News

Press Release 2025 1Q

D&L Releases First Quarter 2025 Financial Results

- 1Q25 earnings up 10% YoY to P681 mn as Batangas plant continues to ramp up operations

- Total volume for the quarter was up 33% YoY although rapid increase in commodity prices tempered potential boost to earnings

- Export sales up 69% YoY; contribution to total sales at record level of 34%

- Return ratios started to improve; ROE stood at 12.1% (+1.4ppts vs FY24), ROIC stood at 10% (+1ppt vs FY24)

- Global uncertainties keep near-term expectations grounded; management unfazed, keeping focus on building resiliency and long-term growth strategies

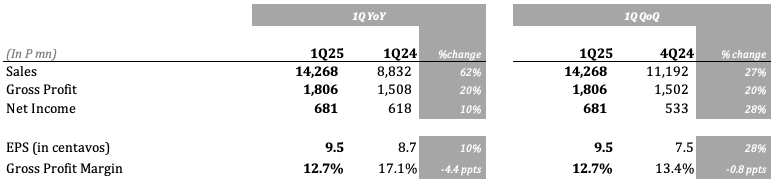

Key Figures Summary

May 07, 2025 – D&L Industries’ recurring income reached P681 million, or earnings per share of P0.095 in the first quarter of 2025. This is higher by 10% YoY, driven by the continued growth in exports and ramp up of operations in Batangas plant. Total volume growth for the period was strong although rising commodity prices tempered its potential positive effect on net income.

“The year started with strong momentum. However, the increasing global uncertainties have led to a noticeable slowdown and dampening of global business sentiment,” remarked D&L Industries President & CEO Alvin Lao. “Nonetheless, the Philippines may be one of the least affected countries given its import-heavy trade balance. In addition, the lower proposed reciprocal tariff for the Philippines versus its neighboring countries may put the Philippines in an advantageous position. Despite the macroeconomic noise, D&L still managed to book a 10% YoY earnings growth for the quarter on the back of robust volume growth for both High Margin Specialty Products (HMSP) and commodities,” Lao added.

“While volatility is likely to persist in the near-term, we remain unfazed and continue to focus on building resiliency and long-term growth strategies. We believe that with our product portfolio, the majority of which cater to basic and essential industries, we will continue to grow and be relevant in an ever-changing business environment and world trade order,” Lao concluded.

Batangas plant continues to ramp up operations; return ratios start to improve

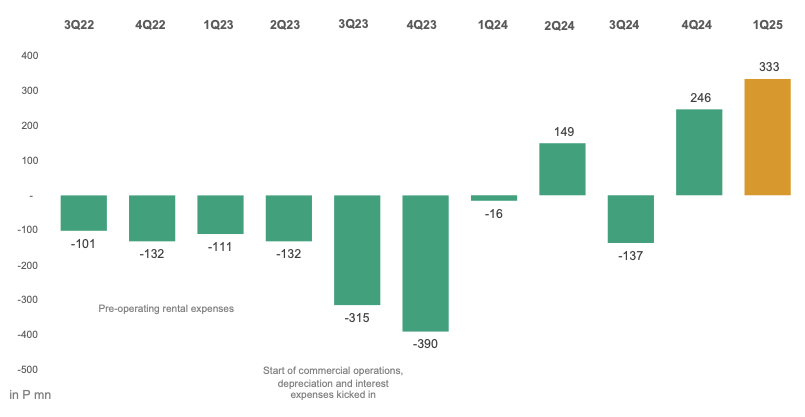

D&L’s Batangas plant continues to ramp up operations well into the first quarter of the year with net income growing by 35% QoQ to P333 million. This positive momentum gives the company the confidence that, over time, its industry leading facilities in Batangas will continue to play an increasingly significant role in boosting its overall net income. D&L believes that it has only just begun to tap into the plant’s potential, given the vast opportunities it sees in both local and international markets.

To date, the new plant has successfully fulfilled orders for both local and export customers. Several audit and certification processes are ongoing in order to on-board more customers.

Quarterly income of Batangas plant

With the increasing income contribution from Batangas plant, the company’s return ratios have started to see improvements. ROE stood at 12.1% for the quarter, higher by 1.4ppts from FY24 level. Meanwhile, ROIC stood at 10% for the quarter, higher by 1 ppt from FY24 level. Management targets a steady improvement in both ratios to reach mid to high-teens in the medium-term.

Total volume was up 33% YoY but rising commodity prices tempered potential boost to income

Total volume growth was robust for the period as both HMSP and commodities booked double-digit volume growth. HMSP was up 36% YoY while commodities were up 30%, bringing total volume growth for the quarter at 33% YoY. The buoyant volume growth was driven by a combination of the strong exports, new customer wins, market share grab, and positive regulatory development with the increase in mandated biodiesel blend from 2% to 3% starting October 1, 2024.

The potential significant boost of the robust volume growth to net income, however, was tempered by the unprecedented increase in commodity prices for the period which led to a temporary margin contraction. Coconut oil, which is one of the key raw materials of the company, saw its average price increase by 74% YoY for the quarter and 37% YTD.

While D&L passes on price changes to customers, it takes the company an average of 30-45 days to adjust its prices which normally leads to a temporary margin contraction or expansion in an environment of rapidly changing commodity prices. The substantial increase in coconut oil prices was largely due to increasing global demand at a time when supply is temporarily constrained due to the negative effects of El Niño last year on coconut tree yield. The seasonal harvesting period from May to July may bring relief on the tight supply-demand situation leading to softening of prices. D&L expects its margins to recover once commodity prices start to stabilize.

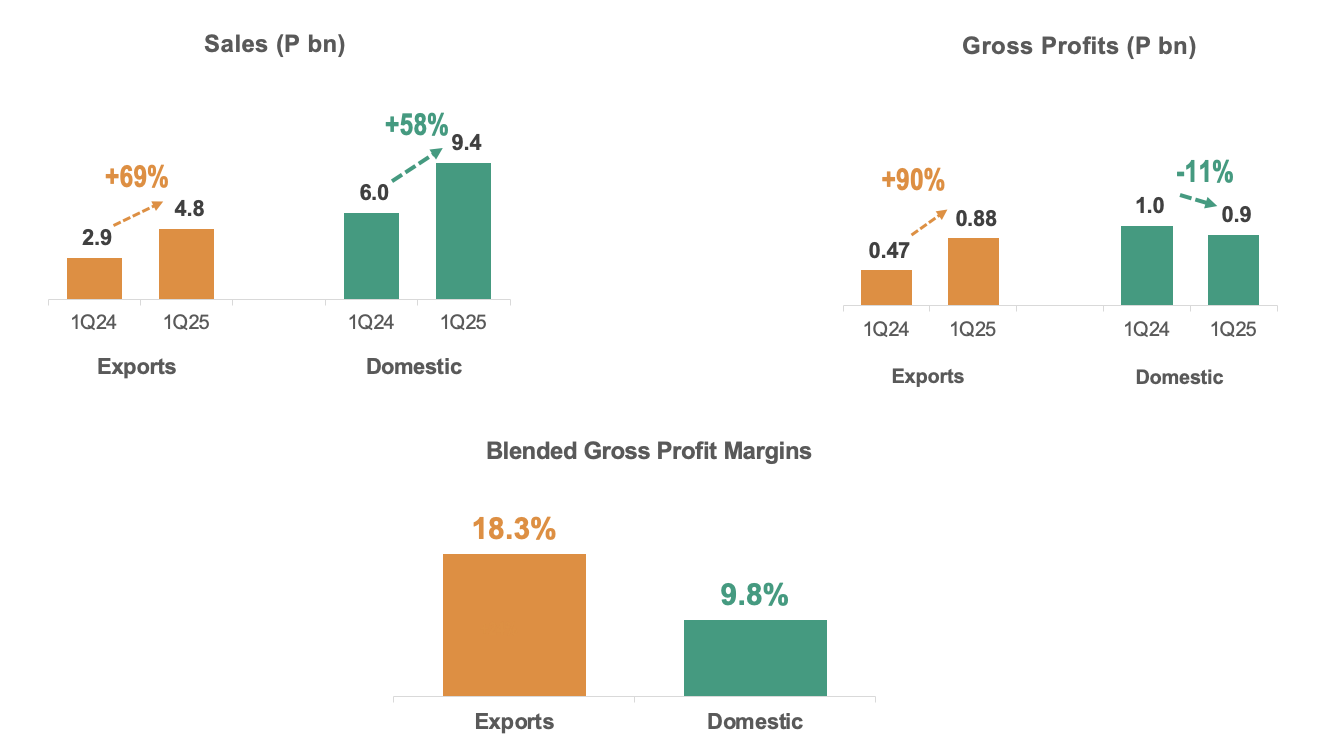

Exports is a key growth driver

Exports continued its positive momentum in 1Q25 booking a total sales of P4.8 billion, which is higher by 69% YoY. Meanwhile, export gross profits jumped by a whopping 90% YoY over the same period. Average gross profit margin (GPM) for exports which stood at 18.3% is notably higher than average GPM of 9.8% for the domestic business. This shows that exports remain a bright spot amidst increasing global uncertainty and volatility.

With low hanging fruits and markets that have yet to be penetrated, D&L sees a significant potential upside for this segment. Over the medium-term, the company targets exports to account for 50% of total sales. In 1Q25, export sales contribution stood at a record level of 34%.

Exports vs Domestic Market

Natura Aeropack Corporation (NAC) and D&L Premium Foods Corp (DLPF), the operating companies behind D&L’s Batangas plant, are aggressively pushing high-value added coconut oil-derived ingredients and finished products for the food, personal hygiene, and home care segments in the export market. With the increasing concern on the massive deforestation associated with the use of palm oil and the depletion of non-renewable energy sources and high carbon footprint associated with the extraction and use of petroleum, coconut-derived ingredients offer an excellent natural, organic, and sustainable alternative for many industries and applications.

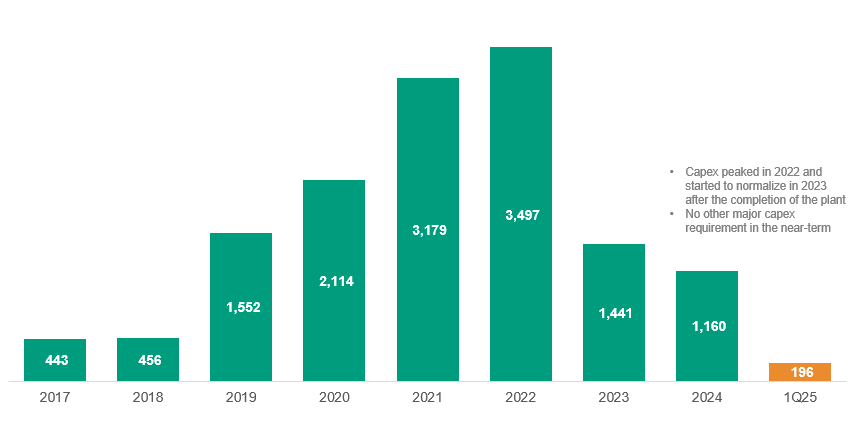

Balance sheet remains strong; capex has started to trend lower

The company’s balance sheet remained in a solid position even with the huge capex over the past couple of years and unprecedented increase in commodity prices which translates to higher working capital requirements. As of end-March 2025 interest cover remained at a comfortable level of 4x with net gearing at 92%. Average cost of debt was slightly lower at 6.2% as of end-March 2025 vs 6.29% as of end-December 2024. With the generally dovish stance of the Bangko Sentral ng Pilipinas (BSP), there is room for the average cost of debt to go down in 2025.

From a capex standpoint, the company does not expect any major capex spending in the near-term. As shown on the chart on the succeeding page, capex has started to taper off in 2023 with the completion of the Batangas plant. In 1Q25, capex stood at below P200 million, which if annualized will yield a sub-P1 bn capex for the year.

Historical Capex (in P mn)

Segment Results

Food ingredients

The food ingredients division delivered a stellar volume growth of 33% in 1Q25 as volumes for both HMSP and commodities were up double-digits. The robust volume growth, coupled with higher commodity prices, drove a 65% increase in revenues for the quarter. Gross profit margins were lower by 3.5 ppts largely due to the rapid increase in commodity prices and higher initial cost base at the Batangas plant as it continues to ramp up production. Overall, the food ingredients division booked an 18% YoY growth in earnings.

Chemrez

Chemrez delivered a strong recovery in 1Q25 with earnings growing by 27% YoY for the period. The growth was mainly driven by the robust performance of the biodiesel division with the increase in mandated biodiesel blend from 2% to 3% starting October 1, 2024.

From a strategic perspective, the company continues to invest in the development of more customized specialty ingredients which can yield better profitability and higher impact on net income. The new plant in Batangas gives Chemrez a new runway for growth given the additional capability and capacity to manufacture higher value-added products for both its local and international customers.

The specialty plastics division takes a breather from the strong performance last year with 1Q25 earnings down 5% YoY. With 50% of this division’s revenues coming from wire harness for global automotive industry applications, the uncertainties related to tariffs have dampened the business sentiment in the sector. While volatility remains, the company intends to continue to grow and keep itself relevant in this space by innovating and introducing new products that cater to Electric Vehicles (EV).

In the long run, the company anticipates sustained growth in this segment, driven by its groundbreaking research and development efforts, particularly in enhancing the sustainability of plastics.

Consumer Products ODM

The Consumer Products ODM division saw its volume grow by 23% YoY during the first quarter of the year as inflation started cooling off. However, as Batangas plant remains in the ramp up phase, higher fixed cost per unit resulted in lower margins. Overall, net income for this division fell by 30% YoY in 1Q25. The company expects margins to recover over time with the improvement in utilization rate. Meanwhile, exports provide a new leg of growth with contribution to total sales currently at 13% from virtually zero about six years ago. Management sees export contribution to continue to go up over the long term.

-end-

D&L Industries is a Filipino company engaged in product customization and specialization for the food, chemicals, plastics and consumer products ODM industries. The company’s principal business activities include manufacturing of customized food ingredients, specialty raw materials for plastics, and oleochemicals for personal and home care use. Established in 1963, D&L has the largest market share in most of the industries it serves, as well as long-standing customer relationships with the Philippines’ leading consumer and manufacturing companies. It was listed on the Philippine Stock Exchange in December 2012. For more information, please visit https://www.dnl.com.ph/investors/.

This press release may contain some “forward-looking statements” which are subject to a number of risks and uncertainties that could affect D&L’s business and results of operations. Although D&L believes that expectations reflected in any forward-looking statements are reasonable, D&L does not guarantee future performance, action or events.

INVESTOR RELATIONS CONTACT

Crissa Marie U. Bondad

Investor Relations Manager – D&L Industries Inc.

+632 8635 0680

crissabondad@dnl.com.ph / ir@dnl.com.ph