to what we have seen with the various plants that we have built over the past 60 years, the commercial operations of a new plant will mean incremental expenses that may affect near-term income. This is part and parcel of putting up a new plant, as what we have done multiple times. We have a lot of confidence that even though it may take time, this plant will be a huge benefit for the company. It will allow D&L to explore opportunities that were previously beyond our existing capabilities. With the new plant, we see new markets, higher value added products, and deeper innovations that will further push our boundaries. There has never been a more exciting time for D&L. We are profoundly inspired by its potential and we are steadfast in our commitment to see it to fruition,” Lao concluded.

Batangas plant is D&L’s next leg of growth

D&L’s Batangas plant sits on a 26-ha property in First Industrial Township – Special Economic Zone in Batangas. This facility will mainly cater to D&L’s growing export businesses in the food and oleochemicals segments. It will add the capability to manufacture downstream packaging, thus allowing the company to capture a bigger part of the production chain. For instance, while the company primarily sells raw materials to customers in bulk, the new plants will allow it to “pack at source”. This means that D&L will have the ability to process the raw materials and package them closer to finished consumer-facing products. This will enable D&L to move a step closer to its customers by providing customized solutions and simplifying their supply chain, which is of high importance given ongoing logistical challenges.

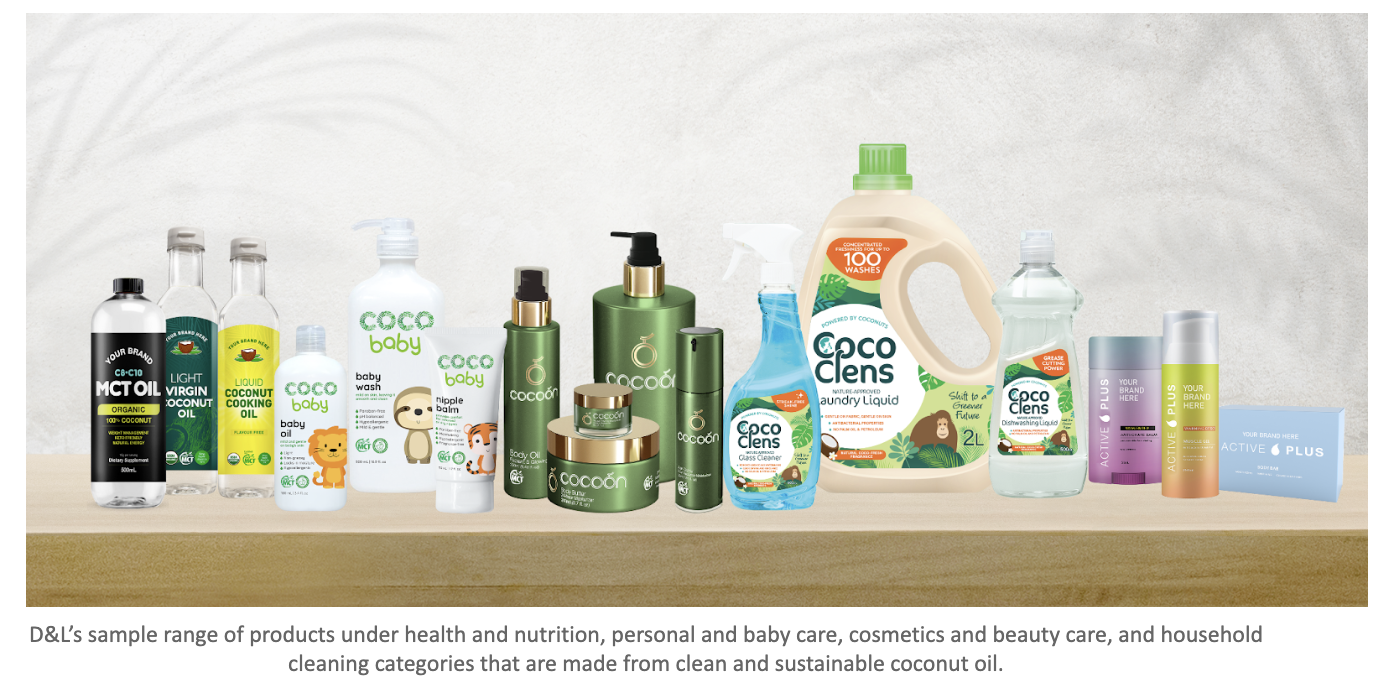

The new plant will also be instrumental in D&L’s goal of putting the Philippines on the map as a quality manufacturing hub for sustainable, natural and organic products. The company is gearing up towards launching a full range of shelf-ready products for its export customers, made from coconut oil, for the personal and baby care, cosmetics and beauty care, household cleaning, health and nutrition, and food and vegetable oils categories that are sustainable, natural, and organic. This initiative offers a plug-and-play solution for global brand owners who are looking to beef up their sustainable product offerings. D&L targets export sales to account for at least 50% of total revenues in the long-term.

D&L’s Batangas facility

Subtle but continued sequential recovery

The high volume orders from prior periods coupled with the lingering effects of high inflation and generally cautious consumer sentiment resulted in an earnings decline of 28% YoY in 1H23 to P1.24 billion. Nonetheless, for 2Q23, there was a subtle but continued sequential recovery with earnings for the quarter growing by 9% q-o-q to P646 million.

In addition to the effects of inflation and high base last year, there were also incremental expenses booked in 1H23 relating to the new plant in Batangas. Excluding the Batangas-related expenses, 1H23 income would have fallen by just 13% YoY to P1.5 billion. Moving forward, as the Batangas plant ramps up operations, its incremental revenues should offset the costs.

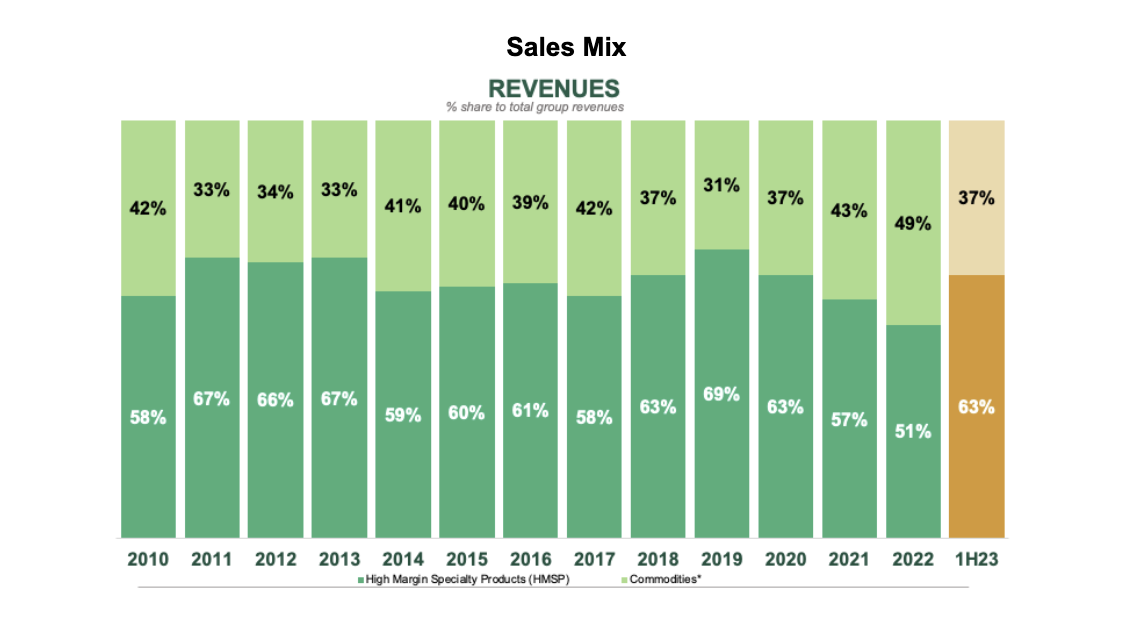

Sales mix back to pre-pandemic level; Margins recover sharply

While events over the past three years have resulted in a change in sales mix favoring commodities, 1H23 saw a reversal of this trend with High Margin Specialty Products (HSMP) revenue contribution back to pre-pandemic level at 63% from 51% in FY22. This, in turn, resulted in a 4.6 ppts improvement in blended gross profit margins to 17.7%.

Over time, as commodity sales continue to normalize and as the company continues to allocate much of its resources in growing the HMSP business, D&L expects to see a continued increase in HMSP revenue contribution.

Nonetheless, while commodity products have lower margins, the company intends to keep this segment as it continues to have a strategic importance in the overall business in the form of 1) maintaining customer goodwill, 2) protecting HMSP business by blocking off potential competitors, 3) covering some of the fixed costs, and 4) assuring the quality of HMSP raw materials.

Free Cash Flows turned positive while debt level started coming down; Highest confidence in ability to service bonds maturing in 2024 and 2026

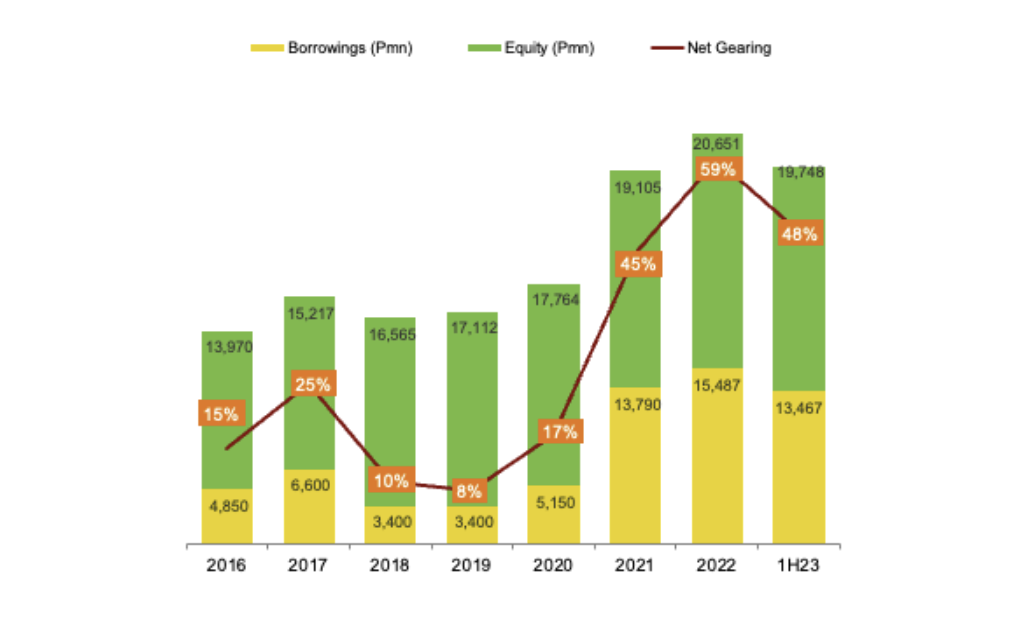

As the company moves past peak capex with the completion of its Batangas plant, coupled with the normalization of commodity prices, the company’s free cash flows (FCF) turned positive for the first time in two years. In 1H23, the company’s FCF stood at positive P2 billion vs negative P1.7 billion and negative P3.4 billion booked in FY22 and FY21, respectively.

Capital Structure

Meanwhile, the company’s debt level has started to come down. In 1H23, total outstanding debt stood at P13.5 billion, lower than the P15.5 billion debt in FY22. As there are no other major capex planned aside from the expansion plan in Batangas, the improvement in the FCF gives the company the financial flexibility to further reduce its debt level over time.

As of end-June 2023, net gearing has likewise decreased to 48%, which remains to be a conservative level. Interest cover stood at 9x while the average interest rate increased to 5.5% from 4.7% in full year 2022. The P5 billion maiden bond offering of the company issued in September 2021 is helping cushion the recent increase in interest rates. The bonds carry a coupon rate of 2.8% p.a. and 3.6% p.a. for 3-year and 5-year tenors, respectively. These would have been significantly higher at approximately 6.7% for the 3-year tenor and 6.8% for the 5-year tenor if the company were to issue the bonds today.

With improving free cash flows, normalization of capex needs, as well as the continued optimism on the future prospects of the business, D&L has the highest confidence in its ability to service the bonds which are maturing in 2024 and 2026.

Segment results: Consumer Products ODM and Food Ingredients seem to be the bright spot

Consumer Products ODM

Consumer Products ODM segment saw its income grow by 41% YoY for the quarter. This resulted in almost doubling of the segment’s income contribution to the group which stood at 13% in 1H23 from a mere 7% income contribution in full-year 2022. The strong growth was mainly driven by the continued reopening of the economy and the resumption of face-to-face activities which fuelled demand for many personal care products. Total volume for the segment was up 59% YoY while GPM expanded by 2.1 ppts.

Food Ingredients

With the normalization of commodity prices, the food ingredients business saw its margins recover sharply, increasing by 6.8 ppts in 1H23. The margin improvement was across the board as all the subsegments recorded margin expansion for the period. This has more than offset the impact of the volume decline largely attributable to lower commodity sales in a post pandemic world.

On a gross profit level, the food ingredients business booked a 22% increase YoY in 1H23. However, the incremental operating costs related to the new Batangas plant coupled with higher interest expense resulted in a 3% decline in net income. Nonetheless, with the peak season yet to come and as the economy continues to open up, further recovery is anticipated for the Food Ingredients business.

Chemrez

The stellar performance of Chemrez last year with its FY22 earnings growing by 47% YoY set up a high base for this year. However, a confluence of events such as 1) high inflation and weaker consumer spending, 2) early onset of the rainy season affecting the demand for construction materials, and 3) highly competitive landscape in the biodiesel business putting pressure on margins resulted in an earnings decline of 47% YoY in 1H23.

While the first half proved to be challenging, there are signs that export volumes are starting to come back. Moreover, Chemrez has embarked on an aggressive export thrust with the appointment of distributors in key export markets. These efforts are aimed at bringing in new export business as the Batangas plant starts commercial operations.

Specialty Plastics

While the Specialty Plastics business was off to a slow start in 2023 with first quarter income falling by 36% YoY, there was a marked recovery in the second quarter with earnings growing by 28% QoQ. This was largely driven by the improvement in GPM which was up 2.6 ppts QoQ.

In an ever changing regulatory landscape especially with the Extended Producer Responsibility (EPR) Act and the proposed excise tax on single-use plastics bags which are expected to affect the plastics industry in general, D&L sees a unique opportunity to increase its relevance to customers. The company is set to launch a new alternative to plastics that is equally durable and cost-competitive but is renewable, sustainable, and made from indigenous materials.

Over the long term, this division is expected to continue to grow fuelled by the company’s R&D investments that are aimed at developing new applications for its products and introducing new technologies that will make plastics more economical and environmentally-friendly at the same time.

D&L champions high impact sustainability initiatives

D&L Industries has embraced a holistic approach to sustainable innovation, long before the term “ESG” became mainstream. With R&D at the company’s core, D&L is relentless in developing products that answer the needs of its customers while at the same time staying attuned to the needs of the planet. In the global scene, D&L is seen as an advocate for sustainable products derived from sustainable materials such as coconut oil, given its extensive technical knowhow and wide array of product offerings.

With its state-of-the-art manufacturing facility in Batangas, D&L is spearheading a paradigm shift in its approach towards sustainability. With the new capabilities that the Batangas plant will bring, D&L aims to offer turnkey solutions to customers that are both economically and environmentally friendly.

D&L envisions empowering brands globally to make a meaningful shift towards high impact sustainability initiatives in the manufacturing of their products by giving them the option to buy direct from source. The direct from source approach simply means converting raw materials into finished goods in the country of raw material origin, instead of going through multi-leg production stages which usually happen across different locations in the globe. This naturally translates into simpler logistics, less wastage, lower costs, higher efficiency, and as such, significantly cutting down the carbon footprint (C02) of the entire supply chain.

D&L is gearing up towards launching a full range of shelf-ready products for its export customers, made from coconut oil, for the personal and baby care, cosmetics and beauty care, household cleaning, health and nutrition, and food and vegetable oils categories that are sustainable, natural, and organic. This initiative offers a plug-and-play solution for global brand owners who are looking to beef up their sustainable product offerings. Under this strategy, D&L will primarily target export customers who do not have the proximity to the source and instead would traditionally go through multiple layers of production before their products get into its final form and ready for end-customer purchase or consumption.

Examples of products under health and nutrition, personal and baby care, cosmetics and beauty care, and household cleaning categories that are made from clean and sustainable coconut oil that D&L develops for its clients.

-end-

D&L Industries is a Filipino company engaged in product customization and specialization for the food, chemicals, plastics and consumer products ODM industries. The company’s principal business activities include manufacturing of customized food ingredients, specialty raw materials for plastics, and oleochemicals for personal and home care use. Established in 1963, D&L has the largest market share in most of the industries it serves, as well as long-standing customer relationships with the Philippines’ leading consumer and manufacturing companies. It was listed on the Philippine Stock Exchange in December 2012. For more information, please visit https://www.dnl.com.ph/investors/.

This press release may contain some “forward-looking statements” which are subject to a number of risks and uncertainties that could affect D&L’s business and results of operations. Although D&L believes that expectations reflected in any forward-looking statements are reasonable, D&L does not guarantee future performance, action or events.

INVESTOR RELATIONS CONTACT

Crissa Marie U. Bondad

Investor Relations Manager – D&L Industries Inc.

+632 8635 0680

crissabondad@dnl.com.ph / ir@dnl.com.ph