News

D&L Releases First Quarter 2024 Financial Results

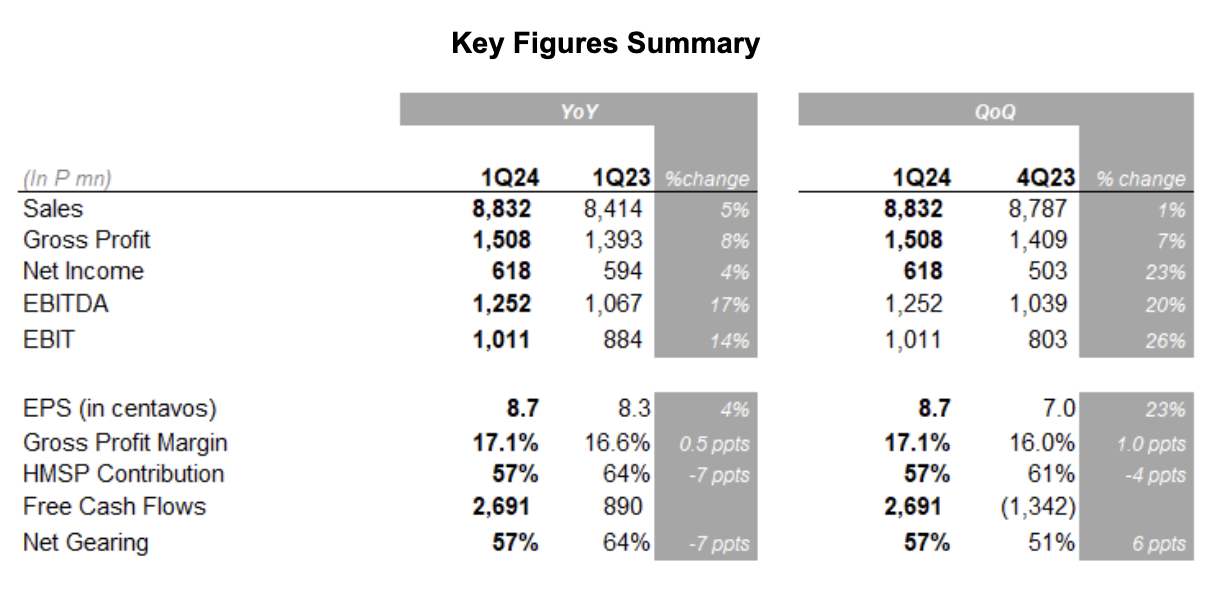

- 1Q24 earnings up 4% to P618 mn with Batangas plant almost breaking even; EBITDA for the period was up 17% YoY to P1.25 bn

- High Margin Specialty Products (HMSP) margins for the quarter up 4.5 ppts YoY, surpassing pre-pandemic level; HMSP volumes +13% YoY, up for the third consecutive quarter

- Export sales contribution approaching record high, stood at 32% in 1Q24

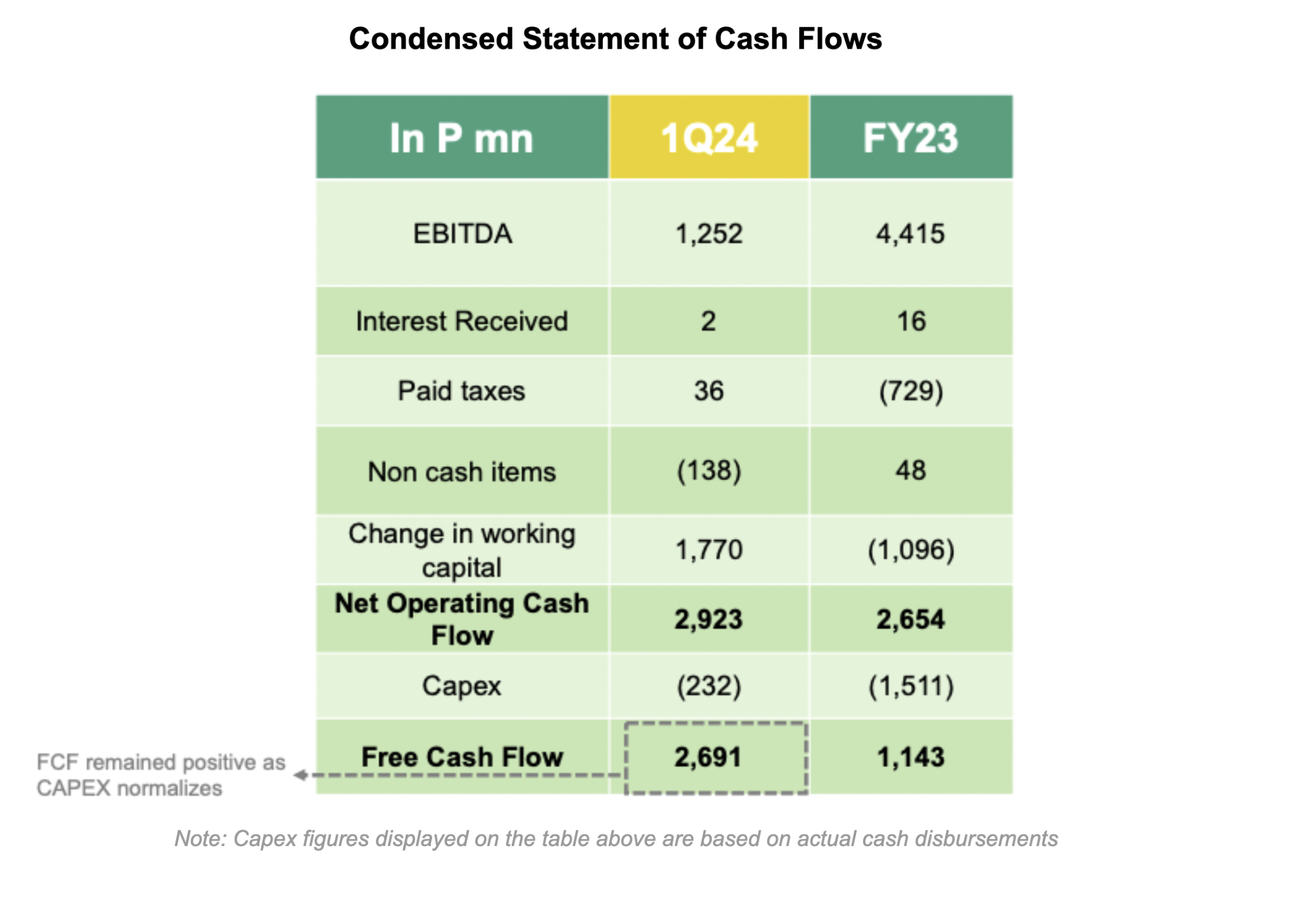

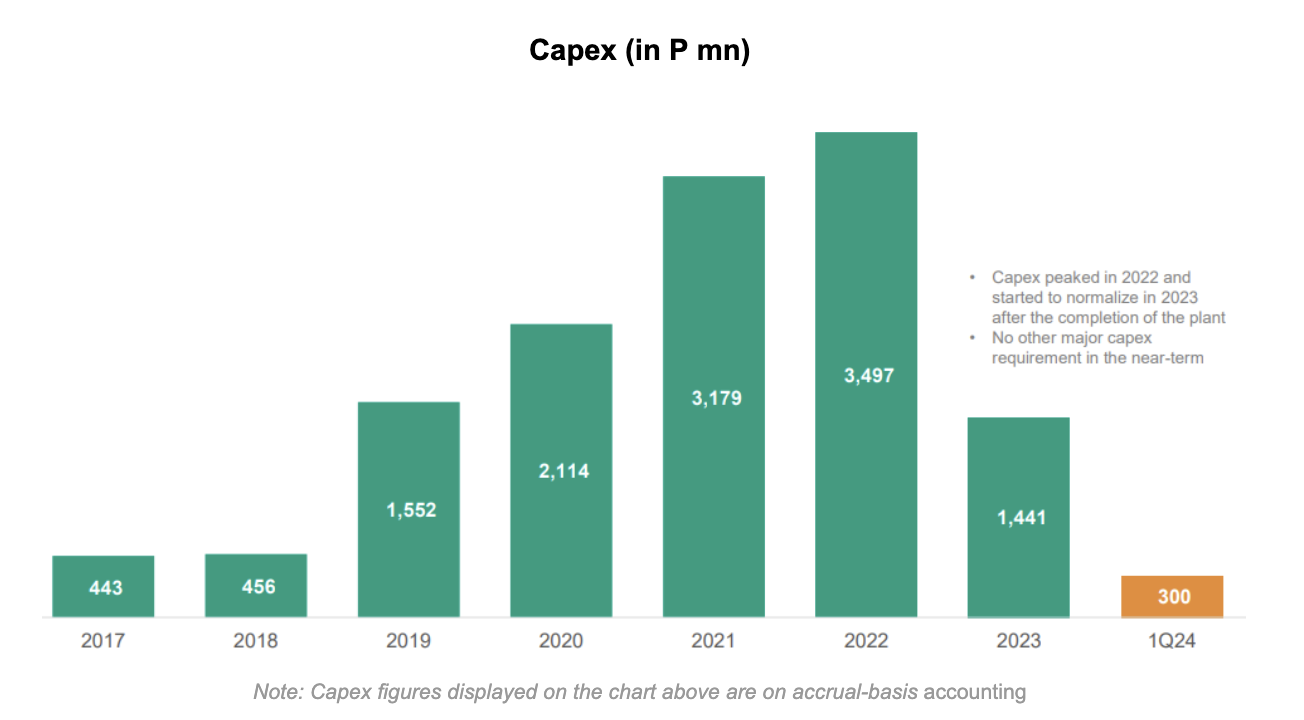

- 1Q24 Free Cash Flows (FCF) stood at P2.7 billion, already higher than FY23 FCF of P1.1 billion as capex spending normalizes

- D&L receives premier national award for Intellectual Property from the Intellectual Property Office of the Philippines (IPOPHL)

May 8, 2024 – D&L Industries’ recurring income reached P618 million, or earnings per share of P0.087, in the first quarter of 2024. This is higher by 4% YoY, with the Batangas plant almost breaking even for the quarter. Meanwhile, EBITDA, which excludes the impact of the increase in depreciation and interest expenses due to the new plant, was up 17% YoY in 1Q24 to P1.25 billion, which is indicative of the underlying strength of the core business.

“While it is still early days, the Batangas plant has already shown remarkable progress with respect to the ramp up of its operations as well as in surpassing its initial commitments with PEZA. With the current run rate, it is possible that we may see breakeven sooner-than-expected,” remarked D&L President and CEO Alvin Lao.

“Meanwhile, we continue to closely watch macro factors which can potentially dampen business sentiment such as the lingering effects of inflation, depreciating peso, and even the excessive heat that may impact consumer spending patterns,” Lao added.

“Barring any unforeseen event, we keep our stance and continue to guide for at least double-digit growth in earnings for this year. Over the longer-term, we have a lot of confidence that the investments that we have made over the past years will pave the way for higher and more sustainable profit growth. To date, the new plant has been instrumental in opening up new markets for us as we aspire to become a truly global Filipino manufacturing company,” Lao concluded.

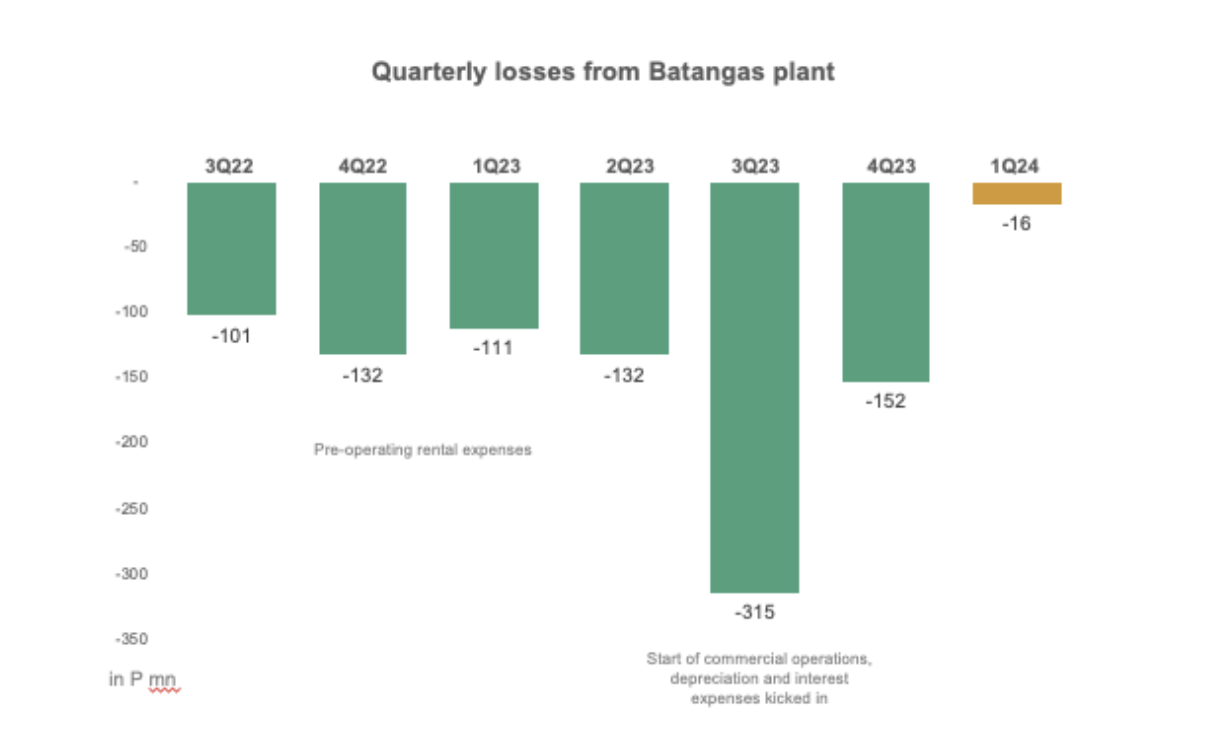

Losses from Batangas narrow as operations continue to ramp up; plant may breakeven ahead of schedule

Since the start of its commercial operations (SCO), the Batangas plant has continued a steady and consistent ramp up in operations. In the first quarter of 2024, there was a marked improvement in its operations with the plant almost breaking even. From a P315 million loss recorded during the first quarter of commercial operations, losses have narrowed drastically to merely P16 million in 1Q24. With the current run rate, it is possible that the plant may breakeven ahead of the initial schedule of at least two years since the SCO.

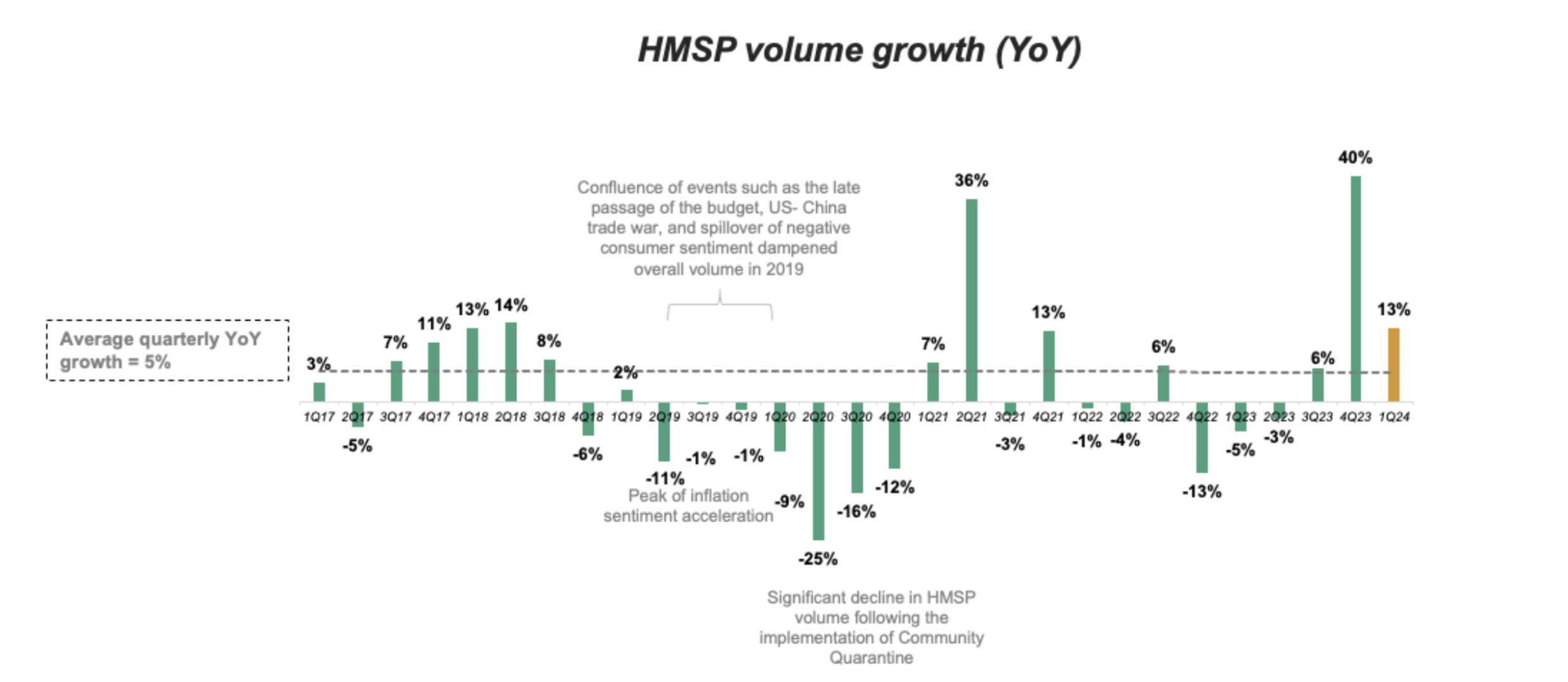

HMSP margins surpass pre-pandemic level with volume up for the third consecutive quarter

In 1Q24, the high margin side of the business has shown promising progress with margins already surpassing pre-pandemic levels. HMSP margins were up 4.5 ppts for the period mainly driven by better customer demand, improving mix within the various HMSP categories, and relatively less volatile commodity price movements during the quarter.

Meanwhile, the Batangas plant, which is mainly geared towards the development and manufacturing of higher value-added products, has consistently helped spur HMSP volume since the start of its commercial operations. Total HMSP volume was up 13% YoY in 1Q24 and was up for three quarters in a row since the new plant started operations.

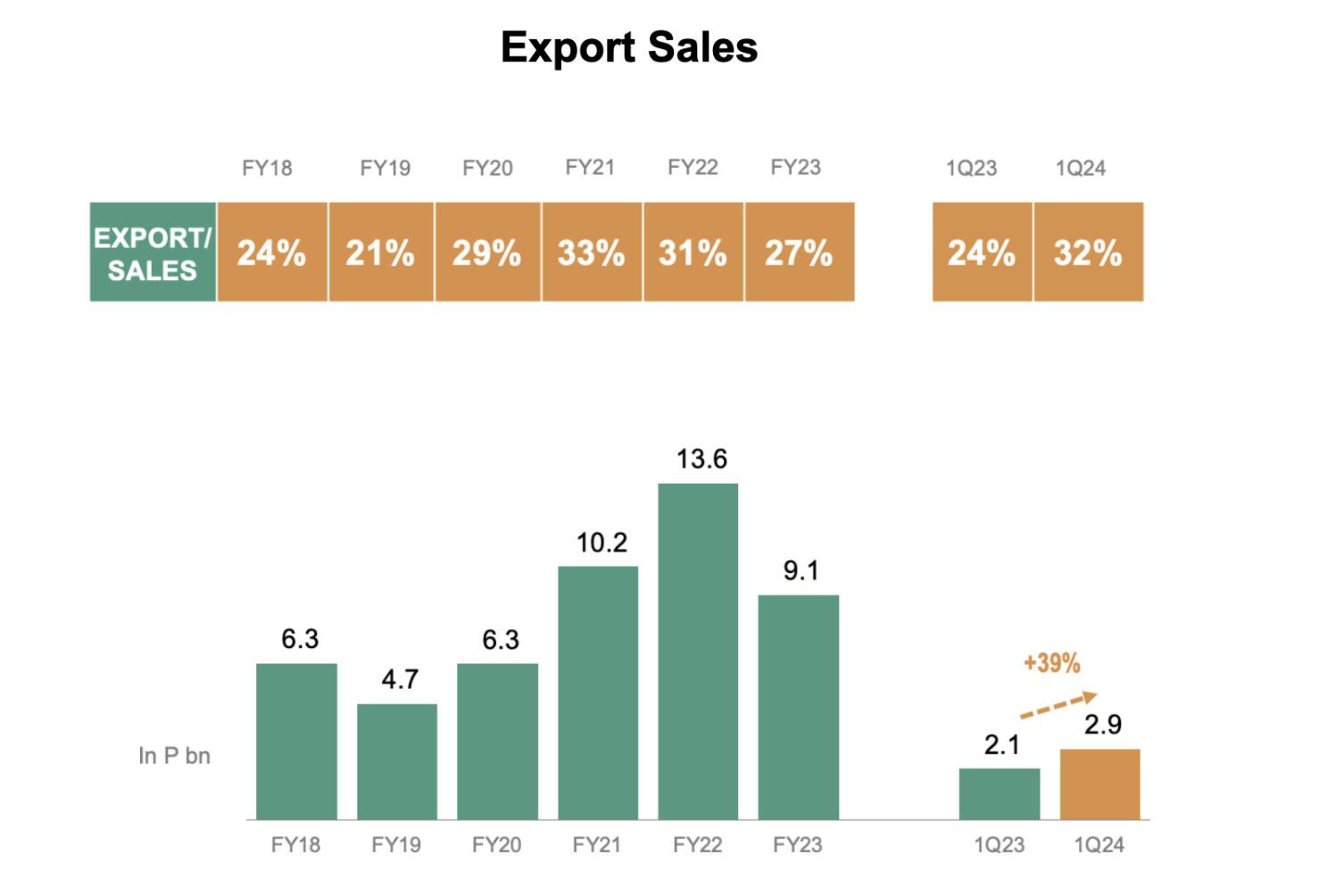

Export sales contribution approaching record high; Batangas plant surpasses first year export commitment to PEZA ahead of schedule

In 1Q24, exports recovered sharply with revenues up 39% YoY, bringing the export contribution to total sales almost at record high at 32% for the period. With the new capabilities and capacity that the Batangas plant brings, D&L reasonably expects that it will be able to achieve its goal of having exports account for at least 50% of total revenues over the medium-term.

To date, the new plant has successfully fulfilled several orders for both local and export customers. Several audit and certification processes are ongoing in order to on board more customers.

As of March 2024, Natura Aeropack Corporation (NAC) and D&L Premium Foods Corp (DLPF), D&L’s wholly-owned subsidiaries operating the Batangas facility, have both surpassed their first year export commitment with PEZA. Combined, the two subsidiaries have delivered 230% of their export commitment to date.

FCF for the quarter stood at P2.7 billion, surpassing full-year FCF of P1.1 billion in FY23

As the company moves past peak capex after the completion of its Batangas plant, coupled with the normalization of commodity prices, the company’s free cash flows (FCF) in the first quarter of the year has already exceeded the full-year amount booked in 2023. In 1Q24, the company’s FCF stood at P2.7 billion vs P1.1 billion in FY23 and negative P1.7 billion and negative P3.4 billion booked in FY22 and FY21, respectively.

As there are no major capex spending planned in the near term, the improvement in the FCF gives the company the financial flexibility to further reduce its debt level over time.

Meanwhile, net gearing for the period went down to 55% from 67% in FY23. Interest cover stood at 5x while the average interest rate slightly decreased to 5.59% from 5.74% in FY23. The P5 billion maiden bond offering of the company issued in September 2021 is helping cushion the recent increase in interest rates. The bonds carry a coupon rate of 2.8% p.a. and 3.6% p.a. for 3-year and 5-year tenors, respectively. These would have been significantly higher at approximately 7.1% for the 3-year tenor and 7.4% for the 5-year tenor if the company were to issue the bonds today.

With improving free cash flows, normalization of capex needs, as well as the continued optimism on the future prospects of the business, the company’s maiden bond issuance has retained its highest credit rating (PRS Aaa with stable outlook) as issued by Philratings in its rating review issued last April 2024.

D&L receives premier national award for Intellectual Property from the Intellectual Property Office of the Philippines

D&L Industries was conferred the prestigious Gawad Yamang Isip award for Inventions by the Intellectual Property Office of the Philippines (IPOPHL) for successfully commercializing inventions that have benefited the Filipino people and society at large.

The award was specifically for the invention and subsequent patenting of the “composition of medium chain triglycerides containing substantial amount of lauric acid,” which is the key formulation of Laurin® CocoMCT, which is coconut oil in its most concentrated form that contains only the healthiest and most beneficial part. D&L Industries is the pioneer in manufacturing CocoMCT in the Philippines and is currently among the top suppliers globally. With the commercialization of this product, the company is able to provide a sustainable livelihood to coconut farmers and their communities through the programs of the Lao Foundation with Dualtech Training Center.

With investments in R&D as among the top priorities of the company, D&L aims to develop more patentable technologies that can better lives through sustainable innovation.

Gawad Yamang Isip is the premiere national award for intellectual property (IP) creators and owners whose works helped improve Filipinos’ lives using the IP system. This year’s GYI awards were conferred to individuals and institutions whose innovation have contributed to the fulfilment of the United Nation’s 17 Sustainable Development Goals (SDGs).

Segment Results

Food Ingredients

The food ingredients division delivered a stellar 24% YoY earnings growth in 1Q24 despite incremental expenses associated with the Batangas plant. This was largely driven by a 35% YoY increase in volume coupled with a 1.1-ppt improvement in gross margins.

Both local and export markets have delivered good volumes for the quarter which was fuelled by new customers and market share grab. As Batangas plant ramps up operations coupled with the improving macroeconomic backdrop and an aggressive export thrust, management is optimistic on the long-term growth potential of this segment.

Chemrez

Although income is still down 9% YoY in 1Q24, there are signs that things are gradually improving for Chemrez. EBIT, which excludes the impact of higher interest expenses associated with the new plant in Batangas, was up 3% YoY in 1Q24. Meanwhile, on a quarter-on-quarter basis, there was already a recovery with earnings growing by 8%.

While the past year was challenging for this division, there are various catalysts on the horizon that underpins its long-term growth potential. With the new capacity coming from the Batangas plant, Chemrez has bolstered its sales team to intensify its efforts in developing relationships with potential customers. So far, Chemrez has been successful in opening up new markets and onboarding new customers, the impact of which should be felt in the coming quarters as the company continues to deepen its relationships with customers and increase market penetration.

Specialty Plastics

The Specialty Plastics division delivered record quarterly income for the period with earnings growing by 76% YoY. Total volume for the division was up by 10% YoY while margins were up by a remarkable 8.5 ppts YoY. The robust earnings growth was driven by both of its subsegments – engineered polymers and colorants and additives.

Engineered polymers are mainly used for automotive wire harness applications. The shortage in semiconductor chips in recent years which has hampered the global auto production has started to improve which resulted in a rebound in auto production and better demand for the various materials in the automotive supply chain including engineered polymers that the company manufactures. Meanwhile, for colorants and additives, the company’s more aggressive sales efforts with the expansion of its sales team has so far yielded new customers and additional volumes.

Over the long term, this division is expected to continue to grow fuelled by the company’s R&D investments that are aimed at developing new applications for its products and introducing new technologies that will make plastics more economical and environmentally-friendly at the same time. The company has started to fulfill trial orders for a new alternative to plastics that is equally durable and cost-competitive but is renewable, sustainable, and made from indigenous materials.

Consumer Products ODM

The stellar performance of Consumer Products ODM in the first quarter of last year with its 1Q23 earnings growing by 76% YoY set up a high base for this year. However, with high inflation and weak consumer sentiment prevailing for most of last year, many customers have remained overstocked for the first quarter of this year, resulting in lower volumes for this division and a consequent 60% drop in earnings YoY. Nonetheless, with lower inflation expectations for this year, the outlook is better for the next couple of quarters.

D&L champions high impact sustainability initiatives

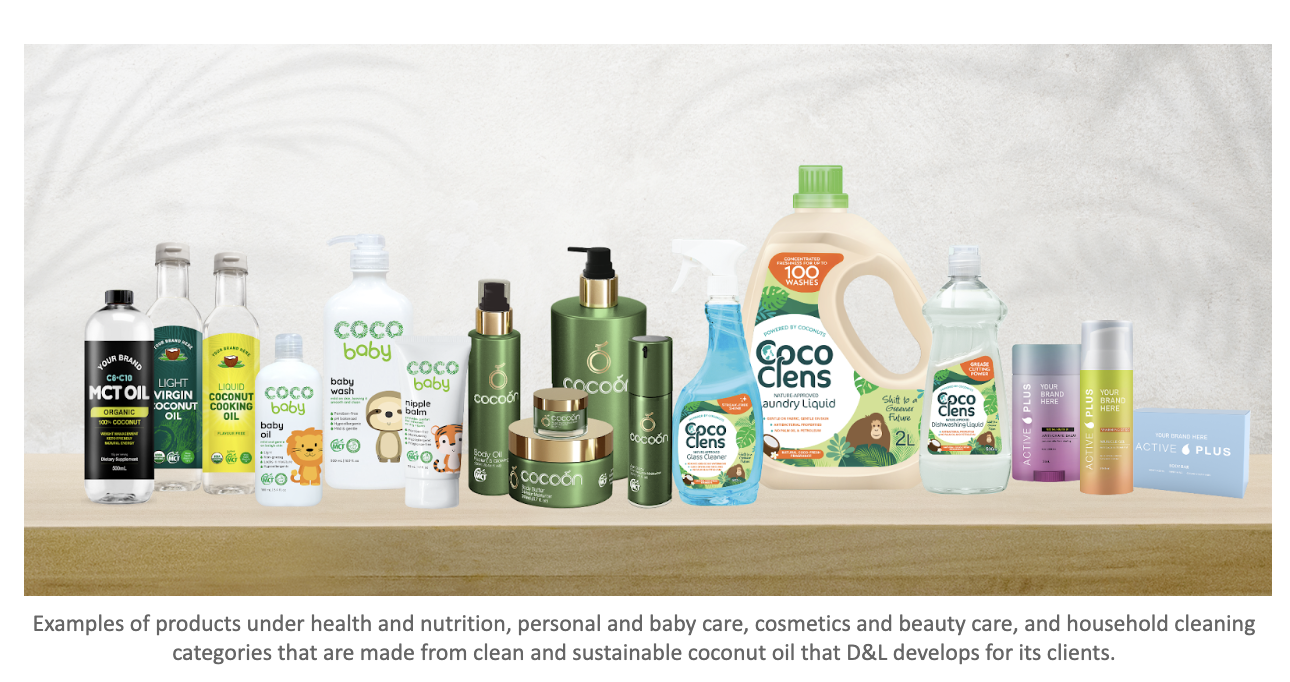

D&L Industries has embraced a holistic approach to sustainable innovation, long before the term “ESG” became mainstream. With R&D at the company’s core, D&L is relentless in developing products that answer the needs of its customers while at the same time staying attuned to the needs of the planet. In the global scene, D&L is seen as an advocate for sustainable products derived from sustainable materials such as coconut oil, given its extensive technical knowhow and wide array of product offerings.

With its state-of-the-art manufacturing facility in Batangas, D&L is spearheading a paradigm shift in its approach towards sustainability. With the new capabilities that the Batangas plant will bring, D&L aims to offer turnkey solutions to customers that are both economically and environmentally friendly.

D&L envisions empowering brands globally to make a meaningful shift towards high impact sustainability initiatives in the manufacturing of their products by giving them the option to buy direct from source. The direct from source approach simply means converting raw materials into finished goods in the country of raw material origin, instead of going through multi-leg production stages which usually happen across different locations in the globe. This naturally translates into simpler logistics, less wastage, lower costs, higher efficiency, and as such, significantly cutting down the carbon footprint (C02) of the entire supply chain.

D&L is gearing up towards launching a full range of shelf-ready products for its export customers, made from coconut oil, for the personal and baby care, cosmetics and beauty care, household cleaning, health and nutrition, and food and vegetable oils categories that are sustainable, natural, and organic. This initiative offers a plug-and-play solution for global brand owners who are looking to beef up their sustainable product offerings. Under this strategy, D&L will primarily target export customers who do not have the proximity to the source and instead would traditionally go through multiple layers of production before their products get into its final form and ready for end-customer purchase or consumption.

D&L Industries is a Filipino company engaged in product customization and specialization for the food, chemicals, plastics and consumer products ODM industries. The company’s principal business activities include manufacturing of customized food ingredients, specialty raw materials for plastics, and oleochemicals for personal and home care use. Established in 1963, D&L has the largest market share in most of the industries it serves, as well as long-standing customer relationships with the Philippines’ leading consumer and manufacturing companies. It was listed on the Philippine Stock Exchange in December 2012. For more information, please visit https://www.dnl.com.ph/investors/.

This press release may contain some “forward-looking statements” which are subject to a number of risks and uncertainties that could affect D&L’s business and results of operations. Although D&L believes that expectations reflected in any forward-looking statements are reasonable, D&L does not guarantee future performance, action or events.

INVESTOR RELATIONS CONTACT

Crissa Marie U. Bondad

Investor Relations Manager – D&L Industries Inc.

+632 8635 0680

crissabondad@dnl.com.ph / ir@dnl.com.ph