News

D&L Releases Second Quarter 2024 Financial Results

- 1H24 earnings up 6% YoY to P1.3 bn with Batangas plant turning profitable in 2Q24

- Momentum continues to build up, on a QoQ basis, 2Q earnings up 13%; HMSP volumes +33% YoY in 2Q24, up for the fourth consecutive quarter

- Export sales contribution at record high, stood at 33% in 1H24

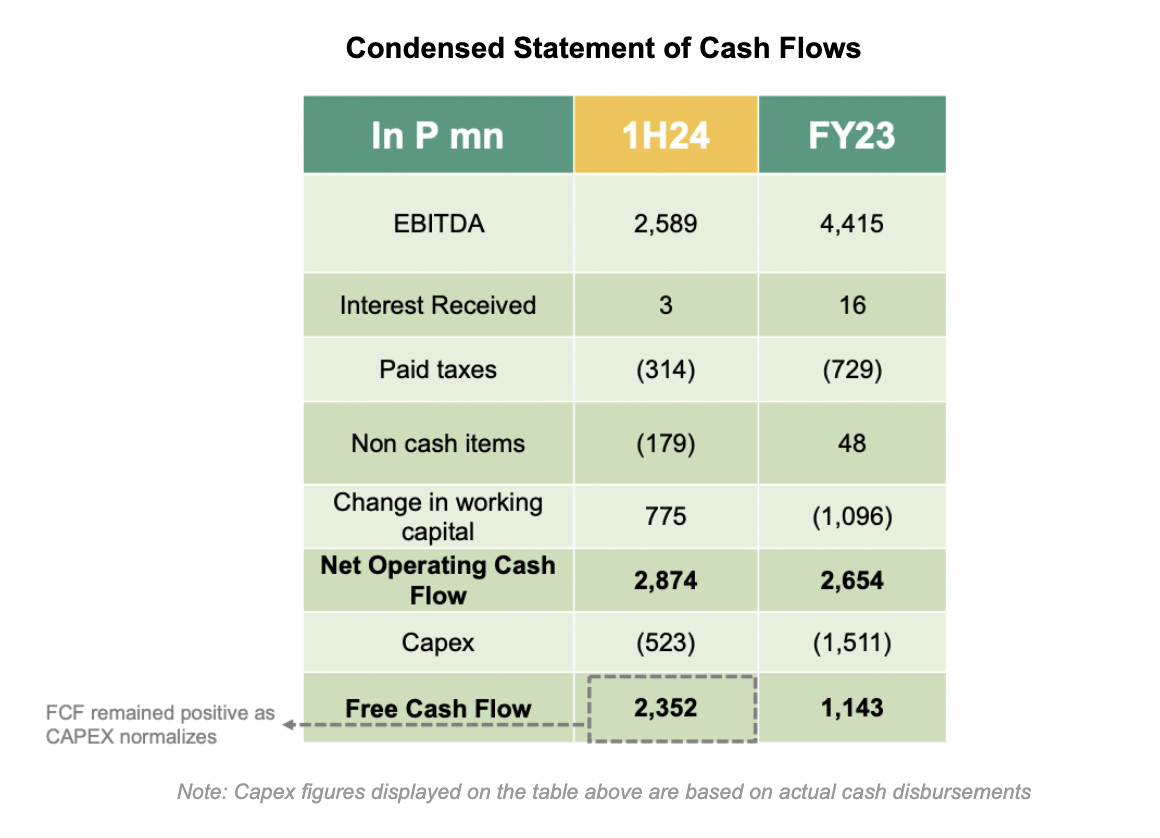

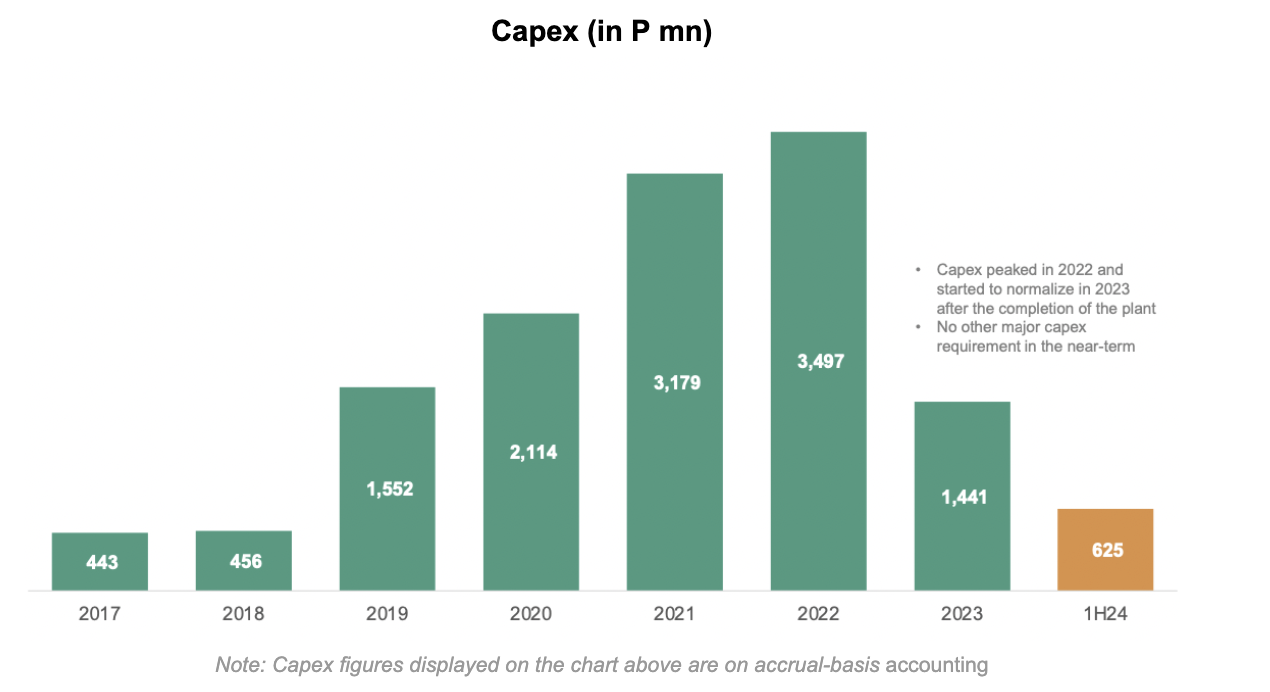

- With lower capex and relatively stable commodity prices, 1H24 FCF stood at P2.4 bn, higher than the FY23 FCF of P1.1 bn

- Management remains optimistic and maintains at least 10% earnings growth guidance for the year

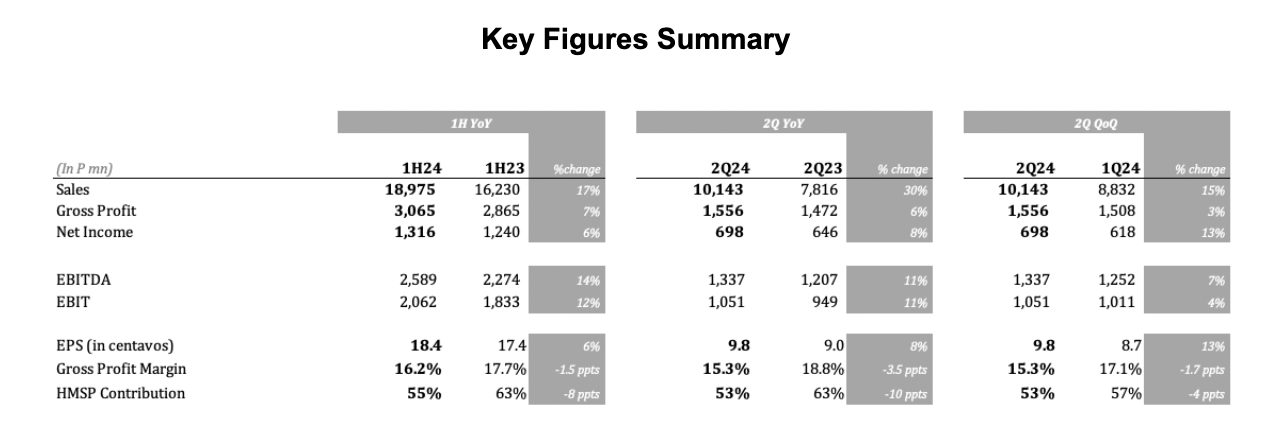

August 13, 2024 – D&L Industries’ recurring income reached P1.3 billion, or earnings per share of P0.184, in the first half of 2024. This is higher by 6% YoY, with the Batangas plant turning profitable in 2Q24. On a quarter-on-quarter basis, momentum continues to build up with 2Q14 earnings up 13%.

“The second quarter of this year marks the turning point in our Batangas operations as it booked a quarterly profit for the first time since we started commercial operations in July 2023. As we further ramp up operations and onboard new customers, we see gradually increasing earnings contribution from this new plant over time,” remarked D&L President & CEO Alvin Lao.

“For this year, we are keeping our guidance at low double-digit growth in earnings. At the same time, we continue to monitor macro developments that may potentially dampen business sentiment such as the higher-for-longer interest rates, lingering effects of inflation, depreciating peso and even the potential hard landing or recession in the US,” Lao added

“While there are uncertainties in the near-term macroeconomic environment, we remain optimistic on the long-term prospects of our business. Our investments over the past couple of years are starting to bear fruit and we see higher and more sustainable growth coming from it. Moreover, our Batangas plant puts us in a very good position to capture opportunities not just in the Philippines, but globally,” Lao concluded.

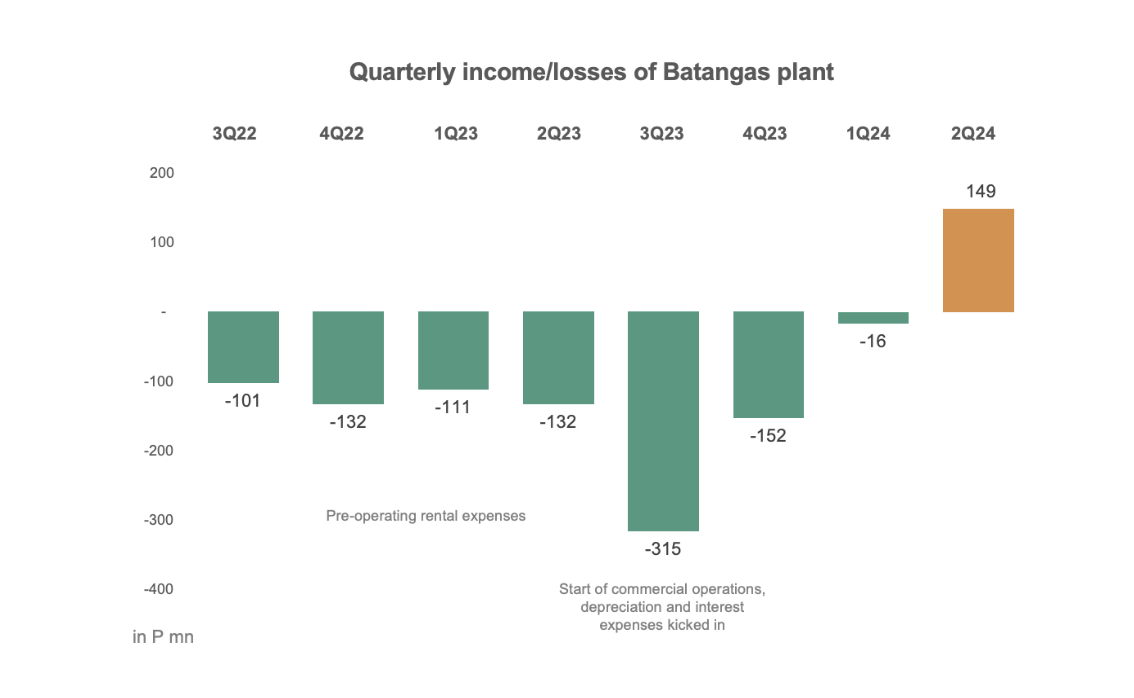

Batangas plant turned profitable ahead of schedule

With steady and consistent ramp up in operations, the new plant in Batangas turned profitable in 2Q24, which was less than a year since the start of its commercial operations. This is ahead of the initial schedule of within two years of operations which was based on the performance of the older plants that the company had built over the years.

The new plant booked a net profit of P149 million for the quarter. This represents a consistent quarter-on-quarter improvement in operations, from a peak loss of P315 million in the first quarter of commercial operations to almost breaking even in 1Q24 to finally being profitable this quarter.

To date, the new plant has successfully fulfilled several orders for both local and export customers. Several audit and certification processes are ongoing in order to on-board more customers.

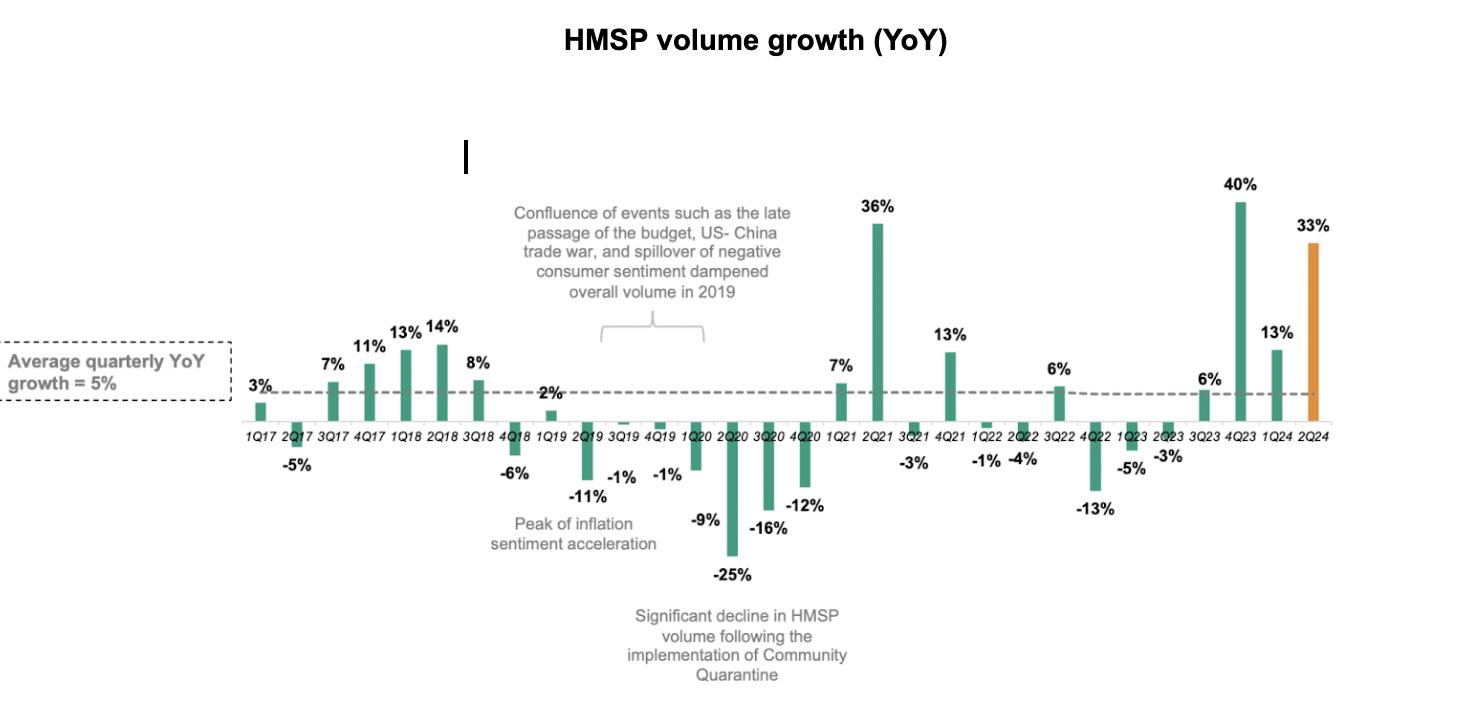

Momentum continues to build up; HMSP volumes up for the fourth consecutive quarter

While the past couple of quarters have been characterized by macro headwinds coupled with incremental expenses coming from the commercial operations of the Batangas plant, earnings are once again gaining momentum as volumes continue to improve and as the Batangas plant starts to contribute to the bottom line.

Earnings in 2Q24 were up both on a year-on-year (+8%) basis and quarter-on-quarter (+13%) basis. This was primarily driven by the higher volumes booked for the period which helped offset the higher cost base coming from the commercial operations of the Batangas plant.

For the High Margin Specialty Products (HMSP) segment alone, which is the key earnings driver of the company, volumes were up 33% YoY in 2Q24. This is the fourth consecutive quarter that this segment posted higher volume growth. The additional capacity coming from the Batangas plant, which is mainly geared towards the development and manufacturing of higher value-added products, is helping spur the growth in the HMSP segment.

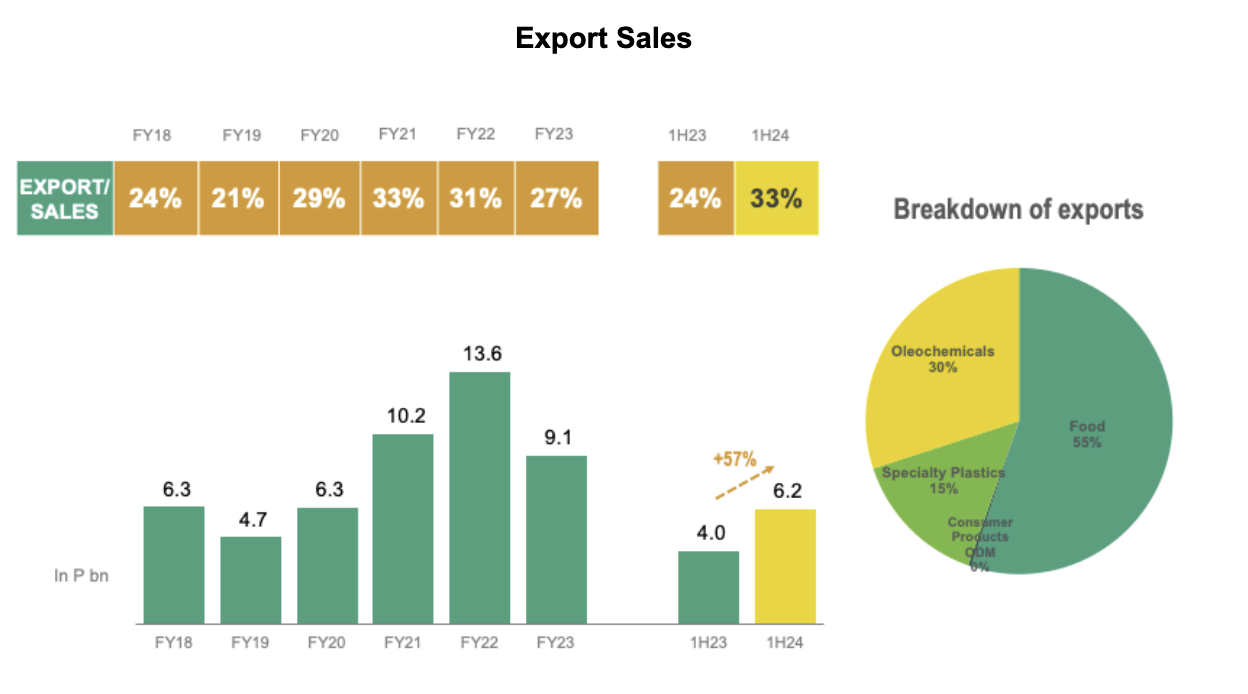

Export sales contribution at record high, stood at 33% in 1H24

In 2Q24, export sales accelerated further growing by 75% YoY. This brings the total export sales growth to 57% YoY for the first half of the year. Meanwhile, export sales as a percentage of total sales stood at 33% in 1H24 which is already at par with the record-high export sales contribution reported in FY21.

The growth in exports was primarily driven by both existing and new export customers. With the commercial operations of the Batangas plant, the company has been more aggressive in growing its exports business given that it now has the capability and capacity to be able to supply to bigger export customers. Over the medium-term, management is optimistic that it will reach its goal of having export sales account for at least 50% of total revenues.

1H24 FCF stood at P2.4 bn, already higher than the FY23 FCF of P1.1 bn

With no wild upside swings in commodity prices and the continued normalization of capex, the company’s free cash flows (FCF) remained positive for the period. 1H24 FCF stood at P2.4 billion, which already exceeds the full-year FCF of P1.1 billion recorded in FY23.

As there are no major capex spending planned in the near term, the improvement in the FCF gives the company the financial flexibility to further reduce its debt level over time.

As there are no major capex spending planned in the near term, the improvement in the FCF gives the company the financial flexibility to further reduce its debt level over time.

Meanwhile, net gearing for the period was lower at 60% from 67% in FY23. Interest cover stood at 5x while the average interest rate stood at 5.73%. The P5 billion maiden bond offering of the company issued in September 2021 is helping cushion the recent increase in interest rates. The bonds carry a coupon rate of 2.8% p.a. and 3.6% p.a. for 3-year and 5-year tenors, respectively. These would have been significantly higher at approximately 6.6% for the 3-year tenor and 6.8% for the 5-year tenor if the company were to issue the bonds today.

Segment Results

Food Ingredients

The food ingredients division continued its stellar performance in the second quarter, with earnings growing by 30% YoY, bringing 1H24 earnings growth to 27% YoY despite incremental expenses associated with the Batangas plant. This was largely driven by the 46% volume growth for the period as both HMSP and commodity segments posted higher volumes.

New customers and market share grab in both local and export markets have fuelled the volume growth for the period. As the Batangas plant ramps up operations, coupled with the improving macroeconomic backdrop and an aggressive export thrust, management is optimistic on the long-term growth potential of this segment.

Chemrez

Although 1H24 income is still down by 3% YoY, there are signs that things are gradually improving for Chemrez. For instance, in 2Q24 alone, on a y-o-y and q-o-q basis, earnings are already higher by 3% and 13%, respectively.

While the past year was challenging for this division, management believes that Chemrez is well-positioned to capitalize on long-term opportunities. The new plant in Batangas gives Chemrez additional capability and capacity to manufacture higher value-added products for both its local and international customers. In addition, recent industry developments such as the proposed increase in the biodiesel blend should bode well for Chemrez.

Specialty Plastics

The Specialty Plastics division delivered strong results in 1H24 with earnings growing by 51% YoY. Total volume for the period was up by 12% YoY while margins were higher by 6.3 ppts YoY.

Improvements in the global auto industry translated to higher demand for engineered polymers for auto wire harness application, which the company manufactures under this division. In addition there were successful market share grabs during the period, as the company continues to demonstrate its reliability as a supplier and as it invests in resources to further develop customer relationships.

Consumer Products ODM

The strong performance of Consumer Products ODM in the first half of last year with its 1H23 earnings growing by 41% YoY set up a high base for this year. However, with high inflation prevailing for most of last year and the apparent change in consumer spending priority for the period, many customers of this division remained overstocked in 1H24. This resulted in lower volumes and a consequent 60% YoY drop in earnings. Nonetheless, the outlook for the second half of the year is better given the lower inflation expectations and as customers gradually depletes their existing inventory.

D&L champions high impact sustainability initiatives

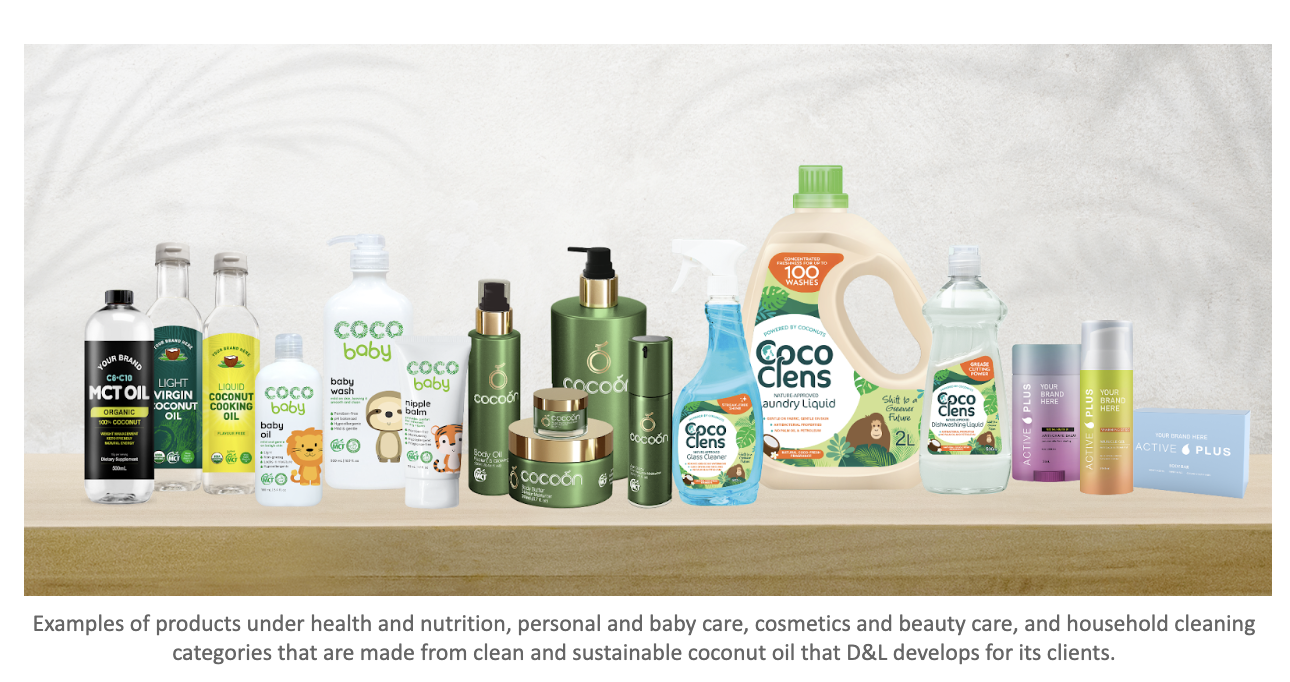

D&L Industries has embraced a holistic approach to sustainable innovation, long before the term “ESG” became mainstream. With R&D at the company’s core, D&L is relentless in developing products that answer the needs of its customers while at the same time staying attuned to the needs of the planet. In the global scene, D&L is seen as an advocate for sustainable products derived from sustainable materials such as coconut oil, given its extensive technical knowhow and wide array of product offerings.

With its state-of-the-art manufacturing facility in Batangas, D&L is spearheading a paradigm shift in its approach towards sustainability. With the new capabilities that the Batangas plant will bring, D&L aims to offer turnkey solutions to customers that are both economically and environmentally friendly.

D&L envisions empowering brands globally to make a meaningful shift towards high impact sustainability initiatives in the manufacturing of their products by giving them the option to buy direct from source. The direct from source approach simply means converting raw materials into finished goods in the country of raw material origin, instead of going through multi-leg production stages which usually happen across different locations in the globe. This naturally translates into simpler logistics, less wastage, lower costs, higher efficiency, and as such, significantly cutting down the carbon footprint (C02) of the entire supply chain.

D&L is gearing up towards launching a full range of shelf-ready products for its export customers, made from coconut oil, for the personal and baby care, cosmetics and beauty care, household cleaning, health and nutrition, and food and vegetable oils categories that are sustainable, natural, and organic. This initiative offers a plug-and-play solution for global brand owners who are looking to beef up their sustainable product offerings. Under this strategy, D&L will primarily target export customers who do not have the proximity to the source and instead would traditionally go through multiple layers of production before their products get into its final form and ready for end-customer purchase or consumption.

-end-

D&L Industries is a Filipino company engaged in product customization and specialization for the food, chemicals, plastics and consumer products ODM industries. The company’s principal business activities include manufacturing of customized food ingredients, specialty raw materials for plastics, and oleochemicals for personal and home care use. Established in 1963, D&L has the largest market share in most of the industries it serves, as well as long-standing customer relationships with the Philippines’ leading consumer and manufacturing companies. It was listed on the Philippine Stock Exchange in December 2012. For more information, please visit https://www.dnl.com.ph/investors/.

This press release may contain some “forward-looking statements” which are subject to a number of risks and uncertainties that could affect D&L’s business and results of operations. Although D&L believes that expectations reflected in any forward-looking statements are reasonable, D&L does not guarantee future performance, action or events.

INVESTOR RELATIONS CONTACT

Crissa Marie U. Bondad

Investor Relations Manager – D&L Industries Inc.

+632 8635 0680

crissabondad@dnl.com.ph / ir@dnl.com.ph