News

D&L Releases Third Quarter 2025 Financial Results

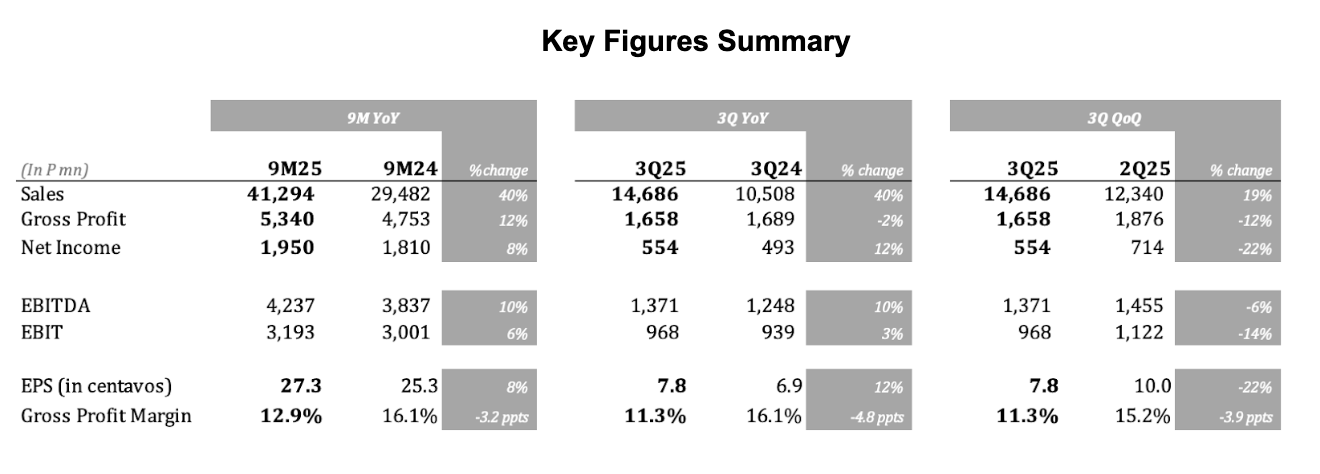

- 9M25 net income +8% YoY; 3Q25 +12% YoY

- Volume growth remains resilient, up 11% YoY, despite unprecedented increase in coconut oil prices

- Exports continue to drive growth with GP +22% YoY in 9M25

- Capex continues to trend lower, providing room for deleveraging once commodity prices ease

- The company’s steady execution amid an exceptionally challenging 2025 reinforces its confidence in delivering stronger performance in the years ahead

November 05, 2025 – D&L Industries’ recurring income reached P1.95 billion, or earnings per share (EPS) of P0.273, in the first nine months of 2025 (9M25). This is higher by 8% year-on-year (YoY). Meanwhile, in the third quarter of 2025 (3Q25), recurring income reached P554 million or EPS of P0.078, higher by 12% YoY. The growth in earnings was mainly driven by the resilient volume growth amidst elevated coconut oil prices.

Management perspective and outlook

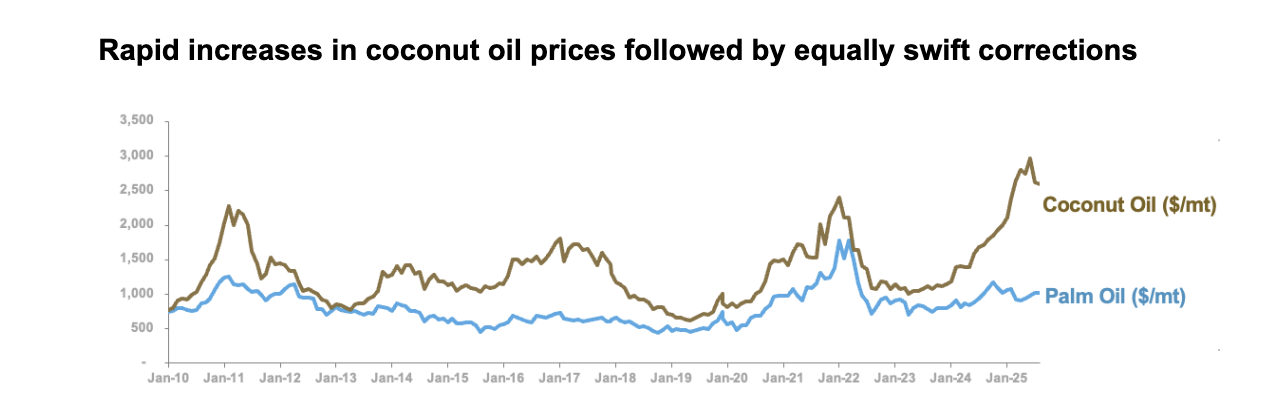

“The operating environment remains challenging, with coconut oil prices reaching a new all-time high in the third quarter. At its peak, prices have nearly tripled from the lows recorded just two years ago,” remarked D&L President and CEO Alvin Lao.

“Despite this, we delivered an 8% earnings growth for the period—driven mainly by healthy volume expansion, which underscores the fundamental strength of our business. While we cannot control commodity price movements, we can control how we navigate these challenges and where we direct our focus and resources. In this volatile environment, we continue to stay true to our core—investing in R&D and innovation. We believe these investments will enable us to develop higher-value, more technical, and differentiated solutions for our customers, helping insulate the business from macroeconomic volatility,” Lao added.

“For the rest of the year, we remain cautiously optimistic. While some customers continue to face pressure from elevated input costs, improving macro fundamentals—such as easing inflation and interest rates—should help spur economic activity,” Lao continued.

“Regardless of near-term market noise, our focus remains on executing our long-term strategies. We are still in the early stages of realizing the full potential of our Batangas plant, which we believe will anchor the next phase of our growth. Our confidence in the company’s long-term prospects is demonstrated by the Lao family’s continued share accumulation through holding company Jadel Holdings, which has increased its ownership stake in DNL by around 5% since the pandemic. In 2024 and year-to-date 2025 alone, the family purchased 20 million and 69 million shares, respectively. At current market levels, the stock offers an attractive dividend yield of about 4.7%, based on dividends paid this year,” Lao concluded.

Volume growth remains resilient, up 11% YoY, despite unprecedented increase in coconut oil prices

Coconut oil, a key raw material for the company, saw its average price surge by 78% year-on-year during the period. In the third quarter alone, prices reached a new all-time high of nearly USD 3,000 per metric ton—almost triple the lows recorded in 2023.

This unprecedented increase in coconut oil prices weighed on the company’s overall blended margins, which declined by 3.2 ppts in 9M25. While prices have since corrected by about 17% from their recent peak, they remain elevated by historical standards. D&L expects margins to fully recover once commodity prices begin to normalize. As shown in the chart below, sharp run-ups in coconut oil prices have historically been followed by equally swift corrections.

Despite the challenging cost environment, overall volume growth remained resilient. In 9M25, total volume rose 11% year-on-year, supported by both high-margin specialty products (HMSP) and commodities. As margins normalize, the underlying strength of the business—underpinned by healthy volume growth—is expected to translate more visibly into earnings.

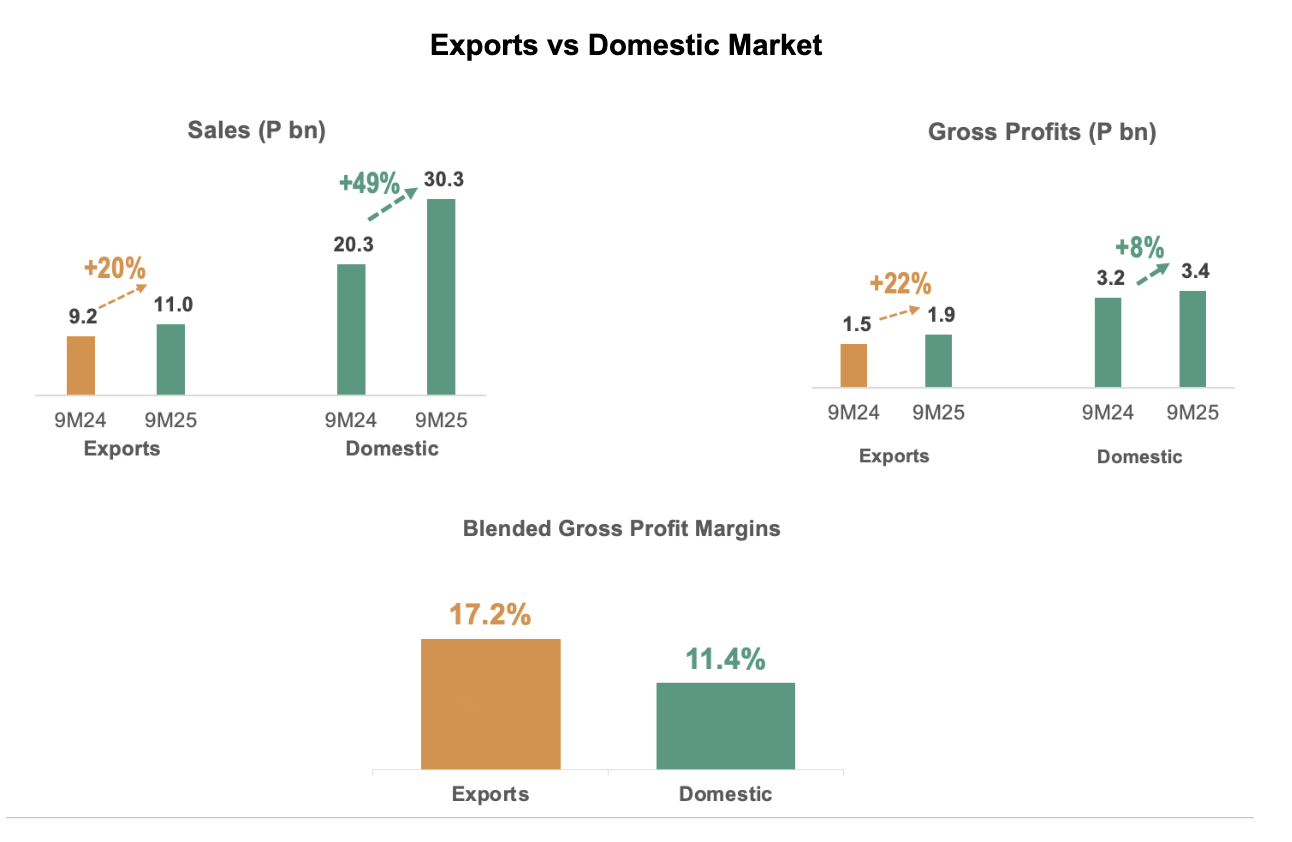

Exports continue to drive growth, gross profit up 22% YoY in 9M25

The export business continued to perform strongly, with revenues up 20% YoY to P11 bn in the first nine months of 2025. Export gross profit rose by 22% YoY in 9M25, outpacing the 8% YoY growth recorded in the domestic business.

Exports remain a key growth driver for the company despite global uncertainties, including the recent implementation of new U.S. tariffs. D&L does not expect a material impact from these higher tariffs, as the U.S. accounts for only around 3% of total revenues. Moreover, most of the company’s U.S. exports are specialty products valued for their unique technical and functional attributes.

To further expand its exports business, D&L is actively exploring new markets and applications where coconut oil’s natural and sustainable profile offers a competitive edge. The company continues to invest in research and development to drive innovation in high-margin specialty oleochemicals and functional ingredients derived from coconut oil. These products, designed for niche applications, are less sensitive to commodity price fluctuations and allow D&L to sustain superior margins.

In 9M25, exports accounted for 27% of total revenues. Management remains focused on raising this share to 50% over the medium term.

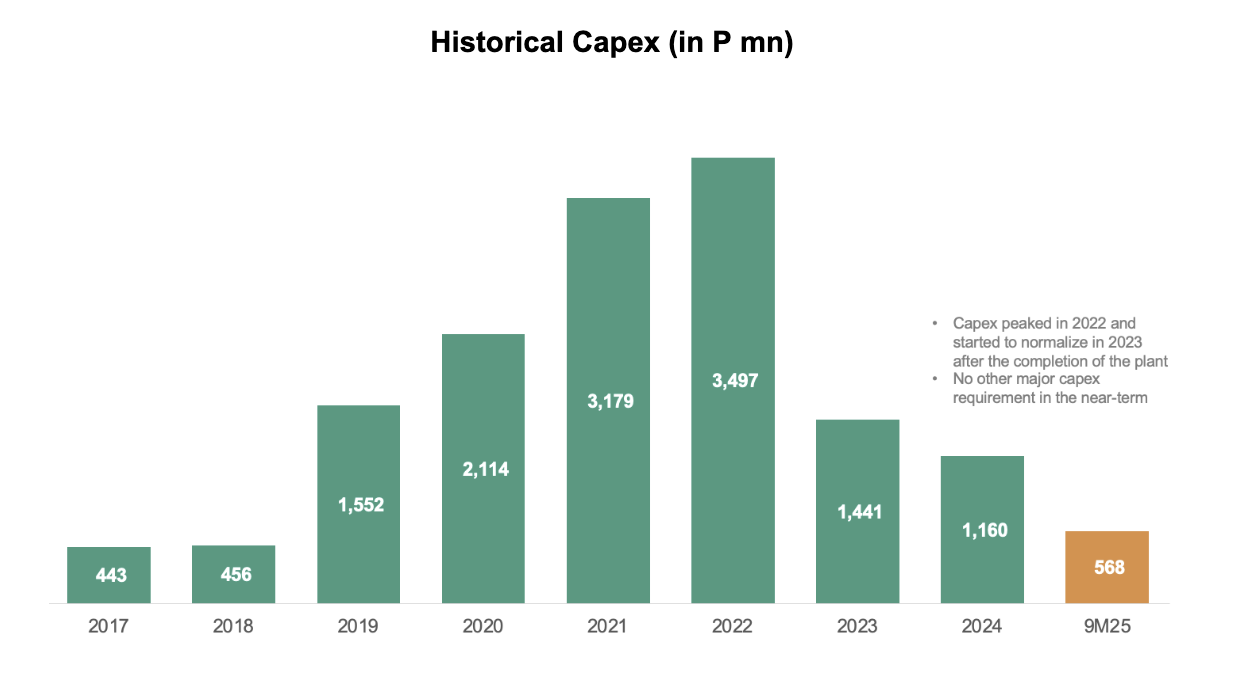

Capex continues to trend lower, providing room for deleveraging once commodity prices ease

The Company’s balance sheet remains solid despite elevated capex in recent years and the impact of higher commodity prices, which increased working capital requirements. As of end-September 2025, interest coverage remained comfortable at 3x, while net gearing stood at 99%. The average cost of debt edged lower to 6.15% from 6.29% at end-2024.

With inflation easing and the Bangko Sentral ng Pilipinas maintaining a dovish policy stance, the Company sees room for further reductions in borrowing costs in 2025. As commodity prices normalize, management also expects a gradual deleveraging of the balance sheet.

Capex is expected to stay modest following the completion of the Batangas plant. Capex reached P568 mn in 9M25. On an annualized basis, this is expected to result in full-year capex of less than P1 bn.

From a free cash flow perspective, the Company continued to show steady improvement, with free cash flow at -₱969 million in 9M25 from -₱3.4 billion in 1Q25. This trajectory is expected to further improve as coconut oil prices ease. Likewise, the cash conversion cycle shortened to 117 days in 9M25 from 131 days in 1Q25, reflecting enhanced working capital efficiency. The improvement in the cash conversion cycle was largely driven by inventory days dropping to 82 days from 91 days, and accounts receivable days improving to 46 days from 50 days over the same period.

Segment Results

Food Ingredients

The unprecedented surge in commodity prices weighed on the Food Ingredients segment, which recorded a 66% YoY decline in earnings for the period. Nonetheless, the segment’s underlying strength remains evident, with total volumes up 7% YoY—driven primarily by robust 22% YoY growth in the High Margin Specialty Products (HMSP) segment.

While 2025 has presented challenges, the outlook for the Food Ingredients group remains positive. Margins are expected to recover as coconut oil prices stabilize, supported by the Company’s intensified focus on expanding its HMSP portfolio—offering customized, higher-value solutions that are more resilient to commodity price volatility.

Chemrez

Chemrez delivered strong results in 9M25, with volumes increasing by 30% and net income rising 88% year-on-year. Growth was supported by sustained global demand for coconut oil–derived products and the implementation of the higher mandated biodiesel blend from 2% to 3% effective October 1, 2024.

Although the government has deferred the planned increase in the biodiesel blend to 4%, Chemrez remains optimistic on its medium-term outlook, particularly in the export market. The Company continues to pursue new market opportunities and product applications that expand its portfolio and enhance its technical capabilities. With the Batangas plant now fully operational, Chemrez is well-positioned to serve a broader international customer base and deliver higher value-added, sustainable solutions.

Specialty Plastics

Building on a strong 32% increase in net income in 9M24, the specialty plastics segment continued to deliver positive results with earnings up 2% YoY in 9M25. The segment remains well-positioned for sustained growth, driven by continued R&D investments and the Company’s commitment to developing innovative, sustainable plastic solutions that cater to evolving customer needs.

Consumer Products ODM

With the Batangas plant ramping up, the Consumer Products ODM division sustained strong momentum, posting a 50% YoY increase in earnings for the period. The Company expects growth to continue as easing inflation boosts demand for consumer discretionary products under this segment.

Exports have also emerged as a solid new growth driver, now accounting for 12% of total sales from virtually zero six years ago. Management remains optimistic that export contribution will continue to rise over the long term as the Company strengthens its global footprint.

-end-

D&L Industries is a Filipino company engaged in product customization and specialization for the food, chemicals, plastics and consumer products ODM industries. The company’s principal business activities include manufacturing of customized food ingredients, specialty raw materials for plastics, and oleochemicals for personal and home care use. Established in 1963, D&L has the largest market share in most of the industries it serves, as well as long-standing customer relationships with the Philippines’ leading consumer and manufacturing companies. It was listed on the Philippine Stock Exchange in December 2012. For more information, please visit https://www.dnl.com.ph/investors/.

This press release may contain some “forward-looking statements” which are subject to a number of risks and uncertainties that could affect D&L’s business and results of operations. Although D&L believes that expectations reflected in any forward-looking statements are reasonable, D&L does not guarantee future performance, action or events.

INVESTOR RELATIONS CONTACT

Crissa Marie U. Bondad

Investor Relations Manager – D&L Industries Inc.

+632 8635 0680

crissabondad@dnl.com.ph / ir@dnl.com.ph