News

D&L Industries Reports FY21 Results

FY21 income +31% YoY, slightly ahead of pre-COVID earnings in 2019

HMSP volume +13% YoY in 4Q21 due to eased restrictions

Record export sales at P10.2 billion; contribution to group sales at 33%

Momentum build up and renewed optimism from lower COVID alert levels

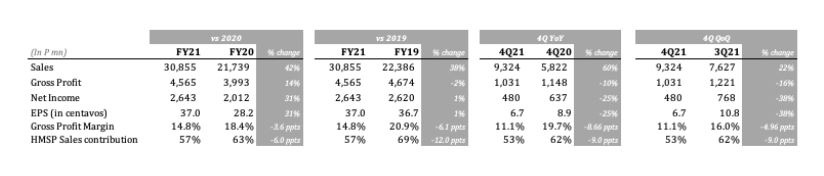

March 30, 2022 – D&L Industries ended 2021 with full-year net income of P2.6 billion, slightly ahead of pre-COVID earnings in FY19 and up 31% YoY vs FY20. The recovery was mainly driven by increased economic activity as well as the robust performance of the company’s export business in 2021. Total volume was up by 11% YoY while the company’s export sales grew by 62% YoY. With a lower COVID alert level in place and continued decline in new cases in the country, the company sees a build up in momentum and renewed business optimism for further recovery.

Management Perspective

“Our business faced incredible challenges during the pandemic. Now emerging two years later on a better footing both operationally and financially, with our earnings already back to pre-COVID levels, we feel that the company has not only proven but also strengthened its resilience,” remarked President and CEO Alvin Lao.

“While we are cautiously optimistic that we are likely at the tailend of the pandemic, we remain focused on our core competencies, ready to ride another wave of volatility brought about by recent geopolitical uncertainties. While Russia and Ukraine are not a significant part of our supplier or customer base, the ongoing conflict poses a threat to global recovery and has sent prices of key commodities skyrocketing over a short span of time,” Lao added. “In the near-term, we see demand affected by two opposing forces – continued economic reopening on one hand, and generally higher prices of basic commodities on the other. Nonetheless, while 2022 won’t be without difficulties, we continue to pursue areas of opportunities that will bring the next leg of growth for the company. With coconut oil continuing to gain traction globally as a natural and sustainable substitute to many petroleum-based raw materials, we plan to further capitalize on this by entering more export markets and by using our R&D expertise to introduce more highly specialized, coconut-oil based products. In addition, our Batangas expansion is expected to come online in January 2023 which will be a key milestone in boosting our export sales further,” Lao concluded.

FY21 income back to pre-COVID levels

Despite the pandemic and higher commodity prices, D&L ended 2021 with full-year net income of P2.6 billion. This is slightly ahead of pre-COVID19 earnings in FY19 and is up 31% YoY vs FY20 net income. Lower corporate taxes provided by the CREATE law had a 4% impact on FY21 net income.

In the fourth quarter, however, the rapid increase in commodity prices coupled with the tailend effect of the Delta surge which peaked in September 2021 tempered D&L’s consecutive quarters of earnings growth. 4Q21 earnings fell 25% YoY to P480 million, as margins dropped 8.7 ppts for the quarter largely due to the lag in price pass through. In addition, there was also a change in product mix in favor of commodities as the country continued to be under a stricter alert level at the beginning of the quarter versus a relatively modest restriction for the entire 4Q20.

Margin squeeze seen as temporary

Prices of some of the company’s key raw materials such as coconut and palm oil have rallied significantly in the past couple of months. Average coconut oil and palm oil prices are either near or have already breached their all-time highs and are up another 23% YTD, coming from over 60% YoY increase for both commodities in FY21.

While D&L is able to adjust its selling price regularly to reflect higher input prices, there is a time lag of 30-45 days before the company can fully pass on price changes. As such, in an environment of rapid price increases, temporary margin contraction is possible. However, management sees this as temporary and expects margins to recover once commodity prices start to stabilize.

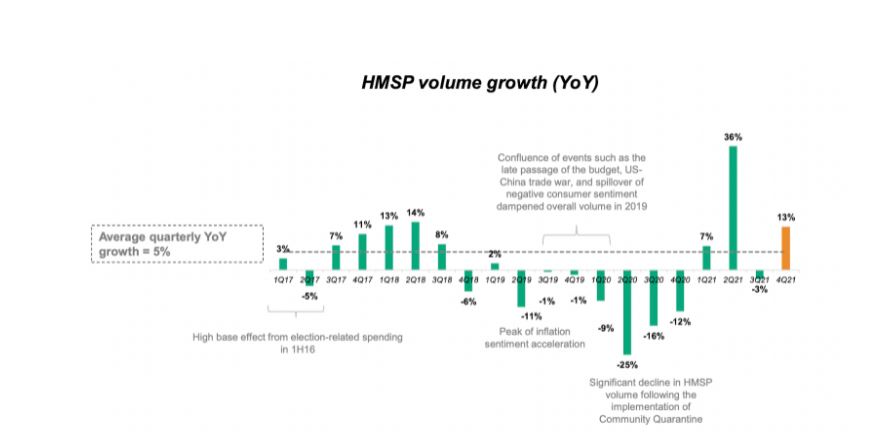

HMSP volume +13% YoY in 4Q21 due to lower quarantine level

In 4Q21, D&L saw its HMSP volumes increase by 13% YoY after the country was placed under a lower quarantine alert level from the previous quarter. Had it not been for the lower margins due to the sharp increase in commodity prices, higher HMSP volumes would have resulted in meaningful earnings growth in 4Q21. Looking ahead, while the soaring commodity prices may weigh on volume recovery, the company sees the continued reopening of the economy to help fuel demand and offset potential weakness.

Record export sales at P10.2 billion, contribution to group sales at 33%

Exports continued its positive momentum in 4Q21, jumping 81% YoY for the quarter, bringing full-year export sales value to a record P10.2 billion, up 62% YoY. Exports now account for 33% of FY21 revenues, evidencing the company’s commitment to diversifying its revenue base by strategically growing its international customer base.

Coconut-based products under food and oleochemicals were the main drivers behind robust export growth in the period. Coconut oil continues to gain traction in the global market due to its perceived natural antiviral, antibacterial, and antifungal properties. In addition, coconut oil remains a valued, sustainable substitute for petroleum-based raw materials used in many applications such as personal hygiene and home cleaning products. Going forward, the company expects its foothold in coconut oil-based exports to strengthen, which should offset some of the weakness in the domestic market in the near term.

Batangas expansion will position the company for long-term growth and enable the achievement of strategic priorities

D&L remains committed to its Batangas expansion which is set to start commercial operations in January 2023. As the company invests in the future and envisions a facility specced to the highest standards, D&L made a few additions and upgrades to the original plan which resulted in an increase in budgeted capex from P8 billion to P9.1 billion. As D&L already began the construction of the new plant even before the pandemic started, there was minimal impact from price increases. As of end-December 2021, the company has spent around P6.2 billion for the project.

In September 2021, the company executed its maiden bond offering, successfully raising P5 billion to help fund the remaining capex for this expansion. The bond received the highest rating of Aaa by Philippine Rating Services Corporation (Philratings) and was 5x oversubscribed, allowing D&L to price its bond at among the lowest rates in Philippine corporate bond history. The issuance was also awarded by the Asset Magazine as the Best New Bond in the Philippines for the year 2021.

The facility will mainly cater to D&L’s growing export businesses in the food and oleochemicals segments. It will add the capability to manufacture downstream packaging, thus allowing the company to capture a bigger part of the production chain. For instance, while the company primarily sells raw materials to customers in bulk, the new plants will allow it to “pack at source”. This means that D&L will have the ability to process the raw materials and package them closer to finished consumer-facing products. This will enable D&L to move a step closer to its customers by providing customized solutions and simplifying their supply chain, which is of high importance given ongoing logistical challenges.

D&L’s Batangas expansion will be instrumental to its future growth, as this facility will enable the company to develop more high value-added coconut-based products and penetrate new international markets. In the new normal, the company has successfully made significant in-roads in supplying various raw materials and even finished products in several relevant fast-moving consumer goods (FMCG) categories. It plans to further expand its global footprint and in the long-term, targets export sales to account for at least 50% of total revenue.

Operational and financial resilience

As the world gradually recovers from the pandemic, D&L is emerging more resilient than ever, having instituted various adjustments and operational contingencies. While there are renewed risks to global growth and recovery, the company believes that it is now in a far better position to thrive in an adverse environment and a potentially protracted economic recovery period. Moreover, as most products that the company manufactures cater to basic essential industries such as food, oleochemicals, plastics and cleaning chemicals, the company sees continued strong demand ahead.

From a capital structure perspective, the company is in a solid position to withstand external pressures. In September 2021, the company successfully raised P5 billion from 3-year and 5-year fixed rate bonds, bringing its total net debt to P8.6 billion. As of end-December 2021, gearing continues to remain manageable at 45% and interest cover at 27x. In addition, the cash conversion cycle for the period was lower at 120 days vs. 127 days in 2020, given lower account receivables days and higher payable days.

Overall, the company’s profitability ratios remain healthy. Return on Equity (ROE) and Return on Invested Capital (ROIC) stood at 13.8% and 11.9%, respectively, in FY21.

Better lives through sustainable innovation

D&L Industries has already been practicing a holistic approach to sustainable innovation, long before the term “ESG” became mainstream. With R&D at the company’s core, D&L is relentless in developing products that answer the needs of its customers while at the same time staying attuned to the needs of the planet. In the global scene, D&L is seen as an advocate for sustainable products derived from sustainable materials such as coconut oil, given its extensive technical knowhow and wide array of product offerings.

D&L sees a future that integrates all aspects of product design and development, as well as manufacturing to come up with products that are better for the consumers and better for the environment. Its Batangas plant signifies the company’s investments to double down on sustainability with a 360 degree approach – designing and building a sustainable infrastructure and operations for a wider array of inherently sustainable products.

The company currently offers various sustainable products such as plant-based replacements for dairy and animal-derived ingredients, biodiesel which is a more environment-friendly substitute for fossil fuels, coconut oil-based natural and organic raw materials for home and personal care products, organic fertilizers, and even sustainable packaging materials. As the world shifts toward a more sustainable consumption, D&L plans to continue to play on its strengths and develop more products designed to better lives while being kind to the planet. The company sees this trend as the next leg of growth and sees the next decade as transformational for the company.

Segment Results

Food Ingredients

The food ingredients segment ended the year with net income higher by 70% YoY, just 15% lower than pre-pandemic levels. Both HMSP and commodity segments saw volume recovery with overall volume growth at 11% YoY. This business was the segment most heavily affected by the pandemic, hence it is also expected to post the sharpest recovery post-pandemic. With quarantine restrictions now easing across the country and in the economic hub of Metro Manila, the company anticipates that further recovery is set to continue as fully vaccinated individuals are granted more freedom of movement, especially when frequenting restaurants, hotels, and the service industry. In addition, election campaign spending may provide an added boost to food companies. In the 2016 Presidential elections, this segment saw its volume increase by 13% YoY.

Oleochemicals

Chemrez posted 15% YoY growth in net income in FY21, while volume grew by 13% YoY. This boost in volume more than offset the overall margin compression of 7%. The margin compression mainly came from the Oleochemicals segment (chemicals derived from coconut oil), due to a surge in coconut oil prices. It takes the company 30-45 days to adjust prices to account for changes in prices of its underlying raw materials. As such, in an environment of rapid price changes, temporary margin contraction is possible. Nonetheless, the company sees its margins recovering in the succeeding quarters once coconut oil prices stabilize.

Specialty Plastics

Specialty plastics income increased by 37% YoY in FY21. This was driven by higher volume which was up 7% YoY and a slight margin expansion of 0.3 ppt. Moving forward, the company expects steady and consistent demand given the crucial role that plastics play during the current pandemic — from various medical applications to packaging for parcel and food deliveries. In addition, D&L has several projects in its R&D pipeline that relate to sustainable inputs for plastic manufacturing.

Consumer ODM

Consumer products ODM, previously referred to as Aerosols, continues to post strong volume growth. Total volume in this segment grew by +17%, as consumer demand for sanitation and disinfectant products remains strong in the new normal. However, given overarching raw material price surges, margins were down 4% which resulted in a 6% decline in profits. Nonetheless, the company does expect margins to recover as it continues to adjust prices every 30-45 days. The company also anticipates demand for its consumer products to strengthen as quarantine restrictions ease, leading to greater foot traffic in retail outlets and more consumers resuming the regular use of personal hygiene products.

-end-

D&L Industries is a Filipino company engaged in product customization and specialization for the food, chemicals, plastics and consumer products ODM industries. The company’s principal business activities include manufacturing of customized food ingredients, specialty raw materials for plastics, and oleochemicals for personal and home care use. Established in 1963, D&L has the largest market share in each of the industries it serves, as well as long-standing customer relationships with the Philippines’ leading consumer and manufacturing companies. It was listed on the Philippine Stock Exchange in December 2012. For more information, please visit https://dnl.com.ph/investors/.

This press release may contain some “forward-looking statements” which are subject to a number of risks and uncertainties that could affect D&L’s business and results of operations. Although D&L believes that expectations reflected in any forward-looking statements are reasonable, D&L does not guarantee future performance, action or events.

INVESTOR RELATIONS CONTACT

Crissa Marie U. Bondad

Investor Relations Manager – D&L Industries Inc.

+632 8635 0680

crissabondad@dnl.com.ph / ir@dnl.com.ph